Finder Energy study outlines concepts and costings for KTJ oilfields

Finder Energy’s subsea study builds understanding of Kuda Tasi and Jahal subsea requirements and increases confidence in costings.

Subsea Concept Study highlights requirements and costs for development of Kuda Tasi and Jahal oilfields

Study outlines eight concepts including phased developments to fast-track production based on two development scenarios

Company evaluating market for second-hand and refurbished equipment that could reduce costs and accelerate project timeline

Special Report: Finder Energy has a firmer understanding into the subsea requirements and costs relating to the development of its Kuda Tasi and Jahal oilfields offshore Timor Leste.

This follows the completion of a Subsea Concept Study by experienced services provider Nobleseas Engineering to provide greater definition for development concepts and costings than earlier engineering studies commissioned by the company.

Finder Energy (ASX:FDR) said results from the study, which used various development scenarios for the two fields including Class IV cost estimates, aligned with expectations and provided greater confidence for the cost estimates used to establish the economic viability of the project.

“This report builds on our understanding of the subsea requirements of the project and gives us greater confidence in the costings that underpin the economics of the project,” chief executive officer Damon Neaves said.

“Our efforts to secure key infrastructure components and fast-track the path to first oil are gathering momentum. Everything we do is aimed at de-risking the project and bringing us closer to unlocking the huge potential of Kuda Tasi and Jahal.”

The company has a 76% stake in PSC 19-11, which hosts the two fields that collectively host 34 million barrels (MMbbl) of discovered oil.

Modelling has found that Kuda Tasi and Jahal could produce 10MMbbl in the first 18 months of production.

The system has proven oil productivity with the historical Kuda Tasi-2 appraisal well demonstrating the potential for each production well to produce more than 20,000 barrels of oil per day – in line with wells producing from the same reservoir in adjacent fields such as Laminaria/Corallina, Buffalo and Kitan.

Listen to the Rock Yarns Podcast with Peter Strachan: Finder’s rising rewards of Asiatic oil

Study scope

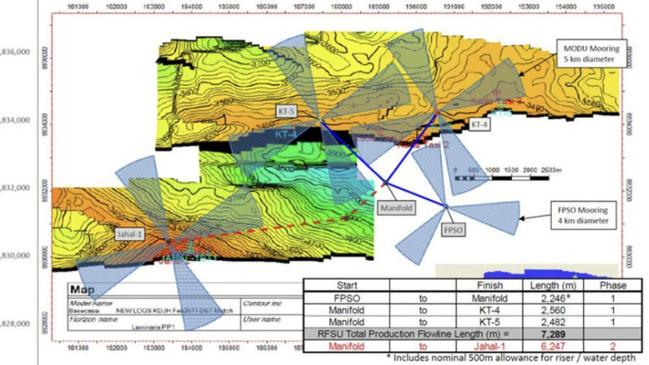

The study covered schematic sketches for eight shortlisted concepts that illustrate the main subsea items relevant for cost estimates.

These include phased developments to potentially fast track first oil production.

Other items covered include umbilical cross sections, type of flowline including indicative stability assumptions based on analogue Timor Sea/regional subsea pipelines, the size and weight estimates for subsea structures, and subsea production system hardware.

Cost estimates are provided for the development based on two different scenarios, each with multiple concepts. Further study work has been recommended for the next phase of project definition.

Field layout concepts were evaluated to bookend the technical solutions for the project and the costs associated with each under different phasing and design scenarios.

The cost differentials between these cases will inform Finder’s decision on the development plan.

Several regional analogue projects were also considered in order to benchmark and check the cost estimates in the report

Kuda Tasi and Jahal are expected to be developed through wells linked to a central manifold that in turn feeds into a floating production, storage and offtake vessel.

Findings from the study will assist FDR in understanding considerations affecting the FPSO selection and the company’s plans to achieve first oil as quickly as possible while refining the scope for the next phase of engineering design.

The company is currently evaluating the market for second-hand and refurbished equipment certified in accordance with regulations and good oilfield practice which could yield substantial capex savings and accelerate the project timeline to first oil.

This article was developed in collaboration with Finder Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.