Star fraud could happen again: casino inquiry told

A $3.2m fraud committed against Star Entertainment could occur again because of ‘cultural issues’ which assumed the customer was always right, the Bell II inquiry hears.

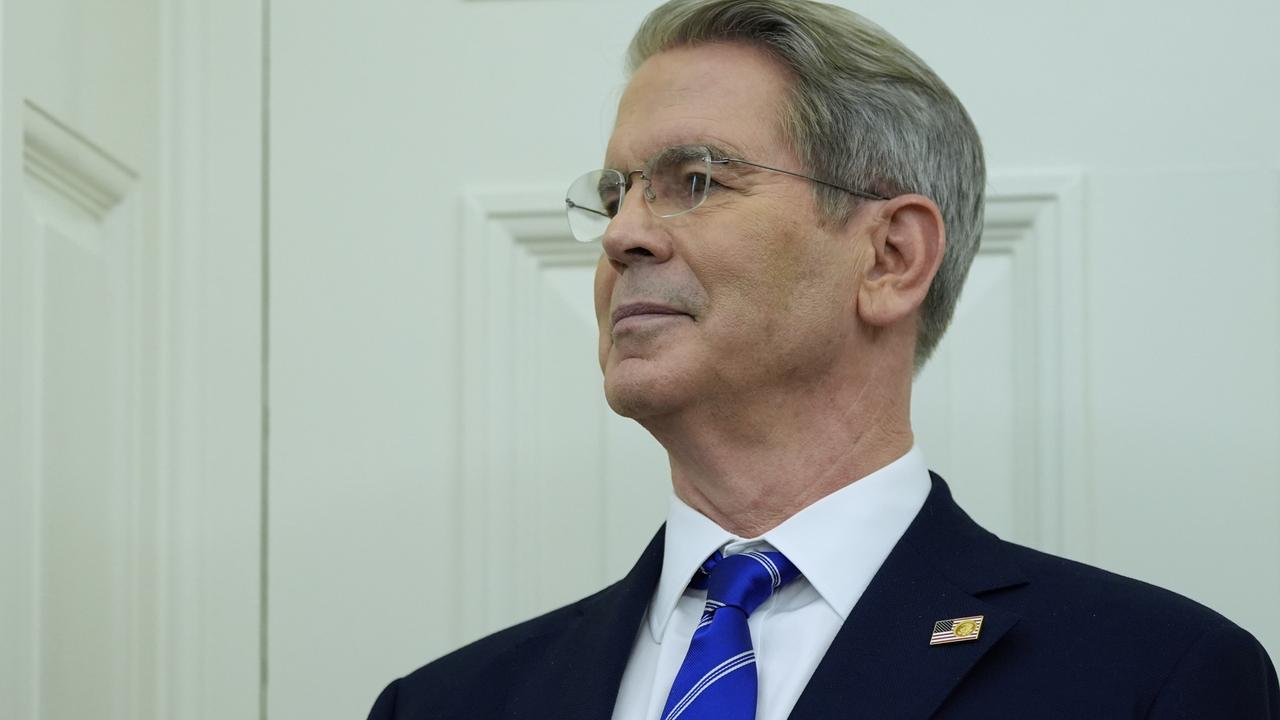

A multi-million dollar fraud committed against Star Entertainment could occur again because of a culture within the troubled casino operator that assumed the customer was always right, the company’s chief risk officer T Scott Saunders told the Bell II inquiry.

The inquiry heard that defects in Star’s “ticket in, cashout” machines allowed customers to reuse winning tickets after they were mistakenly returned to them. That resulted in very large amounts of cash totalling $3.2m being provided to customers in circumstances where they should not have received it.

“I am satisfied the technology issue has been solved, but I can’t say it can’t happen again. I can’t say we have solved all the cultural issues,” said Mr Saunders, referring to the fact that the fraud took two months to be discovered.

“Star sees itself as an entertainment company and the customer is always right, and we just do what the customer wants. We are in the process of changing that culture and turning it into a highly-regulated entity and that means customers are not always right and may have a gambling addiction and don’t actually know what is best for them. Or they may be trying to use our systems for nefarious purposes.”

Mr Saunders said he was concerned Star was not on the same wavelength with casino regulators on the way to clean up its performance, adding “we are nowhere near where we need to be to sustain meaningful and effective regulatory engagement.”

He assumed former Star boss Robbie Cooke’s alleged pushback against the NSW Independent Casino Commission (NICC) report criticising the company’s remediation efforts had not improved relations. The remediation plan needed some refinement, with deadlines being missed and requests for documents not being responded to.

Mr Saunders said Mr Cooke was “balanced and easy to work with” but could have delegated more on occasions. He said Mr Cooke never tried to influence anything he put in reports. “He presented as being very approachable,” he said.

Mr Saunders said that a lack of resources was a factor in Star being unable to enforce responsible gaming policies, including welfare checks on customers.

Mr Saunders said an investigation finding widespread falsification of welfare check records in NSW – which were supposed to show patrons did not gamble for more than three hours without interaction with a staff member — had been extended to its Queensland casinos.

“We haven’t finished the investigation into the root cause of the issue, but we definitely had breaches around the volume of work and not being able to execute the work, so I’ve got to think it (lack of resources) was a factor,” said Mr Saunders. At least seven of Star’s guest service officers have been fired for falsifying welfare checks.

Star also had faced a backlog of mandated source of wealth checks, which meant customers who should have been subject to checks, could enter its casinos.

Such checks mitigate risk that a customer’s funds relate to money laundering, terrorism financing or other serious crimes.

He said the company had been unable to obtain information on many customers who were inactive and had not been to the casino for up to seven years. He said regulators should have been given more details on the progress of the checks.

Star chief controls officer Rav Townsend on Friday defended herself against accusations by inquiry head Adam Bell SC that she misled the inquiry when she said she believed tens of thousands of source-of-wealth checks, mandated by the NSW Liquor and Gaming regulator, had been completed to the standard required.

She said the group did not complete wealth checks on about 22,000 to 25,000 people because those customers had not been active at the casino for some time, or there was no contact information. Instead, Star took alternative measures, including deactivating accounts and putting a note on its system about the need for future wealth checks if the customers returned.

Counsel assisting the inquiry Caspar Conde pointed to delays in Star meeting mediation milestones as an issue in its remediation efforts. Mr Conde asked former Star chief transformation officer Nicola Burke whether she was aware casino special manager Nicholas Weeks had informed the company in December 2023 that of the 170 mediation milestones that should have been completed by the end of year only three had been completed. Ms Burke said the milestones had been technically completed, they had to be validated by outside consultants KPMG. She said the company had a robust remediation plan. “It is fair to say it was ambitious but of course that put a lot of pressure on teams,” Ms Burke said.

Star shares fell 1.19 per cent on Monday to 42c and are down almost 10 per cent since the inquiry started last week.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout