Brokers on Monday: Clinuvel finds friends; ANZ’s unimpressive outlook

Clinuvel Pharmaceuticals and ANZ have been under brokers’ microscopes. One has been given a series of ticks, the other … not so much.

Stockhead checks in with some of the week’s notable broker moves in its Brokers on Monday series.

This week we focus on Clinuvel Pharmaceuticals and the ANZ Bank …

One has received some positive attention over the past week, while the other has disappointed brokers and been downgraded by several.

Brokers begin to sit up

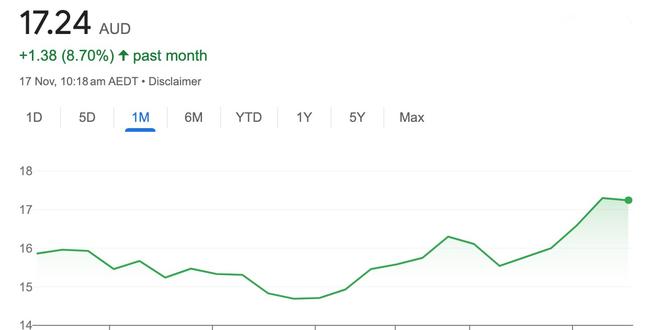

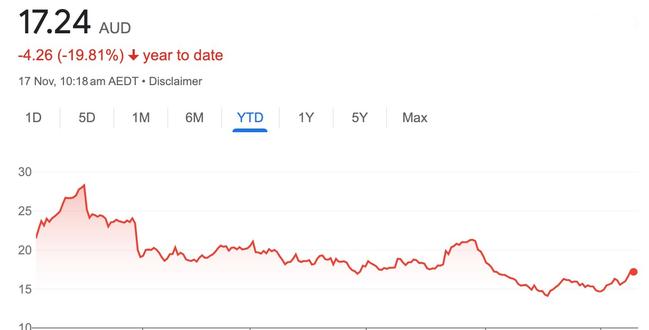

CLINUVEL PHARMACEUTICALS (ASX:CUV)

- Consensus recommendation: Hold

- Consensus price target: $21.33

- Current share price: $17.24, upside of circa 26 per cent (ex-div)

- Morningstar and Ord Minnett initiate coverage of CUV

Clinuvel defines itself as a “global specialty pharmaceutical group focused on developing and commercialising treatments for patients with genetic, metabolic, systemic, and life-threatening, acute disorders, as well as healthcare solutions for the general population”.

Morningstar starts by clocking Clinuvel with a fair value estimate of $18 – and says the stock looks undervalued, trading at an 11 per cent discount.

“We suspect the market is likely too pessimistic on the speed and extent of Clinuvel’s commercial rollout of Scenesse for its existing indication, which contributes 83 per cent to our fair value estimate.”

For the latest investment news, sign up here for free Stockhead daily newsletters

The company’s key product, Scenesse, is the only approved treatment for phototoxic reactions specifically associated with erythropoietic protoporphyria (EPP), a rare genetic disease, the broker says.

EPP sufferers are extremely sensitive to sunlight, and some times some forms of artificial light. They can suffer symptoms from tingling, itching or burning, up to severe pain.

Morningstar forecasts an earnings per share (EPS) compound annual growth rate (CAGR) of 16 per cent for the next five years, with Scenesse remaining fairly protected from competition.

The broker suspects the market is “also underestimating potential new earnings streams”.

Broader indications, including vitiligo (an auto-immune disorder that causes patches of skin to lose pigment or colour) might still be in clinical trials, but Morningstar says “early efficacy and safety data is positive”. This, the broker says, would vastly expand Clinuvel’s addressable market if successful.

Regardless, due to low capital requirements and high-profit margins, Clinuvel enjoys high returns on invested capital.

The Morningstar Uncertainty Rating for Clinuvel is High, and it assigns a Standard Capital allocation rating.

Ord Minnett has also initiated coverage of Clinuvel Pharmaceuticals with an $18 fair value estimate, as well as a Hold rating.

The broker is also relatively upbeat for CUV, saying the market is, on the whole, overly pessimistic about the biotech’s outlook.

MORE FROM STOCKHEAD: Cash splash on financial advisers | Brokers back Webjet, Life360 | ASX small caps ‘underloved’, says Datt

Clinuvel’s current strategy revolves around expanding its direct distribution and increasing reimbursement support for Scenesse and exploring various ways to diversify its earnings beyond the niche adult EPP market.

According to FNArena, CUV’s current forecasts are for a five-year group CAGR of 13 per cent compared with 19 per cent revenue growth in FY23.

Not that bankable

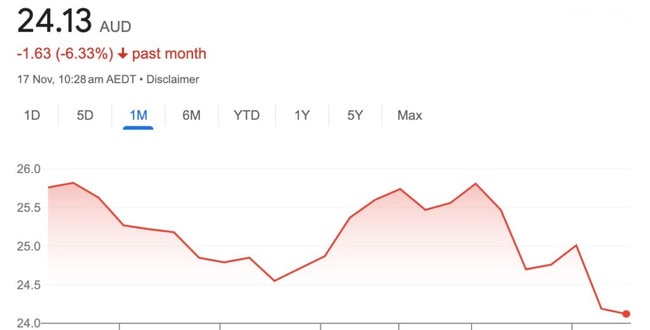

AUSTRALIA AND NEW ZEALAND BANKING GROUP (ASX:ANZ)

- Consensus recommendation: Hold

- Consensus price target: $26.02

- Current share price: $24.13 (-3.2 per cent, ex-div)

- UBS Downgrades ANZ to Sell ($25 Price Target from $26).

- JPMorgan and Citi lower PT ($25.40 from $26.50) and ($26 from $27) respectively.Both brokers downgrade ANZ to Neutral

After the banked dropped its FY23 numbers this week, the feeling was that overall, it was a softer result than the headline implied, with beats in other operating income and asset quality, which are unlikely to be capitalised by investors.

ANZ Bank has delivered a slight miss to UBS’s expectations with its full year results, but the broker attributes the result to the cost of the bank growing above market during a period of heightened competition and some irrational mortgage pricing.

Cash net profits declined 6 per cent year-on-year to $3.6 billion, with net interest income down 5 per cent to $8078 million, but some net interest income pressure was offset by stronger-than-expected non-net interest income.

Citi analysts believe ANZ’s cash earnings are a significant miss on forecasts – around 4 per cent and 2 per cent respectively.

The bank’s weighting to institutional business, formerly a boon, came home to roost as institutional offshore deposits fell, leaving the bank to fall back on more expensive domestic retail TD deposits to support its above-system mortgage growth, which hit retail profits, says the broker.

Visit Stockhead, where ASX small caps are big deals

Going back six months, ANZ’s deposit franchise was a strong point of positive differentiation vs peers, courtesy of its weighting and execution in institutional banking.

However, over the second half, the momentum in the diversification story slowed as offshore deposits in institutional declined sharply. This led to ANZ’s aggressive mortgage market share push needing to be funded by expensive domestic retail Term Deposits, hitting retail banking profitability.

ANZ’s second half Cash NPAT of around $3.6 billion was a slight miss versus consensus expectations.

Net interest income fell 5 per cent half-on-half, while net interest margins contracted 10bps to 1.65 per cent – in the core banking division, the underlying contraction was 7bps, around 3bps worse than expected (albeit this was broadly in line with peers).

Costs rose +3 per cent to $5.1 billion, 3 per cent ahead of consensus, with the cost-to-income ratio slightly worse than expected at 49.6 per cent.

Citi says that even though the “miss” doesn’t appear to be significant, compositionally, this is undoubtedly a “weak” result.

Despite some analysts already questioning ANZ’s low mortgage book of customers in arrears, credit impairment charges rose only 3bps.

Customers 90-days past due rose 4bps whole non-performing loans rose 7bps.

Brokers warn that ANZ’s collective provision coverage is much lower than peers and this will provide less buffer if the economic outlook deteriorates (although it is worth noting that ANZ is less exposed to recent mortgage vintage given their volume growth during and post-Covid).

Analysts have also fairly aggressively reduced ANZ’s FY24 and FY25 EPS targets by 7-9 per cent.

Of particular interest is UBS, which has cut their dividend forecast for FY24 to $1.40, well below the $1.60 consensus and move to a Sell rating.

Visit Stockhead, where ASX small caps are big deals

The erosion of franking credits adds extra complexity, and investors should now factor in a partially (70 per cent) franked dividend in their forecasts.

ANZ declared a final dividend of 94c per share, comprising an 81c dividend partially franked at 65 per cent and an additional one-off unfranked dividend of 13c.

ANZ is trading at 11x P/E, in line with its historical average, although its almost 20 per cent discount to peers is one standard deviation from its historical average of -10 per cent.

At 1x Price to Book, the stock is one standard deviation from historical averages.

Both market revenues and NIM proved a disappointment, offset by strong fee income and several one-offs. Citi also thinks opting for a bonus dividend instead of a buyback means there’s no benefit in terms of shares count moving forward.

Finding something on the upside, Citi says ANZ’s bad and doubtful debts were nearly half consensus forecasts.

So. That’s a little win.

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here