Star casino on the ropes, top investor Bruce Mathieson warns, as cash woes continue

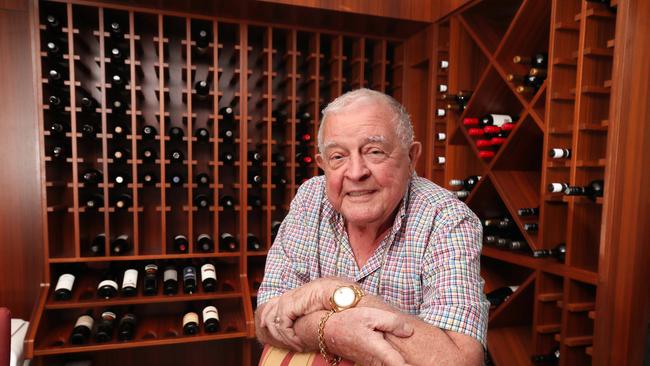

The troubled casino operator’s biggest shareholder, pub billionaire Bruce Mathieson, says the company could either ‘go bankrupt or be bought’ as shares plummet 33pc.

Pub billionaire Bruce Mathieson, the biggest shareholder in Star Entertainment, says the troubled casino operator will either “go bankrupt or be bought” unless it can improve its finances in the coming months.

Mr Mathieson, whose family company own 9.59 per cent of Star, said he would not be interested in putting any more money into the company until its financial future was clearer.

He said the biggest issue remained a looming fine from AUSTRAC for breaches of counter-terrorism and anti-money laundering laws, for which Star has provisioned $150m.

“No one will put in any more money until they know what those fines are going to be,” said Mr Mathieson. “So it either goes bankrupt or someone buys it. No one wants that, including the government.”

He said regulators had to clear the air for the company and remove the uncertainty over the amount of the fine. He said the company’s financial position had deteriorated.

Shares in Star slumped 33 per cent to a record low of 13c on Thursday after it warned the previous day it had burnt through more than $100m of its dwindling cash reserves in just three months.

Its market capitalisation closed the day at $545m - less than the value of its assets.

Star had said its available cash at the end of December had dropped 46 per cent to $79m — a reduction of $70m — from the previously reported position at September 30.

If that cash burn continues, Star would only be able to survive another six weeks without additional funding. The dire state of Star’s bank balance came despite a $100m draw down in the first tranche of a $200m debt facility announced late last year as part of a funding rescue package, Star said in a trading update on Wednesday night.

Investors are now increasingly concerned Star will not be able to survive the next few months as it faces rising debt repayments, tough trading conditions and regulatory costs related to the Bell II inquiry. The shares are down 76 per cent in the past year, with 158m shares changing hand yesterday. Star’s market value is now just under $373m

Regulators, including the powerful NSW Independent Casino Commission (NICC), are closely watching the shaky finances of Star given that the company will be forced to call in administrators if it runs out of cash in the next few months. That could result in the loss of 9000 jobs across NSW and Queensland.

Star said it expects to release its half year results on February 28 but at least one broker is now warning the company could be in its “death throes.”

Star said the loss of cash reflected continued difficult trading conditions, capital expenditure and the first $5m instalment of the $15m fine imposed by the NICC in 2024 for continued regulatory failures uncovered in the Bell II inquiry.

Star is also facing significant legal and consulting fees, ongoing transformation and remediation costs and joint venture contributions for the Queen’s Wharf precinct in Brisbane.

Star has to refinance $1.6bn of debt for the Queen’s Wharf precinct in Brisbane which it jointly owns with Chow Tai Fook Enterprises and Far East Consortium.

Jefferies gaming analysts said that with no evident reprieve in trading conditions, Star is facing significant balance sheet and cashflow stress, exacerbated by Queen’s Wharf and the AUSTRAC penalty yet to be announced.

The analysts said without the additional $100m in the second tranche of the finance package, Star faced a “significant liquidity issue”.

“Balance sheet issues are significant, and can’t be ignored,” the analysts said. “We see no catalyst for an improvement in earnings in the short term.” They forecast earnings at Star had remained negative throughout the first half of the year.

Hunter Green IB director Charlie Green said Star could be facing its final death throes given the huge amount of cash it was burning through.

“One of the key issues is the attitude of the overseas joint venture partners in Queen’s Wharf, and maybe they come to the rescue with the Mathieson family,” said Mr Green. Mr Mathieson last year said he remained committed to the company.

“The equity is all but worthless now, but there will be a conga line of vultures waiting to pick over the carcass,” said Mr Green.

Pac Partners institutional sales team member James Nicolaou warned the “financial viability candle is about to go out” at Star.

“In other words, borrowing a line from the Legendary AFL commentary Rex Hunt … ‘yibbida yibbida, that’s all folks,’” said Mr Nicolaou.

The company said it continued to work towards the “fulfilment of conditions” which must be met before it can draw down the additional $100m under the funding deal.

“A number of these conditions remain challenging to meet given the group’s current circumstances,” the company said. “The group continues to explore other liquidity solutions.”

Star has been struggling with liquidity and viability issues amid its regulatory and management challenges after a tumultuous 12 months which put the group’s casino operations in doubt and generated a record share price plunge.

New chief executive Steve McCann told shareholders at the company’s annual general meeting last month they were at a “critical point” in Star’s liquidity with continued weakness in operating performance of the group.

The company has faced a perfect storm over the past year after a second NICC inquiry by barrister Adam Bell SCfound Star was continuing to fail the standards required of a casino operator.

The financing deal Star stitched together last year appeared to satisfy, for the time being, one of the NICC’s major concerns — that the embattled casino group has enough financial support to keep its operations going. That is now in doubt.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout