Expansion in US and UK markets delivers for Airtasker with 40% lift in operating cash flow

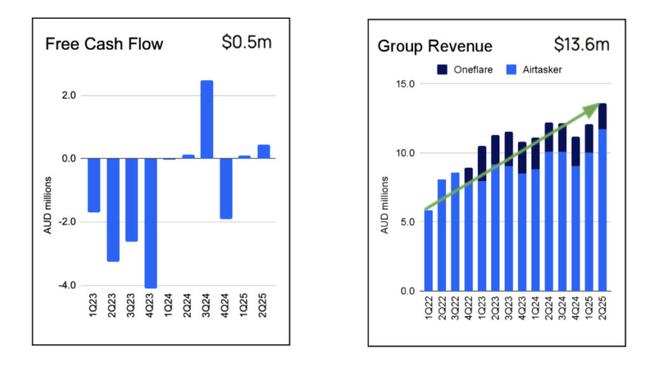

Airtasker has grown its positive free cash flow to $500,000 in Q2 FY25 with operating cash flow of $1m, up 40.0% on pcp.

Airtasker records positive free cash flow of $500,000 and positive operating cashflow of $1 million

Airtasker marketplaces revenue up 15.8% on pcp to $11.7 million

Airtasker UK revenue increases 95.2% on pcp, with Airtasker US revenue up 278.6%

Special Report: Online marketplace for local services Airtasker has grown its positive free cash flow to $500,000 in Q2 FY25, with operating cash flow surging 40% to $1m on the same period in FY24.

Airtasker (ASX:ART) attributed the positive result to growing group revenue by 11.4% on a year earlier to $13.6m, with Airtasker marketplaces revenue up by 15.8% on pcp to $11.7m, rising off the back of increased marketing investment.

Australian marketplace seasonality peaks over the second and third quarters of the financial year, which reflect strong revenues and cash receipts.

The improved operating cash flow showed a $2.5m (19.3%) increase in cash receipts from customers following a $2.7m (89.3%) increase in cash marketing investment.

Airtasker marketplaces momentum was attributed to strong consumer demand, with booked tasks up 10.9% on pcp alongside marketplace reliability improvements with cancellations falling 1.2% and the monetisation rate improving 3.6%to 20.8%.

Source: Airtasker

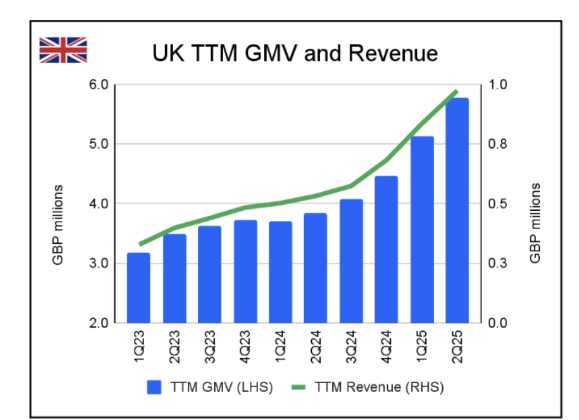

Strong UK and US revenue growth

Further Media capital deals in both the UK and US markets helped pushed revenue up in Q2 FY25.

Airtasker said following the successful release of the UK television advertising campaign ‘Airtasker. Yeahtasker!’ in Q2 FY24, Airtasker UK achieved a 60.9% increase in posted tasks, 66.1% increase in gross marketplace volume (GMV) and 95.2% increase in revenue in Q2 FY25.

On a trailing 12 months basis (TTM), GMV was up 50.3% on pcp to £5.8m (~A$11.2m) and revenue up 82.9% on pcp to £973,000 (~A$1.9m).

Source: Airtasker

‘Airtasker. Yeahtasker!’ did wonders in the key US market as well, driving strong growth in marketplace activity, with Q2 FY25 GMV up 136% on pcp and revenue up 278.6%.

On a TTM basis, GMV was up 39.0% on pcp to US$726,000 (A$1.1m) and revenue was up 118.5% to US$125,000 (A$190,000).

Source: Airtasker

Airtasker invested $3.2m of cash to scale distribution in the UK and the US without increasing its fixed costs in those markets, thereby leveraging its fixed global head office investment.

Positive EBITDA for Airtasker’s Established Marketplaces

During the quarter Airtasker’s Established Marketplaces delivered EBITDA of $6.9m, including $1.9m in non-cash marketing from oOh!media (ASX:OML) and ARN.

After covering global head office costs, Australian net EBITDA was $2m. As non-cash media advertising continues through the peak season in Q3 FY25, Australian net EBITDA is expected to fall with brand marketing payback anticipated over three years.

Group EBITDA came in at a $6.3m loss, driven by an $8.3m net investment in new marketplaces.

Airtasker told investors the loss was expected to increase in H2 FY25 as the company ramps up non-cash marketing investments across Australia, the UK, and the US.

Airtasker eyes next phase of global expansion

Airtasker Founder and CEO Tim Fung said the company was well-positioned for growth moving forward.

“I’m super pleased to announce another quarter of positive free cash flow with Airtasker marketplaces revenue up 15.8% and, importantly, international revenue growth momentum picking up as our global brand investments pay off,” he said.

“With UK revenue up over 95%, US revenue up over 279%, and more than $51m in media capital from some of the world’s best media companies, we feel super well-positioned for the next phase of Airtasker’s global expansion!”

This article was developed in collaboration with Airtasker, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.