DY6 Metals spreads its wings with acquisition of rutile and heavy mineral sands projects in Cameroon

DY6 Metals is acquiring two rutile and heavy mineral sands projects in Cameroon that complement its rare earths and critical minerals projects in Malawi.

DY6 Metals is acquiring two highly prospective rutile and heavy mineral sands projects in Cameroon

The Central project is next to the third-party Minta project and is analogous to the tier-1 Kasiya deposit

Douala Basin project contains known palaeo-placer coastline sand deposits with visible rutile and zircon

Special Report: DY6 Metals is expanding its horizons with the execution of binding agreements to acquire two large, highly prospective rutile and heavy mineral sands projects in Cameroon.

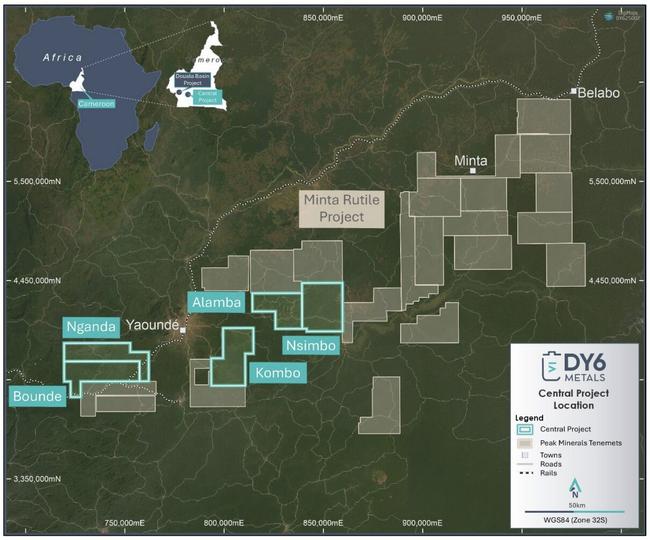

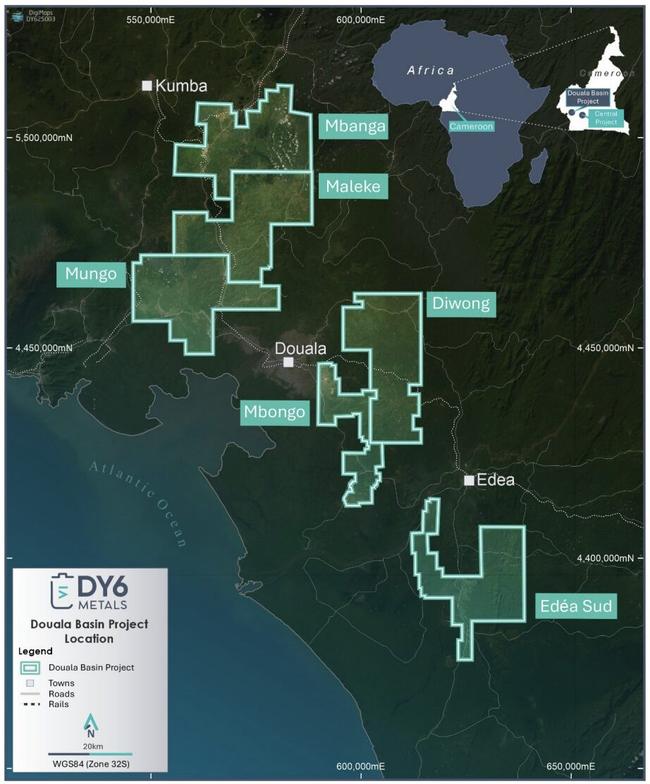

These are the 2140km2 Central rutile project within an emerging, globally significant rutile province in Central Cameroon that borders and shares the same geology as Peak Minerals’ Minta project, and the 2580km2 Douala Basin project which contains known palaeo-placer coastline sand deposits with visible rutile and zircon.

DY6 Metals' (ASX:DY6) move to acquire the two projects comes after it was formally granted the licence over its Karonga base metals project in the March 2025 quarter.

The acquisitions are also expected to complement its existing suite of rare earths and critical minerals projects in Malawi.

