Commodities snapshot: winners and losers for 2022 and beyond

There were big winners and losers in commodities last year. Here’s a snapshot of their performances and how things are shaping up for 2023.

With China, interest rate rises and the Russian invasion of Ukraine in the foreground, 2022 was a wild year in commodity markets.

We take a look at which metals were winners and which were losers over the past 12 months and look at where they seem to be heading in 2023.

For the latest mining news, sign up here for free Stockhead daily newsletters

WINNERS

COAL (Newcastle 6000 kcal)

2022 start: US$169.60/t 2022

Finish: US$404.15/t

High:US$157.57/t (April 5)

Low: US$76.01/t (October 31)

Change: +138.29 per cent

It was a year like no other for coal miners, who saw price rises for the unloved fossil fuel outstrip even metal du jour lithium to become the hottest ticket on the ASX in 2022.

ESG be damned, energy shortages exacerbated by Russia’s invasion of Ukraine and a ban of Russian coal in the key European market saw coal prices soar, having already touched all time highs in 2021.

Despite expectations rising Indian and Chinese domestic production would see coal prices moderate, thermal coal prices rose to over $US450/t at one point, spending most of the second half of the year at eye-watering levels in excess of $US400/t.

Metallurgical coal prices stunningly rose to almost $US670/t in the immediate aftermath of the invasion, with typically discounted pulverised coal for injection, a cheap replacement fuel for met coal in blast furnaces heavily supplied by Russia, closing the gap to premium hard coking coal.

That was good news for Stanmore Coal (ASX:SMR), which saw the value of its $US1.2 billion deal to acquire BHP’s (ASX:BHP) 80 per cent stake in BMC soar between its announcement in November 2021 and closure in May last year.

Visit Stockhead, where ASX small caps are big deals

BHP decided to trade away the “lower quality” PCI and semi soft coking coal assets in favour of focusing on its “higher quality” BMA premium hard coking coal mines amid a shift to rearrange its portfolio for so called future facing commodities.

Stanmore later paid $US270 million after dividends for the final 20 per cent stake in the rebadged SMC owned by Japanese trading house Mitsui.

As the global economy, and especially China, wavered through the second half of the year a strange arbitrage emerged, with the normally discounted Newcastle grade thermal coal attracting a healthy premium against coking coal, with some miners, such as Coronado (ASX:CRN), switching sales from steel mills into the European power market.

Speaking of dividends, cashed-up coal miners showered their shareholders with the largest payouts outside the ASX’s big three of BHP, Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG).

Whitehaven Coal (ASX:WHC), up over 400 per cent at one point last year, posted a record annual profit of $2 billion in FY22, paying out interim and final dividends of $449 million, upwards of $500 million in a buyback and launching a new buyback which could mean it returns more than $2 billion to absorb 25 per cent of its stock.

Yancoal (ASX:YAL) delivered a $696 million interim dividend and repaid $US2.75 billion in debt, nearly clearing its liabilities by the end of 2022.

New Hope Corp (ASX:NHC) and Coronado also paid out big windfalls to shareholders with even once struggling junior Terracom (ASX:TER) returning 10c per share in each of August and November after paying off a $US215 million Euroclear Bond refinanced as late as the second half of 2021. Wowsers.

Will it continue? Prices remain high, with premium met coal again traversing above $US300/t and thermal coal futures continuing be offered at upwards of $US250/t for delivery years away, though a warmer than expected northern winter has hurt demand.

Key stories to watch will be the impact of China unwinding an unofficial ban on Australian coal exports and the outcome of complaints about a new royalty regimen in Queensland, protested by BHP and Glencore among others, which introduced three new tiers including a massive 40 per cent on coal sold at upwards of $300/t (AUD).

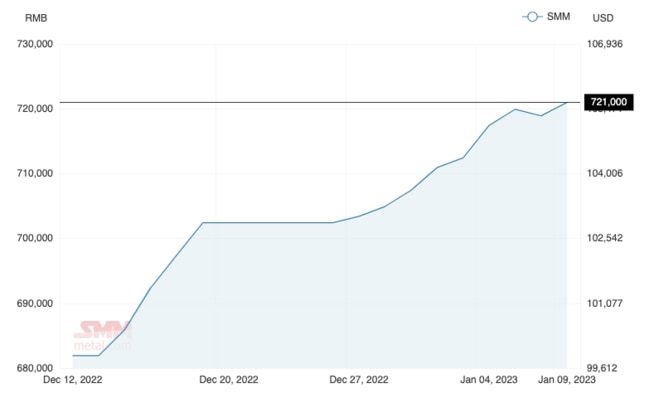

LITHIUM (Fastmarkets Hydroxide CIF China, Japan and Korea)

2022 start: $US36,000/t

2022 Finish: $US83,500/t

High:$US85,000/t (November 23-December 22)

Low: $US36,000/t (January 6)

Change: +132 per cent

Where do we go from here?

Lithium prices, depending on which price agency you follow, peaked in China last year at around $US85,000/t.

But the most treacherous path is not to the top of the mountain but the way down, and investors evidently were spooked when investment banks began calling a top for prices of the battery metal.

Lithium producers were carted twice in 2022, first when Goldman Sachs dropped predictions of a 2023 and 2024 price slide in May and then again in December as prices for chemicals in China plateaued and cooled as Lunar New Year approached and subsidies that have seen the EV market rise exponentially approached an end.

Prices remain extraordinarily high by historical standards, upwards of $US74,000/t for both hydroxide and carbonate in China according to Fastmarkets MB, with combined CIF China, Japan and Korea prices still above $US80,000/t.

Miners are still big winners as well. Pilbara Minerals (ASX:PLS) made $8.5 million a day in the September Quarter and is expected to begin paying dividends this year.

Its Battery Material Exchange spodumene auctions, which have fetched upwards of $US8000/t on a 6 per cent Li2O basis have pointed to the hot market for lithium raw materials, with its contracted offtake price expected to lift from an average $US4266/dmt (5.3 per cent Li2O basis) in the September term to $US6300/dmt on a 6 per cent basis.

Most analysts expect prices to fall from record highs this year, but also upgraded forecasts in recent months to account for prices that have remained strong for longer than expected.

Benchmark Minerals Intelligence saw prices for carbonate and hydroxide stabilise in early December before falling “as fears over weak Q1 2023 demand and rising Covid-19 cases in China spurred cathode companies to destock inventories and traders to sell off technical grade carbonate material”.

But BMI expects spodumene producers to renegotiate contracts at higher levels in early 2023.

“Benchmark anticipates that the ongoing renegotiation of spodumene offtake contracts will see feedstock prices continue to rise through Q1 2023, which could squeeze margins for converters if lithium chemical prices continue to fall,” the price reporter said in its December assessment.

“These rising feedstock prices may therefore place upward price pressure on carbonate and hydroxide should demand pick back up in China following the Spring Festival.”

While some majors, such as BHP, have shunned the growing lithium space on the grounds the market is too small and immature, others have embraced the new commodity market, with its big rival Rio Tinto planning to become a major producer backed by its assessment that demand will expand between four and seven times by 2030.

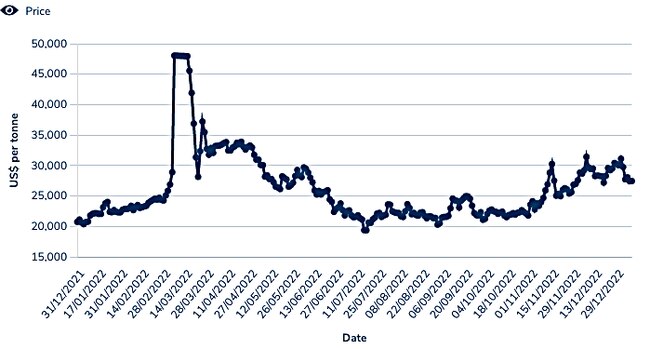

NICKEL

2022 start: $US20,750/t 2022

Finish: $US30,550/t

High: $US48,000/t (March 9)*

Low: $US19,050/t (July 15)

Change: +47.22 per cent

*LME cancelled trades between $US50,000-$100,000/t after March short squeeze.

A stunning 47.22 per cent lift in LME nickel prices across 2022, powered in part by the rising use of nickel in batteries, masked the liquidity struggles facing traders after the LME’s all-time implosion in March.

The root cause was a massive build-up in short positions from miners and traders, including China’s stainless steel making giant Tsingshan, which became exposed when prices for nickel started running early in the year as Russia entered Ukraine.

Between March 4 and March 8, $US16 billion in margin calls were settled, many times the daily average, with prices rising 69 per cent as the short squeeze emerged on March 7 to $US50,300/t then doubling in a manic morning on March 8, threatening to wipe out the world’s biggest nickel market participant.

The LME called a panicked halt to trade and kept the market shut for days, a move which bruised investor confidence in the world’s largest metals clearing house.

It has pledged to get its house in order after a damning review released this week.

But beyond the drama, nickel is looking like a strong fundamental bet and a commodity with a massive growth profile from the explosion in electric vehicle sales over the next two decades, if we can find enough of the stuff to service demand.

RFC Ambrian, in a report last year, estimated that between 0.7 and 1.1Mt of additional class 1 nickel in the form of nickel sulphate would be required to satisfy the growth of the battery market by 2030.

By that point, total demand for nickel, in RFC Ambrian’s assessment, will increase from 2.4Mt in 2020 to between 3.8-4.8Mt by 2030, a CAGR of 4.6-6.9 per cent.

Existing nickel sulphide producers will add 121,000t to the market through expansions, with new greenfields nickel sulphide projects potentially adding 224,000t.

That means the world will be increasingly reliant on the conversion of ‘Class 2’ Indonesian nickel into matte and mixed hydroxide from new high pressure acid leach plants to fulfil its battery order book.

Market participants are hopeful ESG premiums will be attached to cleaner, lower emitting class 1 nickel sulphides like those produced in Australia, and they have become hot commodities.

Private equity mob Kinterra offered $45 million cash to acquire nickel tiddler Cannon Resources (ASX:CNR) in October, while IGO (ASX:IGO) nabbed the $1.3 billion plus cash purchase of Western Areas and Andrew Forrest’s Wyloo Metals pipped BHP to the acquisition of Canada’s Noront Resources, since renamed Ring of Fire Metals.

BHP was not to be outdone, adding the $1.7 billion, 35,000tpa West Musgrave development in a late 2022 deal to acquire copper miner OZ Minerals (ASX:OZL) and investing in the Kabanga Nickel project in Tanzania.

Meanwhile, BHP also added Ford to its list of carmaking customers for nickel sulphate from the 85,000tpa Nickel West business in WA alongside EV giant Tesla and the world’s biggest car manufacturer Toyota.

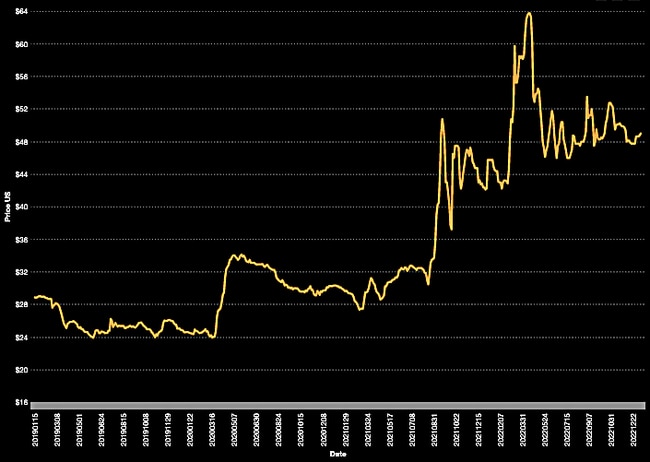

URANIUM

2022 start: $US42.38/lb 2022

Finish: $US48.63/lb

High:$US63.75/t (April 13)

Low: $US42.25/lb (January 3)

Change: +14.74 per cent

Every year it seems uranium bulls will be tipping a breakout. Will 2023 be the year it finally happens?

Spot prices for uranium bear less resemblance to other, larger markets, given it is an energy source and is primarily sold under long-term contracts between miners, enrichers and utilities.

The spot market is very small, but has been used by utilities to avoid signing new long-term deals in recent years, while prices have been in the toilet.

But the arrival of Sprott and other funds buying up uncontracted uranium for investment purposes in 2021 changed the game, and utilities which are facing shortages in a couple of years are coming back to the market to sign supply deals.

Uranium prices spiked amid the fallout of Russia’s invasion in Ukraine, given the Putin’s belligerent nation is one of the world’s largest enrichers of uranium, rebounding after initial fears following unfounded concerns Russian forces may have caused damage to Europe’s largest nuclear power plant at Zaporizhzhia.

The fallout of Russia’s (so far non-nuclear) war also posed problems for major producers Kazakhstan and Uzbekistan, who use transport routes and enrichment services in Russia.

Yellowcake spot prices were humdrum through the second half of the year, but at almost $US50/lb closed at their highest year end level since 2011, when the Fukushima nuclear incident and Japan’s nationwide reactor shutdown put the industry on the skids.

Boss Energy (ASX:BOE) and Paladin Energy (ASX:PDN) both announced restart plans for their Honeymoon and Langer Heinrich mines, respectively, while Deep Yellow’s (ASX:DYL) merger with Vimy Resources was the first major M & A activity in the industry in years.

Market participants are confident prices will rise once utilities who have slept on securing new supply are forced into the market, amid a growing push from the nuclear sector to promote its form of energy as a solution to wean the world off its reliance on fossil fuels.

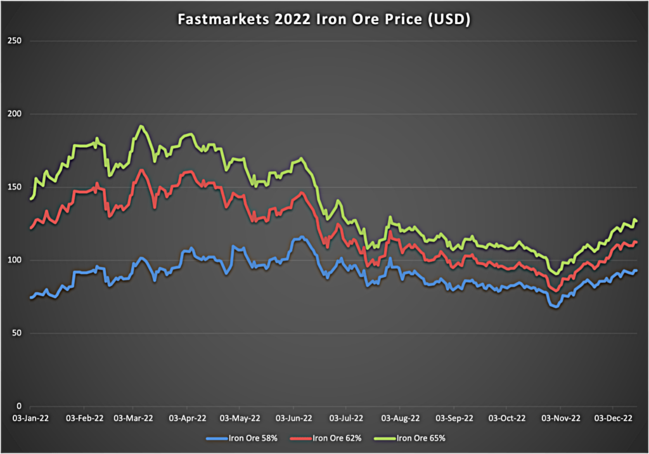

IRON ORE (SGX Futures)

2022 start: $US108.38/t 2022

Finish: $US116.12/t

High: $US157.57/t (April 5)

Low: $US76.01/t (October 31)

Change: +7.14 per cent

Iron ore has two big question marks hanging around it in 2023. The first is what impact the introduction of China’s state buyer, the China Mineral Resource Group, will have on the price of the commodity.

Many analysts say it could make iron ore pricing less volatile, though few are predicting a price collapse as China re-emerges from its Covid bubble with plans to revitalise its economy and property industry.

The second is whether Rio Tinto (ASX:RIO) and its Chinese partners come to an arrangement with the Guinean government to develop the long-stalled Simandou mine, which could bring anywhere from 60-200Mtpa of high grade iron ore onto the seaborne market from later in the decade depending on who you believe.

Last year 62 per cent Fe iron ore spot prices surged to more than $US160/t in early April before collapsing within six months to under $US80 (their lowest level since Vale’s Brumadinho dam disaster in January 2019) as China’s economy went stale and steel mill owners starting sieving cash like, well, a sieve.

But their late 2022 and early 2023 rebound has producer hopes high that China’s recovery will be a boon for miners.

Regardless of prices, production growth remains a major focus for the big boys.

Fortescue Metals Group (ASX:FMG) and BHP hit record export tonnes in FY22, while Rio looked like it may have been on track to hit the lower point of its guidance for the first time in years as 2022 came to a close.

FMG could produce a new record in FY23, targeting shipments of between 187-192Mt, but all eyes are squarely on both its green energy ambitions and the progress of its new 22Mtpa Iron Bridge magnetite operation.

BHP has medium term plans to expand to 300Mtpa and longer term ambitions of shipping 330Mtpa by later in the decade, while Rio’s deal to develop its dormant Rhodes Ridge deposit with Wright Prospecting could help it finally expand to long run Pilbara targets of 345-360Mtpa by the end of the decade.

Chris Ellison’s Mineral Resources (ASX:MIN), meanwhile, approved the construction last year of its 60 per cent owned 35Mtpa Onslow Hub, mooted to produce at costs that would be profitable at any point in the iron ore price cycle.

LOSERS

COPPER

2022 Start: $US9682/t 2022

Finish: $US8400/t

High: $US10,720/t (March 7)

Low: $US7005/t (July 15)

Change: -13.24 per cent

It is hardly surprising that as China sagged under the weight of Covid lockdowns and western governments entered a rate rise race to the top through the middle of 2022 that copper took a hit.

It is known, after all, as Dr Copper, a barometer of the health of the global economy.

Threatening all time highs for a third time in under a year when the invasion of Ukraine set off fears of extreme shortages, copper briefly looked set to fall below $US7000/t in what would have been a massive drop.

In the end prices rebounded as China’s demand returned with the end of its restrictive Covid Zero impulses, supported by all-time-low warehouse inventories and a string of supply issues due to social and political unrest and regulatory issues in Chile, Peru and Panama.

Chile, in particular, saw production fall 4.5 per cent year on year despite expectations of a post-Covid rebound. While the market had been expected to enter a surplus in 2022, through to October the International Copper Study Group estimated a deficit of 307,000t.

Copper is a major beneficiary of the shift to electric vehicles, which contain around four times the copper metal content of internal combustion engine cars, and the transmission infrastructure needed to underpin a large rollout of renewable energy.

That fact has led the world’s biggest miners to prioritise growth in the commodity, from BHP’s $9.6 billion cash buyout of OZ to Rio Tinto’s $US3.3 billion bid to take out minority shareholders in Oyu Tolgoi owner Turquoise Hill Mining.

