Brookside’s strategy fuels success in US oil and gas sector

Australian oil and gas junior Brookside Energy junior reports another strong quarter of production with boosted cash and reserves.

Brookside Energy has reported a 50% increase in Proved Developed Producing (PDP) reserves to 2.65 million BOE, bringing its PDP reserves replacement ratio of 268%

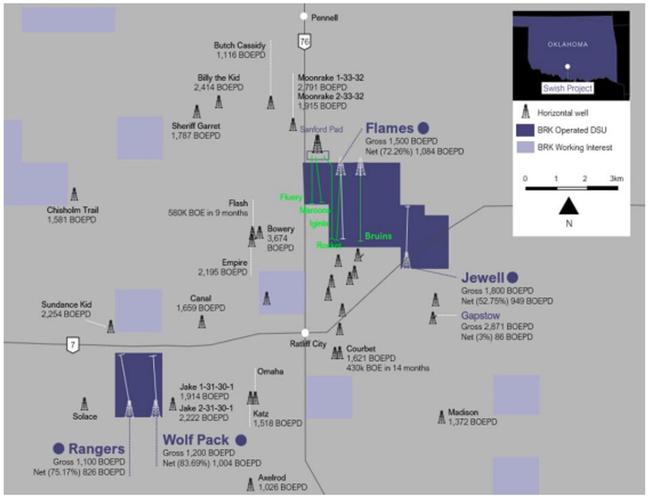

The latest results come as one of the only ASX-listers in the American oil and gas sector looks to production from its ninth well in Oklahoma’s SWISH Play next quarter

In response to the current moderating oil prices, Brookside is focusing on near-term cash generation alongside disciplined development pacing and operational efficiencies

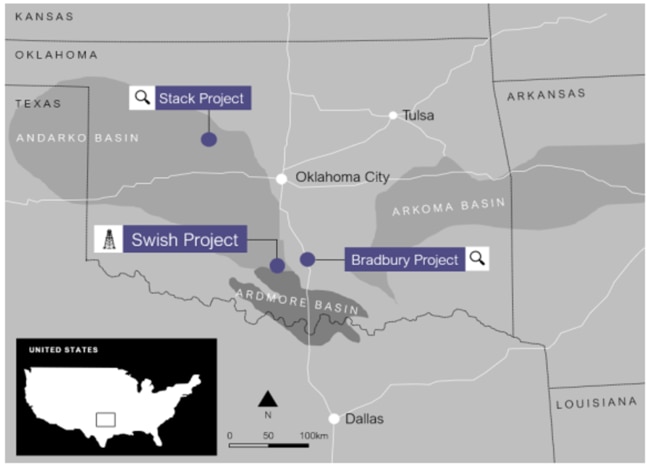

Special report: Brookside Energy has reported another strong quarter of production with upticks reserves and cash from its acreage in Oklahoma’s prolific Andarko Basin.

The latest results have been released as the Australian junior prepares for first production from the Bruins Well, which has been successfully spudded after reaching an impressive total measured depth of 16,718 feet within 30 days.

Brookside (ASX: BRK) has just installed production casing at Bruins ahead of schedule and the company is looking forward to its ninth well in the SWISH Play contributing to its production and cash flow when it comes online in the second quarter of 2025.

Sustained volumes

Brookside’s Group Net Production for the March quarter totalled 172,762 barrels of oil equivalent (BOE) – 56% liquids. This reflected the company’s share of production from the non-operated wells in the Gapstow development and the continued strong performance of its operated SWISH Play wells, including the FMDP wells.

Production for the period averaged 1,920 BOE per day on a net basis, with liquids-rich barrels continuing to drive revenue and margin strength.

While Gapstow production volumes were recognised in the March quarter, Brookside’s share of this revenue has not yet been received from the operator and will be reported in the second quarter.

Cash receipts during the quarter were A$18.1 million from sales volumes of approximately 285,132 BOE, at a realised price per BOE of US$39.91.

The company finished the quarter with a strong cash position of A$12.68 million, up almost 12 per cent on the previous quarter.

Reserves up

Brookside’s independently assessed year-end reserves showed material growth across all categories: Proved Developed Producing (PDP) stands at 2.65 million BOE, up 50.1 per cent; Total Proved (1P) is 4.98 million BOE, up 21.8 per cent; and Total Proved and Probable (2P) is 12.35 million BOE, up 6.8 per cent.

The PDP reserves increase of 1.41 million BOE more than doubled Brookside’s FY2024 production of 525,456 BOE, representing a very robust 268 per cent replacement ratio.

Step change

Brookside’s non-operated portfolio delivered a step-change in production during the March quarter following the full-cycle contribution from eight Gapstow wells operated by American company Continental Resources.

Over the first 90 days of production the Gapstow wells achieved gross production of ~1.65 million BOE and Brookside’s net production was ~27,500 BOE. Brookside’s cumulative Net Revenue Interest (NRI) is ~16%7, with the production and cash flow materially enhancing its financial performance.

These results validate the productivity of the SWISH Play and Brookside’s strategy of complementing its operated developments with high-quality non-operated wells.

SWISH Play

Brookside’s SWISH Play-operated wells continued to perform in line with expectations during the quarter, with cumulative production from the eight wells reaching 2.75 million BOE. Notably the liquids yields – a key element of free cash flow generation – remain within forecasted levels.

Additionally, Brookside’s four FMDP wells, which mark its first operated multi-well pad development in the SWISH Play, are performing as forecast. They are also outperforming (on a normalised basis) the Flames Well, the ‘parent well’ in the FMDP Drilling Spacing Units (DSU).

Balanced strategy

Managing director David Prentice said the results underscored the strength of Brookside’s asset base and efficiency in converting investments into long-life producing reserves.

“While continuing to expand our drilling inventory and pursue future growth opportunities, we remain committed to capital discipline.

“In response to moderating oil prices, Brookside is adopting a balanced strategy, focusing on near-term cash generation, operational efficiency, and disciplined development pacing, while seeking to maximise shareholder returns – consistent with the approach of leading US companies in the sector.”

He said this strategy gave the company the resilience it needs to withstand the current conditions: “The oil market volatility is serving as a reminder that our business is built to thrive in tough markets.

“We run lean with lower than industry average operating costs around $9 per BOE so we remain cash flow positive even at lower oil prices.

“In fact, if we stop drilling after Bruins and prices stayed low for the next five years, we’d still generate more cash flow than our current cap during that time.

“And the best part, our oil and gas reserves would still be in place ready to develop when prices rebound.”

Brookside’s SCOOP

SWISH is in the southern part of the of the Anadarko Basin, in an area dubbed SCOOP, where other companies have followed Brookside’s lead.

SWISH, by the way, stands for Sycamore and Woodford shale In the Southern Half of SCOOP, while the latter acronym stands for South Central Oklahoma Oil Province.

Prentice said: “We made this discovery and some of the clever work we did early on in prospecting delivered up these results.

“We named our particular part of the world in southern SCOOP the SWISH. And the plays, or the sub play if you like, have been so successful that the name has been picked up by the other operators.

“We’re now in a situation where we’ve got some of the larger, more successful companies surrounding us, so we’re right in the middle of a very hot area.”

Brookside is also making progress to become more accessible to the huge number of American investors interested in the O&G sector by listing on the New York Stock Exchange.

This article was developed in collaboration with Brookside Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.