iTech puts drill to ground in quest for Scimitar copper-gold

iTech Minerals initiates maiden drilling for copper-gold at Scimitar prospect

The largest of two conductor plates at Scimitar prospect will be targeted with a 600-metre diamond hole

Drilling of second conductor contingent on identifying mineralisation in first hole

Soil anomaly of 5km by 4km holds elevated copper, gold, silver, lead, zinc, antimony and arsenic levels

Special Report: With gold above US$3000 an ounce on global geopolitical instability, iTech Minerals hopes to unearth a treasure at the Reynolds Range project in the Northern Territory.

iTech Minerals (ASX:ITM) has put diamond drill bit to ground to test a potential copper-gold system at Scimitar prospect.

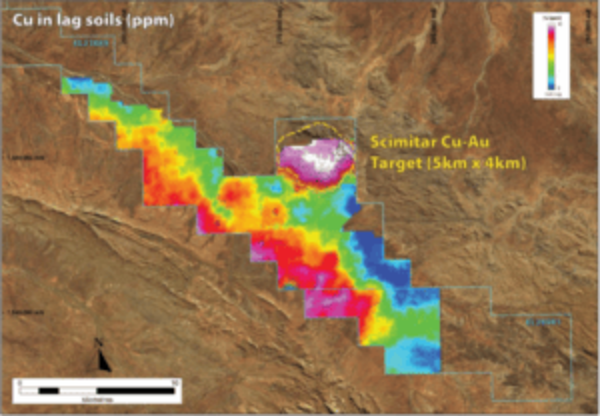

Several exploration data vectors point to potential for a large system including two large moving loop electromagnetic conductor plates over about 1.6km, outcrops where rock chips graded up to 18.2% copper, 1,490g/t silver and 3.3g/t gold and a 5km by 4km multi-element soil anomaly.

The soil anomaly holds elevated levels of copper, gold, silver, lead, zinc, antimony and arsenic, identified during a soil sampling survey undertaken by Normandy Mining.

Multi-element lag soil geochemical anomalies at the Scimitar copper-gold prospect. Pic: ITM

“While the Scimitar Prospect is an exciting target, it is just the first step in a pipeline of targets that we plan to drill test at the Reynolds Range Project throughout 2025,” iTech Minerals managing director Mike Schwarz said.

“The iTech team is currently taking advantage of this time in the field to conduct the next round of geophysics to tighten up a number of promising gold targets that we have been developing over the past 12 months.

“For iTech shareholders, this all means there will be plenty of news flow to look forward to across our gold and copper prospects at a time of historically high prices.”

iTech will begin drilling with the larger of the two conductor plates present beneath Scimitar, with plans to drill a second hole into the smaller plate if the first reveals evidence of mineralisation.

Demand for gold at all-time high

Gold smashed records to rise to more than US$3,100 an ounce just over two weeks ago, having risen 20% in the March quarter of 2025.

The safe-haven commodity has since retreated to US$3,000 per ounce today but Bank of America analysts recently raised their target to US$3,500 an ounce, citing rising demand from retail investors, central banks and insurers based in China.

Central banks were the third largest source of demand for gold in 2024, with data from the World Gold Council showing central banks added a net 44 tonnes to their gold reserves in January-February.

This article was developed in collaboration with iTech Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.