Rutile is much sought after as the purest, highest-grade naturally occurring form of titanium.

Titanium is in turn valued for its high corrosion resistance and high strength-to-weight ratio that makes it ideally suited for aerospace applications.

As titanium dioxide, it is essential for pigment manufacturing. Natural rutile is headed for significant deficits in the coming years, with discovery rates slowing to a crawl.

The company has engaged experienced mining executive Cliff Fitzhenry, who had previously worked for Rio Tinto and Sovereign Metals, as technical consultant to help oversee exploration at both Central and Douala Basin.

“We believe that Cameroon is shaping up to become a new frontier for major rutile discoveries. The proposed acquisition will position DY6 to be a major player in this exciting sector,” chairman Dan Smith said.

Fitzhenry added the acquisitions provide DY6 with a highly prospective mineral sands portfolio targeting two mineralisation styles.

“The Douala Basin project has known paleo-placer coastline dunes with thick sand packages and visible VHM present, while the Central project has all the right indicators to be prospective for residual placer saprolite hosted rutile deposits,” he said.

DY6 has also received firm commitments for a $400,000 share placement priced at 4c per share.

Mineral sands projects

The Central project consists of five exploration permits within an area that is rapidly emerging as a globally significant rutile province.

It is predominately underlain by a bedrock of kyanite-bearing mica schist which is thought to be the primary source of the rutile which is then concentrated and upgraded in the overlying saprolite material during the in-situ weathering process.

This forms an in-situ, eluvial saprolite hosted rutile deposit target type analogous to Rio Tinto-backed Sovereign Metals' (ASX:SVM) tier-1 Kasiya rutile and natural graphite deposit in Malawi.

Historical artisanal mining of alluvial deposits in the area produced some 15,000t of high-purity rutile between 1935 and 1955.Central also borders the Minta project where initial sampling has revealed widespread, high-value mineral assemblages with up to 93% total heavy minerals with valuable rutile being the most common valuable heavy mineral.

Meanwhile, Douala Basin consists of three granted exploration permits and three exploration permits under valid applications that are all within 50km of the deepwater port city of Douala.

Geologically, it is a coastal sedimentary basin consisting of a package of mainly marine sedimentary formations of Cretaceous to Quaternary in age.

Thick, preserved sequences of sandy material are known to exist across the tenement package and these are thought to represent palaeo-placer coastline dune deposits which are prospective for classic aeolian placer heavy mineral sands.

Of particular interest is the Diwong licence that was previously held by French multinational Eramet, which drilled 60 sonic holes totalling 1080m and 39 hand auger holes totalling 190m targeting rutile and zircon.

This drilling intersected thick sequences of sands and confirmed the presence of rutile and zircon within the valuable heavy mineral assemblage.

Following completion of the acquisition, DY6 plans to undertake further due diligence on the Central and Douala Basin projects that will include the compilation and analysis of all historical data and preliminary reconnaissance work.

It will then carry out an initial exploration program that will comprise detailed geological mapping of the defined exploration targets, along with hand auger drilling across defined targets.

The company will also begin engagement with relevant government authorities, regional stakeholders and local communities regarding the planned exploration programs.

Acquisition terms

DY6 entered into a binding agreement with Gondwana Capital to acquire its wholly-owned subsidiaries Aardvark Minerals and EKOM Metals, which in turn hold the Central and Douala Basin projects respectively.

It will make an upfront payment of $200,000 in cash and issue 5 million shares at a deemed issue price of 4c each to the vendor.

Subsequently, it will pay Gondwana $150,000 in cash and issue 5 million performance rights that convert into shares on a one to one basis at an issue price of 4c each once all licence applications are granted within six months of completing the acquisition.

Another 4 million performance rights will be issued once it achieves at least five drill intercepts of either 5m or greater at a minimum grade of 2% heavy minerals, or 10m or greater at a minimum grade of 1% HM within 18 months of the acquisition.

Should DY6 successfully delineate a JORC or NI43-101 compliant resource of at least 50Mt at a minimum grade of 1% HM with 36 months, it will then issue another 6 million performance rights to Gondwana.

This article was developed in collaboration with DY6 Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.