In other major corporate activity Aeris Resources (ASX:AIS) is set to double its primary copper production through the acquisition of Soul Patts’ Round Oak Minerals, Sandfire Resources (ASX:SFR) collected the keys to the MATSA copper complex in Spain and Bill Beament and Nev Power backed SPAC Metals Acquisition Corp, expected to list in Australia this year, paid $US1.1 billion for Glencore’s CSA mine in Cobar.

Goldman Sachs, which infuriated many battery metals investors with its bearish approach to lithium, has been a major copper bull.

While commodity strategist Nicholas Snowdon’s off-the-cuff call that $US100,000/t was not outside the realms of possibility may seem fanciful, it does seem prices will have to rise to incentivise new production.

In a review of the world’s top undeveloped copper projects last year, GS says $US9000/t is the new incentive price after recent inflationary pressures with $US13,000/t needed to develop the supply required for the energy transition.

RARE EARTHS (NdPr Oxide)

2022 start: $US134/kg 2022

Finish: $US104/kg

High: $US175/kg (March)

Low: $US82/kg (September)

Change: -22.6 per cent

Rare earths spent the first part of 2022 surging to levels not seen since the halcyon days of the late 2000s, when Lynas Rare Earths (ASX:LYC) first moved to break the Chinese monopoly over the magnet supply market.

It then drifted into a funk, wrought by China’s economic slowdown, belying expectations that neodymium and praseodymium, key to the supply of magnets for EVs and wind turbines, will see a massive rise in demand across the 2020s.

That bullish demand projection encouraged Lynas to move early on plans to expand its Mt Weld mine in WA, with its supply of NdPr oxide to almost triple to 12,000tpa by 2025.

It has also brought a string of new players into the market and provided the steam for long-suffering explorers to progress their development plans.

Notably some of Australia’s richest people are getting on the bandwagon, with Gina Rinehart investing in rare earths stocks at home and in Brazil, Chris Ellison helping bring Victorian minerals sands rare earths developer VHM (ASX:VHM) to IPO and Twiggy Forrest signalling the commodity as the main diversification strategy for its metals business outside iron ore.

Meanwhile Arafura Rare Earths (ASX:ARU), which now counts Gina Rinehart as a significant shareholder, has moved closer to an FiD on its Nolans rare earths project after signing offtake agreements with Hyundai and Kia, while Iluka Resources (ASX:ILU) has begun work on Australia’s first refinery at its Eneabba project after receiving a low cost $1.2 billion Commonwealth loan to back its construction last year.

Further down the industry, the junior end of the market lit up with a number of discoveries of ionic clay rare earths across Australia, while WA1 Resources (ASX:WA1) proved one of the most exciting stocks on the ASX after it uncovered a niobium rich orebody at its West Arunta near Kiwirrkurra on the WA-NT border, rising almost 500 per cent over the past year.

GOLD

2022 start: $US1820.10/oz 2022

Finish: $US1812.35/oz

High: $US2017.15/oz (March 9)

Low: $US1618.20/oz (September 28)

Change: -0.44 per cent

Gold enters 2023 riding a wave of positivity of a kind reserved for bulls of the safe haven commodity.

Prices were not hammered anywhere near as hard as they may well have been as the US Fed initiated eight consecutive interest rate rises, including a handful at the hair-raising severity of 75bps.

Since the close of 2022 prices have gained to over $US1870/oz, with a weaker Aussie dollar a secret weapon for local producers, taking spot prices for bullion to upwards of $2700/oz.

There are notes of caution, with investment bank RBC warning that gold may have run too hard, too fast, outpacing fundamentals with the magnitude of its rebound over the past month or so.

On the other hand, bankers from Argonaut and Canaccord are bullish on precious metals, with the former’s chairman Eddie Rigg telling Stockhead he would not be surprised if it again breached $US2000/oz.

Central banks have also turned to precious metals at record rates to guard against currency weakness, with China a major player amid concerns over the Yuan in the face of a slowdown in its long-growing economy.

But bullion sentiment can turn on a dime.

Market watchers were biting their nails nervously overnight for the most recent US inflation print, having already priced in a slowdown in rate rises for 2023.

OTHER METALS

Prices correct as of December 31, 2022.

SILVER

Price: $US23.95/oz

+3.72 per cent

TIN

Price: $US24,808/t

-36.55 per cent

ZINC

Price: $US2972.50/t

-16 per cent

COBALT

Price: $US51,955/t

-28.55 per cent

ALUMINIUM

Price: $2392/t

-17.72 per cent

LEAD

Price: $2281/t

-0.34 per cent

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here