Blood is thicker this quarter: Morningstar’s pathological outliers, Part 1 – Sonic Healthcare

As the pandemic faded, so did investors’ thirst for now-undervalued ASX pathology stocks, says Morningstar, as it puts Sonic under the microscope.

The biomedical treatment of disease and injury is what we call pathology.

Needles. Blood. Tissue. Other gross things. Etc.

From the common place lab services which take and test our blood – to the cutting edge biological research of medical innovation – jabbing everyone with syringes is merely the tip of the haemagloberg.

And while all pathologists undoubtedly look back at 2020-22 with a wistful sigh of Covid-longing, for these major ASX-listed bloodsuckers, the pandemic was a Cambrian-like explosion of activity which has left a void that’s been hard to fill.

For the latest health news, sign up here for free Stockhead daily newsletters

Today, shares in Sonic Healthcare (ASX:SHL), Healius (ASX:HLS), and Australian Clinical Labs (ASX:ACL) have fallen by roughly 60 per cent on average since the start of 2022.

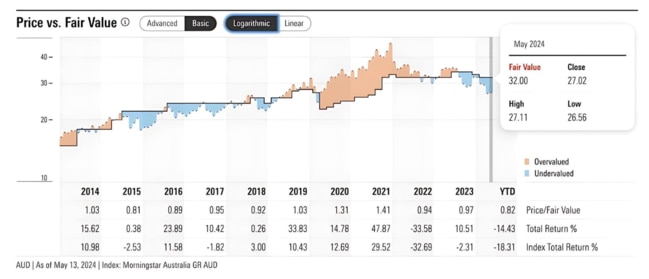

And, according to the studies of Morningstar equity analyst Shane Ponraj, each stock now trades at an average 35 per cent discount to Morningstar’s fair value estimates which look thusly:

- SHL – $32

- HLS – $3

- ACL – $3.50

Ergo sum: Australia’s top pathology providers are significantly undervalued.

In this bloody-minded three-part Stockhead special, Ponraj extracts, dissects and analyses each of the majors across the full spectrum of each business.

And finds opportunity in rude health.

Short pathological lie of the land

Ponraj said that within the broader ASX healthcare sector, pathology stocks screened attractively.

The rather niche subsector trades at an average price/fair value estimate of 0.65 versus the healthcare sector average of 1.11.

That means there’s a lot of room to grow.

Ponraj said the joys of higher-for-longer elevated margins during coronavirus testing were never going to last forever, no matter how it might’ve seemed like it at the time.

And in the intervening few years, it appeared traders had found new and more timely narratives, so pathology providers had fallen out of favour with the market, and margins were now below pre-pandemic levels.

While the market doubts a return to pre-pandemic profitability, Ponraj said he saw several reasons to expect a stronger recovery than market consensus, due to increased pricing, stabilising costs, and scale benefits.

“Our fiscal 2028 operating margin forecasts for Sonic, Healius, and Australian Clinical Labs are 14 per cent, 12 per cent, and 11 per cent, respectively, versus operating margins of 12 per cent, 8 per cent, and 4 per cent in fiscal 2020 before material coronavirus earnings.

MORE FROM STOCKHEAD: RAC says combo lifts cancer killers | Optiscan, Mayo plan pathology breakthrough | ASX biotechs catching experts’ eyes, Part 1 | Part 2

Blood tells

Ponraj said the three main pathology providers, with better than 80 per cent combined market share, were well-positioned to benefit from industry trends.

And long-term volume growth drivers were intact.

“In the near term, we expect elevated volume growth as patients return to routine diagnostic testing and general practitioner attendances recover on new bulk billing incentives,” Ponraj said.

“We forecast a five-year revenue compound annual growth rate of 5 per cent for the pathology industry, with roughly two-thirds from expected volume growth and the rest from pricing.

“Demand is driven by population growth, ageing demographics, higher incidence of diseases, wider adoption, and a higher number of tests available.”

Today, Ponraj runs the microscope over the biggest of the ASX’s pathology providers.

SONIC HEALTHCARE (ASX:SHL)

Ponraj says Sonic is a third larger than its closest competitor.

“Sonic is the leading private pathology operator in Australia, Germany, Switzerland, and the UK, which together contributed roughly 70 per cent of pathology revenue in pre-pandemic fiscal 2019.

“In Australia, Sonic earned pathology revenue of $1.5 billion in fiscal 2019 versus Healius’ $1.1 billion, making it a third larger than its closest competitor.

“In the same year, Sonic’s global pathology EBITDA margin was 18 per cent versus Healius’ Australian pathology EBITDA margin of 12 per cent, with Sonic’s margin also likely diluted by its less-dominant regions.

“We think much of this substantial differential is driven by cost advantages derived from scale.

Economies of scale, you say

The first of these advantages is Sonic’s higher testing volume results which mean a lower cost per test as labour, equipment, leases, and overhead costs are all leveraged.

In addition, Healius operates about a third of Australia’s collection centres, slightly ahead of Sonic’s share.

“This is a strong indication that Sonic’s network is not only superior in terms of efficiency but also difficult to replicate, with centres being larger on average and in more populous locations,” Ponraj said.

Basically, Sonic’s ability to churn through more bloods with fewer teeth, to use the rather obvious vampire metaphor, achieves greater efficiency across segments such as transportation costs.

