Australia’s minerals riches can power energy revolution

Australia produces half of the world’s lithium and is the 2nd-largest producer of cobalt. Here’s how it can be a global critical minerals powerhouse by 2030.

As the world accelerates towards a low-carbon economy, a geopolitical race has emerged between nations aiming to secure the supply of the critical minerals required for the energy transition. Australia’s abundant reserves of critical minerals places it at the forefront of this race.

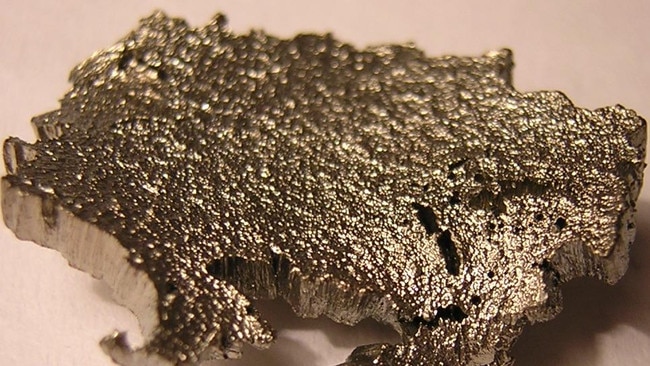

These minerals include lithium, silicon and rare earth minerals, all of which are key components of low-emissions technologies such as solar panels, wind turbines, batteries and electric vehicles (EVs). The energy transition is a global phenomenon that creates wonderful opportunities for Australia.

Critical minerals will be crucial to achieve net-zero carbon emissions by 2050 and ensure global warming does not exceed 1.5 degrees, a goal set out in the Paris Climate Pact. And in order to tap into those resources and capitalise on Australia’s unique position, PwC Australia believes all stakeholders along the value chain – from extraction to production line – must collaborate like never before.

It’s why the firm’s Energy Transition business has authored a landmark report that identifies the critical mineral stakeholder ecosystem and what needs to change now, for us to realise this once-in-a-generation opportunity.

“As a country, Australia has a fantastic natural endowment of critical minerals,” says PwC Australia energy transition partner Lachy Haynes. “And if you put that into the context of a world that is decarbonising and fracturing at the same time, you can see there is a real need for us to pay attention to how we best leverage that endowment for the benefit of all Australians.”

It is a sentiment echoed by Madeleine King, Australia’s minister for resources and minister for Northern Australia. In her recent address at The Australian/PwC Critical Minerals Summit, the Minister highlighted the government’s commitment to growing the country’s critical minerals resources and industries, which she said “will be crucial to help Australia and the world to meet our commitments to net-zero emissions by 2050”.

But while Australia already produces almost half of the world’s lithium, and is the second-largest producer of cobalt and the fourth-largest producer of rare earths, there is room for Australia to do more to deliver on its promise to become a global critical minerals powerhouse by 2030.

To do so, three separate approaches will be essential.

1. Breaking the paradigm of ‘dig and ship’

Australia has long aspired to be more than just a “dig and ship” economy in which commodities are extracted and then immediately exported for processing elsewhere.

To change that mindset, we must change our sense of priorities, says Haynes: “You really have to consider how we ‘dig, process and ship’ or ‘dig, value-add and ship’,” he says.

“That opens a whole dialogue around the question of what we do once we have extracted the minerals. Traditionally with iron ore and coal, our main priorities have been the logistics of getting it to port and shipping it to a customer, but we have now got the opportunity to take the next steps along the supply chain – processing, refining and manufacturing – potentially right through to the end product.”

In a speech in September, Australia’s former chief scientist Alan Finkel said the longstanding imperative to shift away from our traditional “dig and ship” economy has in recent years only intensified.

“We need to think big, we need to think very big,” he said. Doing so is not just a moral priority but it makes economic sense too. Modelling by PwC Australia indicates that if Australia can build more onshore value-add capabilities, and export more refined materials, while maintaining current growth trajectories, the critical mineral sector could add $40.4 billion in GDP by 2035 and potentially create as many as 4,500 jobs per year.

“Building more value-adding capability here would propel our economy to new heights, while creating high- value, future-facing jobs. This is essential for building greater energy independence and our ability to remain resilient in uncertain geopolitical environments,” said PwC Australia Energy Transition Director Conrad Mulherin.

“We need to move past talking about the size of the opportunity and start talking about action. The benefits are clear and the time for action is now. We don’t have a day to waste if we are to make the most of our critical minerals endowment and develop the next thriving export industry for Australia.”

2. Bringing together key stakeholders

Experts agree that Australia’s ambitions for its critical minerals sector present challenges and constraints that can only be overcome through collaboration between the many stakeholders involved.

Governments, scientists, miners, investors and manufacturers all have important roles to play and will need to work collaboratively to accelerate the pace and scale at which Australia can develop its critical minerals reserves, and take advantage of the supply chain opportunities on offer.

“We need to get market participants who are passionate about achieving an outcome coming together to work through what the opportunities are and how we can best take advantage of them,” Haynes says. “The more we create those forums where people can come, share perspectives, be heard and be exposed to other points of view, the quicker we will start to find the common ground necessary to create the platform for collaborative effort.”

3. Creating a policy environment to incentivise growth

In his speech to the Critical Minerals Summit last month, the Treasurer Jim Chalmers, said: “We want to be setting ourselves up for a boom that lasts with benefits that are shared – not tinkering around in the middle of it.”

The role of government in the development of Australia’s critical minerals industry is paramount. Government support can validate projects in the eyes of potential investors, and also help assuage their concerns about the risks involved.

At its most basic level, governmental support can be financial, but it can also come in myriad other forms including accelerating land access, as well as planning approvals and permitting processes.

As important will be the efforts by the government to help attract international funding to the sector by building alliances such as the Quadrilateral Security Dialogue (the Quad) between the US, Australia, India and Japan, and the trilateral security pact between the United States, United Kingdom and Australia (AUKUS).

Such agreements build a platform for positioning Australia as a valuable partner for those allies hoping to engage in so-called “friend-shoring”, a term first used by US Treasury Secretary Janet Yellen in April to describe efforts to rebuild global supply chains so that the most important manufacturing nodes are relocated in politically friendly and reliable countries.

In a recent speech at the Rare Earth Conference in Canberra, Madeleine King described her surprise when she learnt there is currently only one rare earths processing facility in the US.

“I suppose I should have known that before,” said King, “but, like many, I presumed there would have been more capacity to refine rare earths in the US. This serves to highlight the importance of Australia’s efforts to develop this processing facility to ensure our partners have diverse supply chains. But for me it was a light- bulb moment, where the magnitude of the opportunity available to Australia was made clear. The responsibility is equally enormous.”

Australia’s approach to its endowment of critical minerals is a hugely important issue that needs to remain on the national agenda, says Haynes. “And not just for a day, but for the months and years ahead, working with industry, working with government and working with a broader range of stakeholders to try to grasp this opportunity in a way that benefits everyone.”

“The treasurer said it best,” Haynes adds, “when he said ‘we’ve got exactly what the world needs, exactly when the world needs it.’”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout