Aussie ETF sector outpaced private managed funds last year by $40 billion

After eclipsing public managed funds in 2022, the Aussie ETF industry is tipped to have more than $150 billion in funds under management by year’s end.

The Australian ETF industry well and truly out performed local managed funds, which had a shocking time last year, according to BetaShares’ Australian ETF 2022 Review.

And BetaShares chief commercial officer Ilan Israelstam expects the exchange-traded funds to enjoy a big lift in funds under management by the end of this year.

In total the Australian ETF industry received $13.5 billion of net inflows, in a year where the unlisted funds industry sustained net outflows of $26.8 billion.

ETFs have received higher flows than unlisted funds in four of the past five years, with 2021 the exception.

Cumulative flows for the period were $71 billion versus the unlisted funds industry’s total net flows at around $3 billion

Inflows not enough to sustain asset value declines

Australia’s ETF industry’s positive net flows were unable to combat the asset value declines caused by falling share and bond markets.

The industry fell in value by 2 per cent in 2022.

Industry funds under management started 2022 at around $137B but by year’s end were at $133.7B.

While 2021 had an all-time record of $42 billion of growth, 2022 was a different story, with a decline of $3.2 billion in total industry size.

However Israelstam said net inflows still remained robust, particularly given the broader picture for funds management, amounting to $13.5 billion.

This was 42 per cent lower than the net flow figure recorded in 2021 of $23.2 billion, the highest net flows on record.

ETFs continue to grow in popularity

The industry had 6 per cent growth in the number of ETF investors, with 1.9 million Australians now investing in the funds.

“We also continued to experience strong trading values in the industry with annual ASX ETF trading value reaching an all-time high – with $117 billion of value traded on the ASX (compared to $95 billion in 2021, the previous record,” Israelstam said.

At an issuer level, the report showed ETF industry’s flows in 2022 were the most concentrated on record, with the top two ETF issuers Vanguard and BetaShares receiving about 90 per cent of the industry net inflows compared with 62 per cent in 2021.

“With the number of participants in the industry now at 42, its notable that concentration levels are actually rising, rather than falling – illustrating the importance of scale in the industry,” Israelstam said.

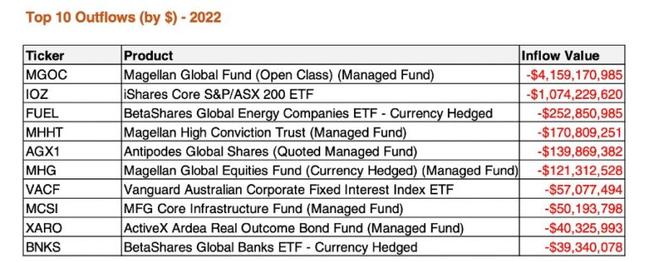

“Also notable was the fact that the five largest issuers for outflows in 2022 were all active managers.”

Passive investing led way in year of record ETF launches

It was the biggest year on record for product launches in the sector, with 52 new ETFs arriving on Australian exchanges in 2022, compared with 33 in 2021, while 13 products closed or matured.

There are now 319 exchange traded products on the ASX compared with 280 as at end 2021.

Similarly to the year before, a large proportion of the new launches in 2021 were active ETFs (33 per cent or 17 new funds).

As a result of the growing popularity of ETFs an increasing number of active fund managers are converting their traditional unlisted managed funds to ETFs via a dual access structure.

Israelstam said the majority of the new launches last year reflected this trend among unlisted fund managers.

“We would expect 2023 to again bring a number of new products, albeit not another record-breaking year given the breadth of product range currently available on ASX/CBOE,” Israelstam said.

He said 2022 had been all about passive investing with significant outflows recorded in active ETFs.

“This trend is particularly striking given the large number of active ETF launches, with the actual flow activity seemingly not dissuading managers from launching active ETF classes of their unlisted funds,” he said.

Israelstam said within the passive category, vanilla index-tracking funds once again dominated over smart-beta alternatives, although the smart beta category received 19 per cent of total flows, a record to date.

Investors stay home in 2022

Israelstam said that as geopolitical and economic concerns plagued global markets in 2022, global equity flows more muted than in previous years, with the Aussie equities category leading net flows.

“Australian equities ETFs received the largest amount of net flows, with about $4.4 billion received versus $5.5 billion in 2021,” he said.

“International equities ETFs, on a relative basis, had a very quiet year, receiving $3.3 billion of net inflows versus $11.8 billion in 2021,” he said.

Given market turbulence short-leveraged US equity exposures were the best performing ETFs in 2022.

Israelstam said strong performance was also recorded in global energy and Australian resources equity exposures, given the popularity of these sectors in 2022.

Fixed income on comeback trail

Fixed income became the second-most-bought category of ETFs in 2022, with investors more willing to invest this asset class as yield rises began to taper off.

“Fixed income ETFs had a very strong year, with $3.6 billion versus $2.9 billion in 2021,” Israelstam said.

Reflections on 2022 and 2023 forecasts

In his end of year 2021 Israelstam said wrote regarding 2022: “We believe the industry will continue to grow strongly, although we doubt it will be as assisted by the market as occurred in 2021.”

He forecast total industry funds under management at the end 2022 to be in the range of $180-$190 billion.

“While I was correct that the market certainly hindered industry growth, I did not predict the extent of market declines which ultimately led to a small decline in the value of the industry,” he said.

“In terms of 2023, we believe that market conditions will continue to act as a hindrance to industry growth but expect net inflows to remain consistently positive and ultimately that the industry will return to a growth footing.

“As such, we forecast total industry FuM at end 2023 to exceed $150 billion in assets.”