“Finally, we think Sonic’s scale benefit over smaller competitors lends greater buying power as procurement of consumables can be centralised at national or even global levels,” Ponraj said.

“Sonic has also extended its scale benefit and market share in Australian pathology with a trailing three-year organic revenue compound annual growth rate of 5.3 per cent to fiscal 2020 versus Healius’ 3.8 per cent and market growth of 4.7 per cent.”

Visit Stockhead, where ASX small caps are big deals

Absolute volume

Ponraj said Sonic’s “medical leadership” model recognised the importance of the referring doctor, as the company sought to differentiate itself on service levels.

Success in SHL’s model was evidenced by organic growth which Morningstar noted consistently tracked ahead of the market – suggesting market share gains.

“In an industry where absolute volume is an important component in achieving greater cost advantage, organic growth supplemented by appropriate acquisitions continues to add value for shareholders,” Ponraj said.

“Sonic’s organic volume growth in its core laboratories segment has typically ranged between 3 per cent and 4 per cent, and we forecast a similar rate over our 10-year forecast period.

“The volume growth is underpinned by population growth, ageing demographics in developed markets, higher incidence of diseases, and wider adoption of preventive diagnostics to manage healthcare costs. In addition, the number of tests available is expanding.”

The increasing complexity of SHL testing services, such as veterinary and gene-based testing, was also resulting in average fee price increases.

Highly acquisitive

And the company likes to grow and spread.

“It’s historically been highly acquisitive, particularly overseas,” Ponraj said.

“Synergies from procurement and integrating IT are relatively easy to capture, and given its cost advantage, Sonic is well placed to boost its organic revenue with bolt-on acquisitions.

“The US and Germany are singled out as the most likely sources of acquisitions, given their fragmented markets.

“In addition to acquisitions, Sonic is sourcing more volume to put through its laboratories from joint ventures with hospitals in the US whose in-house laboratories are typically sub-scale and would operate at higher costs.”

In the States, which contributed less than 30 per cent of pathology revenue in fiscal 2019, Sonic is a distant number-three player relative to US-based Quest and Labcorp which each hold around 9 per cent market share versus 2 per cent for Sonic.

But Ponraj said that while the big competitors’ absolute size provided cost advantages relative to Sonic, the ASX stock held a relative advantage compared with the long tail of subscale providers.

“Sonic’s expansion approach in the US is also differentiated and based on building strong regional positions to maximise the benefits of the hub-and-spoke model and carve out a greater cost advantage,” he said.

Fair value and profit drivers

Morningstar’s $32 fair value estimate for SHL factors in 4 per cent group revenue growth in a typical year and a mid-cycle operating margin of 14 per cent.

“Our estimates deliver earnings per share growth of roughly 5 per cent in a typical year,” Ponraj said. “The laboratories segment is the primary earnings driver.

“We forecast a five-year pathology revenue CAGR of 5 per cent forward to fiscal 2028. We forecast revenue for the base Australian pathology business to typically grow at 5 per cent.

“Diagnostic imaging revenue is forecast to grow at an 8 per cent CAGR over the five years to fiscal 2028 from a combination of organic volume growth and indexation of fees.

Morningstar reckons SHL’s EBITDA margins will expand to 27 per cent by fiscal 2033 from 24 per cent in fiscal 2023 as exposure to more profitable imaging modalities increases.

Risk and uncertainty

“While revenue growth drivers in the base business are well defined and the industry is defensive, it remains hard to predict how much Covid-19 testing will be maintained at a base level, notwithstanding the ongoing threat of new contagious strains,” Ponraj said.

“Given Sonic’s high operating leverage, margins are sensitive to test volume.

“However, regulatory reimbursement pressure is less of a concern as Sonic’s geographic revenue exposure is well diversified and we expect the recent trend of a relatively benign regulatory environment to continue.

“Sonic has historically been highly acquisitive, and there is a risk it overpays for acquisitions and destroys shareholder value if it does not earn returns in excess of its 7 per cent weighted average cost of capital.

“Delivering cost synergies from scale is a primary motivation for acquisitions and is dependent on successful operational execution and integration of the acquired companies.

“The primary environmental, social, and governance risk is related to product governance, where a major failure in lab technology or improper tests lead to a large increase in misdiagnoses. Lab results are critical in making decisions about appropriate treatment and surgery, and a serious systematic failure may expose Sonic to patient liability claims and contract losses.

“However, given Sonic’s geographic spread and proven record in overseeing its global operations with well-established processes, we do not think this is likely or would lead to material value destruction.”

Capital allocation

“Sonic’s balance sheet is in sound condition,” Ponraj said.

“Financial risk is low given low revenue cyclicality and solid cash conversion.

“Assuming no significant acquisitions, we forecast the company to be in a net cash position for most of our 10-year explicit forecast period, while also funding its organic growth and maintaining a 75 per cent dividend payout ratio.

“Investment efficacy is fair. While we think the acquisitive strategy of the company makes sense for shareholders given the fragmented nature and scale benefits available in the industry, Sonic has typically generated a modest ROIC (return on invested capital) of 9 per cent versus its 7 per cent cost of capital.

“Shareholder distributions, which have typically averaged 75 per cent of underlying net income, are appropriate. Sonic has maintained a consistent payout ratio while also funding its growth and maintaining its leading market positions and IT infrastructure.”

This content first appeared on stockhead.com.au

SUBSCRIBE

Get the latest Stockhead news delivered free to your inbox. Click here