Delta spin-off Ballard’s star team and big gold inventory will be its key drivers

Delta Lithium’s spin-off Ballard Mining will benefit from having more than a million ounces of gold and a highly credentialled leadership team.

Special Report: While junior explorers branching off non-core assets is hardly uncommon, it’s not every day that a spin-off begins life with a gold asset with defined resources above the million-ounce mark.

- Delta Lithium’s spin-off Ballard Mining will debut with a resource of more than a million ounces of gold

- Ballard will have an experienced team including chairman Simon Lill and Delta’s chief development officer Paul Brennan as its MD

- Post-IPO activity will include drilling to boost existing and find new resources as well as work towards development

That’s exactly the exalted position that Delta Lithium’s (ASX:DLI) spin-off Ballard Mining will enjoy once it hits the ASX, given that it will hold the Mt Ida project that has an inferred and indicated resource of 10.3Mt grading 3.33g/t, or 1.1Moz of contained gold following a recent resource upgrade.

The upgrade came after Delta let the market know about the gold prospectivity of Mt Ida, where an initially modest gold resource had been defined from its lithium-focused drilling, then supercharged by targeted gold drilling over the last 6 months.

Managing director James Croser told Stockhead in a video interview in late May that the company decided to spend $5-6m in September 2024 to specifically target gold.

This proved to be money well spent after it delivered a resource that exceeded the company’s target of a million ounces – the magical point where potential project lenders sit up and take notice.

While no doubt thrilled by the find, the company then decided on a spin-off as it felt the funds used for drilling for gold had originally been raised for lithium exploration and Delta needed to honour that lithium commitment.

Croser said that while the gold was a wonderful distraction to have, it not desirable to utilise cash raised from lithium investors for the significant sums needed to test the large gold potential at Mt Ida.

“It will take … $25-30m to advance the Delta gold assets at Mt Ida and we decided the best way to do that was in a separate vehicle,” he noted.

Golden credentials

This led to the decision to spin-off Mt Ida into Ballard Mining, which will raise between $25m (minimum subscription) and $30m (maximum subscription) through an initial public offering priced at 25c per share to fund exploration.

Delta shareholders will retain exposure to the gold asset as they will receive one fully paid Ballard share for every 11.25 Delta shares they own as part of the spin-out while Delta itself will hold between 46% and 49% of the new company depending on the take-up of the IPO.

“Ballard will be raising $30m and that'll be 100% dedicated to gold exploration growth and development at the Mt Ida gold asset and Delta gets to ride that wave. (We) will still be exposed via our shareholding in Ballard but we will be a pure lithium business,” Croser said.

While this funding will allow the new gold company to go all out with exploration, the composition of its leadership is also headline-worthy.

Chairing the board will be Simon Lill of De Grey Mining fame while Delta’s chief development officer Paul Brennan will be leaving to take up the helm as Ballard’s managing director.

Lill oversaw De Grey from its beginnings as a gold minnow and through its explosive growth following discovery of the renowned Hemi asset and its eventual acquisition by Northern Star (ASX:NST), which wrapped up in May this year.

Former Ramelius Resources (ASX:RMS) and Wildcat Resources (ASX:WC8) chief financial officer Tim Manners will also step down as a non-executive director of Delta to take up an executive position at Ballard to assist Brennan.

“Stuart Matthews used to be the executive vice president of Goldfields Australia, so he'll be a non-executive director. And I'll be there as a non-exec looking after Delta's interests,” Croser said.

Watch: Perfect timing for a golden move at Mt Ida

Expansion plans

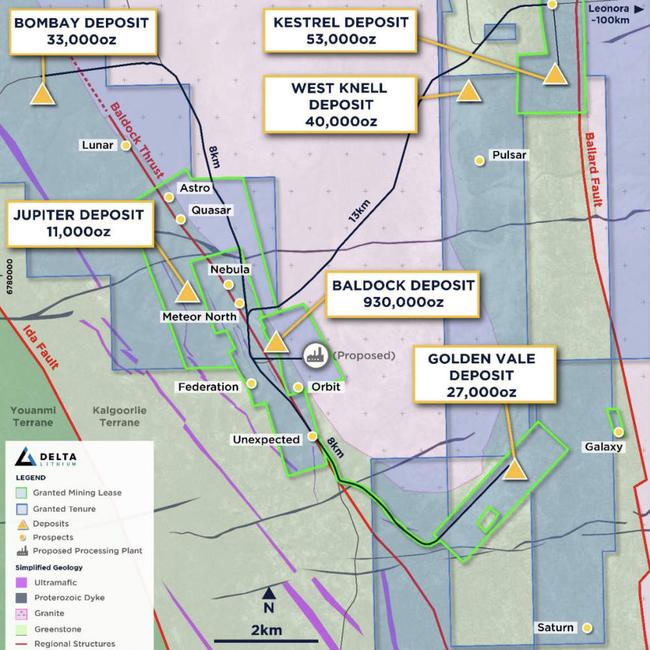

This team will oversee an ambitious work program that could deliver significant progress towards a final investment decision for Mt Ida, which covers some 250km2 of ground.

“Ballard's going to be a very exciting proposition with $30m to spend on the growth piece at Mount Ida,” Croser said.

“They'll be exploring the 26 kilometres of strike around the Copperfield Granite, which really hasn't had any serious gold exploration outside the Baldock area for decades, if ever.

“Everyone's been drilling holes around the Baldock deposit, and that's yielded 930,000 ounces. So a big portion of the use of funds will be looking to expand the gold resources and find another Baldock.”

He added that infill drill at Baldock could underpin a pretty good mine reserve.

Besides Baldock, the recent resource upgrade also increased resources at the Kestrel deposit to 53,000oz at 1.7g/t gold and defined maiden contained resources of 33,000oz, 40,000oz and 11,000oz for the Bombay, West Knell and Jupiter deposits.

The regional drilling and infill work at Baldock will help complete metallurgical and geotechnical studies to a DFS level and progress the project towards FID.

A works approval has already been submitted for a processing plant with capacity of up to 1.5Mtpa and associated tailings storage facility.

On listing Ballard will also start the process of converting exploration leases into mining leases for regional resources.

In-principle approval for the demerger has already been received from the ASX.

Delta itself will be busy carrying out exploration at the newly expanded Yinnetharra lithium project following the acquisition of the adjacent Aston project that gives it a dominant position over the Thirty-Three supersuite granites, which are proven to be the source for the Malinda and Jameson deposits.

This article was developed in collaboration with Delta Lithium, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.