Stock plunge unravels $17bn margin loans

A $17bn punt on margin loans has unravelled as investors were hit to cover losses triggered by a 10pc market plunge in a week.

A $17bn punt on margin loans, which last year took speculative finance for share buying to its highest level since the end of the global financial crisis, has unravelled in dramatic fashion as investors were hit to cover losses triggered by a 10 per cent stockmarket plunge over the past week.

The nation’s biggest retail brokerage CommSec, a division of Commonwealth Bank, was on Friday inundated with “high volumes” of customer inquiries “due to recent market movements”.

Margin loans involve a revolving line of credit which allow an investor to borrow money to invest, and uses shares or managed funds as security. But due to their risky nature, investors can face huge losses if the market fails and can owe more than an original investment may have been worth. This prompts a margin call to top up the equity in the loan.

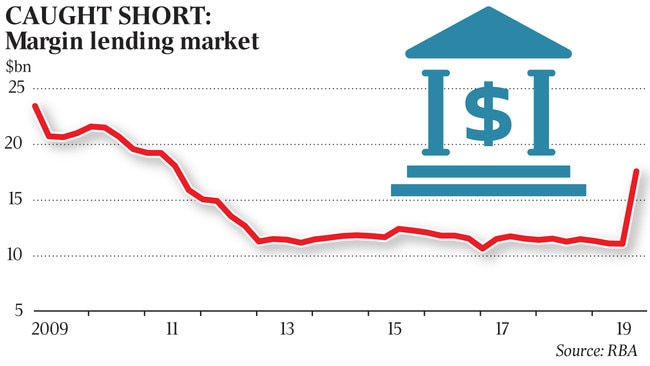

According to Reserve Bank statistics, margin lending in Australia peaked just before the global financial crisis at $42bn in the December quarter in 2007, sliding to just $11bn by the end of 2012, a level at which it held steady over the rest of the decade. However, in the September quarter last year, after the federal election and as the local stock market was primed for a rally by three RBA rate cuts, margin lending surged to a little over $17bn.

Chief executive of Bendigo and Adelaide Bank’s margin lending arm Leveraged, Lily Elliott, said just 1 per cent of customers were subjected to margin calls over the week, but most had “moderate to low gearing levels”.

“Fewer than 1 per cent of our client base have this week been subject to a margin call,” Ms Elliott said.

“While we have seen a slight increase in customer inquiries, we continue to provide a high level of service and are available to assist our customers as needed,” she said.

CommSec declined to comment, but an auto-generated response to customers said the company was “currently experiencing high volumes due to the recent market movements”.

Financial markets traders told The Weekend Australian many of the margin calls over the last week of market falls were covered with extra cash, but that the heavy 3.3 per cent plunge on Friday would “push them over” their limit and force investors to sell shares.

The S&P/ASX 200 index fell 9.8 per cent over the week, marking one of its worst weeks since the 1987 black Monday crash.

Former chief of the Stockbrokers and Financial Advisers Association Andrew Green said the flurry of RBA rate cuts in mid-2019 were likely behind the substantial increase in margin lending.

“It’s the realisation that rates are going to be lower for longer. With that realisation you either grow your assets or you don’t,” Mr Green said.

“The lower for longer situation is forcing retirees to go into equities or hybrids to seeking some sort of investment return,” he said. “They do have to embrace a higher degree of risk to provide an income.”

“Margin lending amplifies the gains and it amplifies the losses. You need to be prepared and able to cover the losses,” he said.

According to the latest Investment Trends Margin Lending Adviser Report, the overall number of margin lending customers had fallen over the last decade, replaced by “a wealthier group of individuals”.

The level of outstanding margin debt per investor has more than doubled between 2012 and 2019, from $111,000 to $235,000, according to RBA figures.

This group of investors is also heading to margin loans without the help of a financial adviser, with the share of outstanding margin debt held by direct investors increasing from 36 per cent in 2012 to 48 per cent in 2019.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout