Mirrabooka’s small and mid-cap focus pays off

Mirrabooka Investments specialises in small and medium sized companies on ASX and NZX, delivering an annual return of 12.4pc per annum since inception.

Mirrabooka Investments specialises in investing in small and medium sized businesses on ASX and NZX

Celebrating 25th anniversary in 2024, annual return of fund since inception in April 1999 has been 12.4% per annum

Mirrabooka Investments was an early investor of large caps ResMed and Hub 24

Special Report: Investing in small caps carries high risk due to market volatility but with the potential for significant returns as these companies grow.

Choosing which small caps have potential to be 10-baggers is obviously the tricky part, but it’s where Mirrabooka Investments (ASX:MIR) specialises and has a proven track record of success.

Celebrating its 25-year anniversary this year, the fund manager specialises in small and medium sized companies, which fall outside the S&P/ASX 50 Index.

Mirrabooka was founded by inaugural chairman Terry Campbell AO with an $85m capital raising by JB Were & Son in April 1999 and before listing on the ASX in 2001.

Campbell worked at JB Were & Son for ~50 years and restructured their private client division. He found while liking the idea of investing in small caps, many clients were reluctant because of a high failure rate.

“If you get unlucky you can lose money on small and mid-caps so the way to do it is to have quite a few stocks to overcome the failure rate, so we decided to set up Mirrabooka,” he said.

“We thought a closed-end fund was the way to do it because if you want to stay in the small cap market you’ve got to be able to sit through the troughs and don’t want to be selling when the market is low when you should really be buying.

“The closed-end fund was really made for successful investing in small and mid-caps.”

A quarter of a century later and Mirrabooka’s stated objectives in its founding prospectus remain unchanged:

- To support and invest in small and medium sized companies listed on the Australian and New Zealand stock exchanges.

- To provide medium to long term investment gains through holding core investments in selected companies.

- To provide attractive dividend returns to investors.

Strong return over 25 years

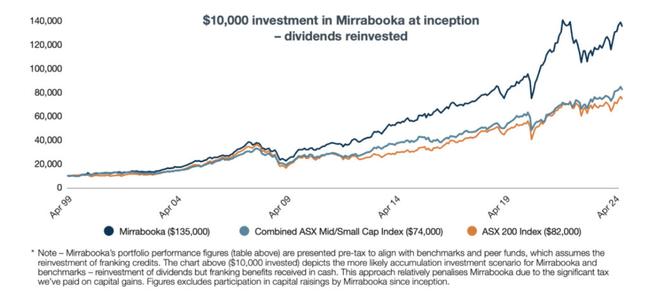

Mirrabooka has consistently delivered strong long-term returns for investors. Including reinvestment of dividends and franking the fund’s annual return per annum since inception in April 1999 has been 12.4% per annum, compared to the S&P ASX Mid/Smallcap Index 8.4% and S&P ASX 200 9.7%.

Source: Mirrabooka Investments

Portfolio manager Kieran Kennedy said Mirrabooka’s average dividend yield, calculated against net asset backing, has been superior to benchmark indices because it has supplemented the dividends received on the portfolio with realised capital gains.

Source: Mirrabooka Investments

“We don’t get the same flow of dividends as a large cap investor but because we’re a company when we do have successful investments we sell, or are trimming back on highly valued companies, we have to pay capital gains tax – which generates franking credits,” he explained.

“So as well as getting growth in the share price, if you look back over 25 years, the average dividend yield has been around 5%, which has come from realised capital gains.”

Picking the winners and losers

Both Campbell and Kennedy concede not all of the fund’s stocks picks have been winners over the years.

Mirrabooka likes to be broadly across sectors, holding around 60 stocks in the portfolio at any one time.

“You want to make sure you find those winners and businesses with a sustainable competitive advantage that can prosper for a long period of time,” Kennedy said.

“The secret is to find those businesses, allocate capital and leave those businesses to do the work and deliver a compound return.”

Kennedy said for Mirrabooka it’s less prediction, less valuation, less forecasting and more observing companies that have key attributes and letting them prosper and generate returns.

Campbell added that Mirrabooka will often also back companies when it is impressed with the founders, with some being quite speculative.

“When you go into the bottom end of the market some of them are going to fail,” he noted.

Kennedy said investing in small and mid-caps is about having an open mind that you might have been wrong and the quality of the business or proposition was not what you thought.

“Rather than thinking it might recover, you have to be disciplined in moving on,” he said.

“You’ve just got to say, ‘let’s now put that capital with better propositions and keep the quality of the portfolio up’.

“Having said that, we can have businesses that might not be performing as we’d hoped but when you go back and look at the fundamentals of why it’s in the portfolio, if all is intact we will be patient.”

Fund benefit from big growth

Campbell said Mirrabooka has been set up so that if one of its holdings does become super successful, ending up for example as a top 50 stock, it doesn’t have to be sold.

“With some of the other smaller cap funds, they weren’t allowed to hold them if they went into the top 50,” he said.

“We were set up so if one of our stocks became a 50s leader, we couldn’t buy it anymore, but we weren’t forced to sell it because it moved up, where you could miss out on quite a bit of gain.”

Among successful stocks Mirrabooka has backed and gained success from is a leader in obstructive sleep apnoea (OSA) and other sleep-related respiratory disorders – ResMed (ASX:RMD).

“ResMed is well and truly a top 50 stock and selling for around $36, but original cost base was $2.50 so it was a great early identification,” Kennedy said.

“If we were trying to predict the next year’s earnings back then we would’ve had no idea – so it’s hard to forecast.

“But the characteristics of a good investment were there and then it can really surprise you 10, 15 or 20 years later just how much value these great businesses can generate.”

Mirrabooka was also an early investor of HUB24 (ASX:HUB), which it originally purchased at $1.60/share and is now trading at ~$60/share.

Mirrabooka top 20 holdings

Source: Mirrabooka Investments, as of August 31, 2024

This article was developed in collaboration with Mirrabooka Investments, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.