Mount Hope Mining is the ASX’s newest copper play

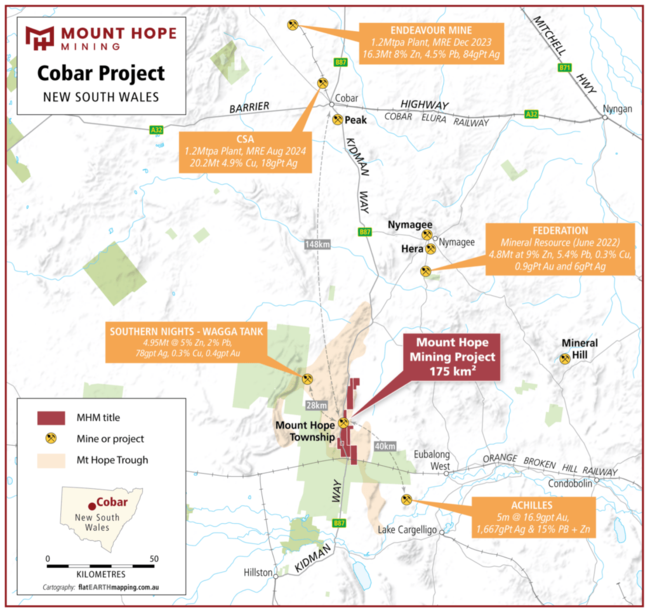

Mount Hope Mining has already identified five priority exploration prospects at its project in NSW’s Cobar region for exploration in early 2025.

Mount Hope Mining lists on the ASX with its namesake copper project in NSW’s Cobar region

Five advanced exploration prospects have already been identified for exploration

Company to carry out further surveys and maiden drilling in H1 2025

Special Report: Mount Hope Mining has burst onto the market as the ASX’s newest copper play with plans to hit the ground running at its namesake project in NSW’s prolific Cobar Superbasin.

Cobar is one of the oldest mining centres in the state, delivering 3Mt of copper metal and over 2Moz of gold across more than 140 years of semi-continuous operations, along with significant quantities of lead, zinc and silver.

The area Mount Hope Mining (ASX:MHM) has made its home base is among the hottest exploration districts in Australian resources right now.

Besides MAC Copper’s (ASX:MAC) CSA copper mine – one of Australia’s highest-grade operations. The region also hosts Aurelia Metals’ (ASX:AMI) Hera and Peak operations, and the new zinc-rich Federation mine.

And it is not just existing operations. Drilling has also yielded exciting new discoveries like Peel Mining’s (ASX:PEX) Wagga Tank and Mallee Bull polymetallic deposits and Australian Gold and Copper’s (ASX:AGC) Achilles discovery near Lake Cargelligo.

Mount Hope itself saw historical mining with some 75,000t of ore processed at a grade of 10.5% in its initial 41-year run from 1878 until 1919 before producing more than 4000t of the red metal in 1942 when mining ended at a depth of just 113m.

The 175km2 project was acquired from Unico Silver (ASX:USL) in October 2024 for 5 million MHM shares at an deemed issue price of 20c each.

Exploration endeavours

Mount Hope Mining, which has started trading under the ticker MHM following a successful $5m initial public offering priced at 20c per share, has already identified the exploration prospects at Mount Hope East, Black Hill, Main Road East, Little Mt Solitary and the Mt Solitary to Mt Solar trend along a 15km north-south corridor.

In November, managing director Fergus Kiley told Stockhead these were classic Cobar-style volcanogenic massive sulphide targets that could be found across the Cobar Superbasin.

VMS deposits are valuable as their higher grades – compared to porphyry deposits – make them more profitable at a smaller scale with modest upfront capital.

Kiley, previously an executive at Andrew Forrest’s major private miner Wyloo, added that the prospects were in the right area, the right rocks, with the right faults nearby as they were defined by a soil geochemical anomaly at surface in the correct structural setting.

With mere days left to go in 2024, MHM has aggressive plans for exploration in 2025.

First off will be a soil geochemical survey over each of the five prospects before ground-based geophysical surveys – including electromagnetic and induced polarisation – are carried out to define drill targets at depth.

The company will then start and complete its maiden drill program in H1 2025.

MHM will also continue to advance its pipeline of less mature exploration targets and look out for consolidation opportunities.

This article was developed in collaboration with Mount Hope Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.