Cross Fault gold discovery grows as OzAurum extends mineralisation

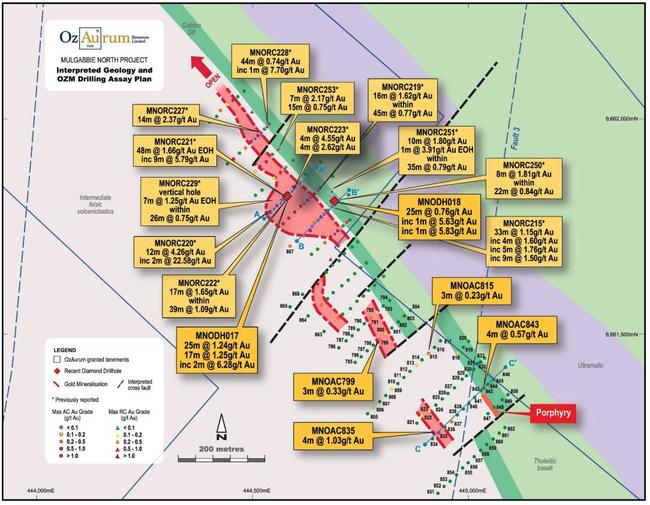

New drill results highlight multiple gold systems and extend the mineralised corridor at OzAurum’s Cross Fault discovery, pointing to increased scale.

Drilling at Cross Fault confirms two mineralisation styles – a sheeted vein array and breccia hosted zones

The presence of visible gold within quartz validates the company’s geological model

High-priority RC and aircore drill targets will be tested as geological interpretation progresses

Special report: Results from two diamond holes at the Cross Fault discovery within OzAurum’s Mulgabbie North gold project confirms multiple mineralisation styles, extends the strike length and underscores growing scale.

The two holes (MNODH 017 and MNOD 018) returned significant intercepts including 25m at 1.24g/t gold from 27m, 1m at 5.83 g/t from 43m and 17m at 1.25g/t from surface.

Very fine specks of visible gold were observed in MNODH 017 in thin quartz veins at 54.85m and 58.3m within oxidised former pyrite.

OzAurum (ASX:OZM) said the results confirmed dual mineralised zones – sheeted vein array and breccia-style mineralisation.

The results will guide upcoming RC drilling at Cross Fault, just 2km south of the 260,000oz Mulgabbie North resource along the Relief Shear in WA.

Aircore drill results

Meanwhile, an 82-hole aircore campaign has returned 4m composite gold assays after drilling was carried out south of the initial Cross Fault area.

The purpose was to define new targets for RC drilling with results including 4m at 1.03g/t gold from 24m and 3m at 0.33 g/t with both ending in mineralisation, and a further 4m hit at 0.57g/t from surface.

The average depth of 28m is shallower on lines to the south and several holes ending in low tenor gold mineralisation provide targets for future RC drilling.

A new RC target is indicated by hole MNOAC 843, which returned 4m at 0.57g/t gold from the surface and was drilled adjacent to the outcropping porphyry, where aircore drill depths are shallow.

‘Immediate, walk up targets’

OZM managing director and CEO Andrew Pumphrey said the presence of visible gold within quartz veins, particularly where oxidised pyrite was observed, strongly validated the company’s geological model and was highly encouraging.

“Aircore drilling has also delivered promising results, particularly near outcropping porphyry where shallow cover limited penetration,” he said.

“These areas now represent immediate, walk-up targets for follow-up RC drilling.

“Together, these results significantly enhance our understanding of the Cross Fault discovery and expand the broader prospectivity of the Mulgabbie North gold project.

“We’re excited to advance to the next phase of exploration, with RC drilling set to test these newly defined, high-priority targets.”

Background on Mulgabbie North

Mulgabbie North is roughly 2km from Northern Star Resources’ (ASX:NST) ~3.5Moz Carosue Dam operation and boasts similar rocks.

OZM has been building momentum at the project since unveiling a high-grade gold hit of 20m at 3.57g/t from surface in February.

The news triggered a fivefold share surge, re-rating the company from below $5m to its current ~$18m valuation.

High Aussie gold prices of around $5000 per ounce are providing explorers like OzAurum with multiple advantages from stronger balance sheets to carry out exploration and drilling to higher valuations and faster development timelines.

What’s happening next?

OZM will be undertaking geological fieldwork along the Relief Shear and the nearby Golden Goose prospect, seeking to locate north-south striking faults in outcrop.

Such faults are associated with gold mineralisation at the nearby Carosue Dam and other significant gold deposits in the Eastern Goldfields.

Laboratory assay turnaround times currently vary from two weeks to six weeks, depending on workload.

Due to the current gold boom, laboratories in Kalgoorlie are busy, with mine grade control samples being given priority over OZM exploration samples.

This article was developed in collaboration with OzAurum, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.