Metalicity hits 30m at 3.86g/t gold in first hole at Pennyweight Point

MCT flags an exceptional 30m at 3.86g/t gold in the first hole drilled at the Pennyweight Point prospect within its Yundamindra gold project.

MCT reports a lengthy 3.86g/t gold from first hole at Pennyweight Point prospect

This marks the first drilling at the prospect in over a decade

A further 31 holes drilled are pending assays

Special Report: Metalicity has flagged an exceptional 30m at 3.86g/t gold in the first hole drilled at the Pennyweight Point prospect within its Yundamindra gold project.

The project currently consists of nine historical highly prospective targets and this is the company’s maiden drilling program at the Pennyweight Point prospect, which boasted historical production of 74,000t at 19.3 g/t gold and has previously returned high-grade intercepts.

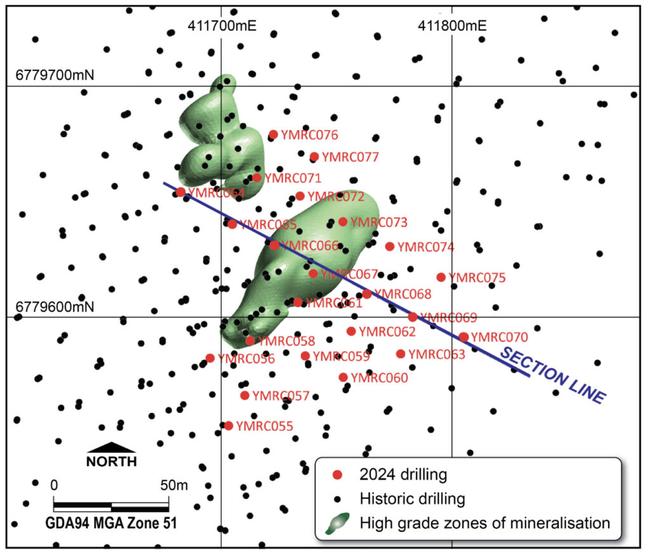

The first hole of the program returned 30m at 3.86g/t gold from 89m, including 20m at 4.37g/t gold from 99m (YMRC069).

Two steeply plunging high-grade mineralised shoots have now been interpreted at Pennyweight Point, the Southern and Northern Shoots, with both remaining open at depth, down dip and down plunge.

First drilling in a decade

“The Pennyweight Point prospect has not been drilled in over a decade, so the results of our maiden drilling program at the prospect have been eagerly anticipated,” Metalicity (ASX:MCT) managing director Justin Barton said.

“Although we have only received assays from the first 2 holes drilled at Pennyweight Point, the excellent results show a high grade thick intersection of 30m that correlate with historical drilling and clearly demonstrate the outstanding potential of the Yundamindra project and provides optimism for the remaining assays.”

A further 31 holes drilled from Yundamindra are awaiting assaying, with 21 holes at Pennyweight Point and 10 holes at the Landed at Last prospect anticipated in the coming weeks.

“With gold prices continuing to hit record highs, it is a great time to build our gold footprint in the area and unlock the substantial potential value at Yundamindra,” Barton said.

A hot neighbourhood

The part of the world Yundamindra sits in is certainly a busy neighbourhood, with the project 65km southeast of Leonora and in close proximity to a number of hungry mills accessible by road.

Those who are confident in Leonora’s long term future for the years to come include Raleigh Finlayson’s Genesis Minerals (ASX:GMD), which announced earlier this year it had spent more than $7m to buy the Leonora Lodge to accommodate construction workers.

In its June quarterly results, Genesis shared it had produced nearly 35,000oz of gold at AISC of $2,698/oz. Analyst Shaw and Partners is forecasting the gold price to climb beyond US$3,000/oz into next year and 2026.

Evidently sharing a similar bullishness on the gold industry’s prospects, Genesis says buying Leonora Lodge is a way to “future proof” its plans around restarting the Laverton Mill and laying the groundwork for production at Tower Hill.

This article was developed in collaboration with Metalicity, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.