Smiles turning to frowns as dentists bitten by corporatisation strategy

Ross McEwan was barely a month into his job as NAB’s new CEO when he received a troubling email about one of his business customers.

Ross McEwan was barely a month into his job as NAB’s new chief executive when he received a troubling email about one of his business customers.

“I hate to write to you knowing you are only just in the building but I wanted to give you a heads up on something that could turn toxic,” Jayne Ansin wrote in the email on January 22.

Ms Ansin had just completed a culture audit on behalf of dentists at listed dental group Smiles Inclusive — which floated on the ASX in April 2018 after raising $32m at $1 a share — and her findings were grim. “Here is a commercial business you are banking with a $19m (unsecured loan) that is being poorly run at best. It is called Smiles and it is a group of 50 joint venture dental practices that have been sold an absolute lemon.

“I have been doing some work with these very unhappy dentists, who are stuck. I just wanted to give you a heads up as I think potentially the relevant part of the NAB may not be dealing with this insolvent business as it possibly should be.”

Mr McEwan replied at 5.51am the next day: “many thanks Jayne, I will certainly get the team onto it and see what’s happening”.

What has happened is a troubling chain of events that ignited long before the COVID-19 pandemic wreaked economic destruction across the globe, forcing the closure of many businesses and lengthening unemployment queues.

Dentists are now locked out of their practices, payments to staff and suppliers have been delayed and covenants breached. Meanwhile, the company has been through three chief executives in two years and is yet to release its half-year accounts as it attempts to wrest a sign-off from its auditor.

Since late February Smiles has been suspended from trading on the ASX after it missed the deadline to lodge its financial results for the six months to December, raising fears about the group’s solvency while drawing accusations it deliberately misled the market after an exodus of dentists.

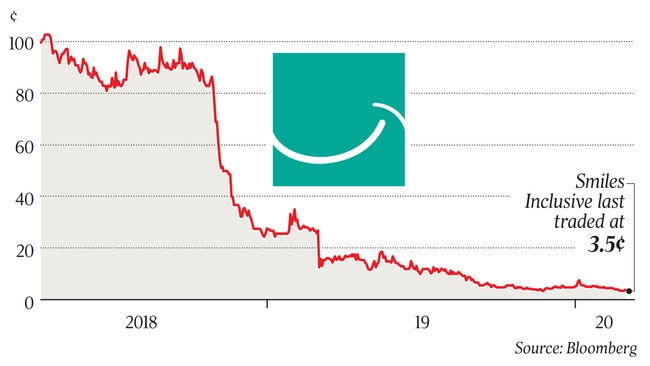

Meanwhile, the company’s shares have crashed from its $1 IPO price to 3.5c, while the ASX has fired off six queries since March last year about Smiles’ financial health and concerns about its continuous disclosure obligations.

Earlier this month a group of 16 dentists finally had enough. They sent a group email to Smiles’ new chief executive Michelle Aquilina, who was appointed on April 14 this year, informing her they were terminating their service agreements with the company on the grounds of insolvency.

For the dentists it was the end of a dream that Smiles had promised before it hit the ASX boards and since its float has consistently failed to deliver on.

The investment pitch was simple. Corporatisation had been slow to take off in Australia’s $10bn dental industry and only accounted for 5 per cent of the overall market. The fragmented industry was ripe for consolidation, which in turn would deliver greater profits.

The dentists were approached about selling their practices to Smiles, which then invited them to reinvest 40 per cent of the sale proceeds back into the business, with the dentists staying on in a profit-sharing agreement.

But cracks began to appear when the company lodged its results for the 2018 financial year. It had lost almost $5m versus its prospectus forecast loss of $300,000. A year later, that loss soared to $31m, while the company embarked on a series of emergency capital raisings to patch up its finances.

How Smiles has continued to trade when it can’t pay its bills is a mystery to the dentists, who spent years carefully building their practices, like most medical professionals, on a basis of trust, relationships and good old-fashioned service.

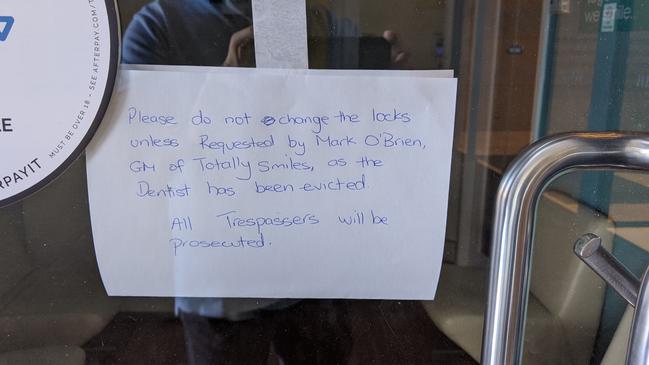

But now those dentists and their staff face an uncertain future. At one practice a note handwritten in biro and held up by masking tape against the window states: “please do not change the locks unless requested by Mark O’Brien, GM of Totally Smiles, as the dentist has been evicted. All trespassers will be prosecuted”.

Perth dentist John Camacho, whose four practices generated more than 10 per cent of Smiles’ total revenue, sent the letter to Ms Aquilina on behalf of the 16 dentists, informing her they were terminating their service agreements with the company.

Soon after Dr Camacho sent the email, Smile released a statement to the ASX saying it was in the process of contacting those dentists named in the letter to “understand their intentions” and was “committed to work with them wherever possible”.

“The majority of those dentists have informed the company that they were unaware of Dr Camacho’s letter to the company and have stated that it is not their intention to terminate their service agreements,” the company statement said.

But within hours of the ASX release going live, 14 of those 16 dentists emailed Ms Aquilina individually, confirming their intention to terminate the service agreements, drawing accusations that Smiles had deliberately misled the market about the exodus of dentists.

The dentists say Smiles responded by locking them and their staff out of their surgeries and the company’s IT system, barring them from ensuring their patients received continuity of care. At at least one surgery, the company even changed the locks.

One of the dentists, Arthur Walsh, whose clinic is a renovated old Queenslander in northern Brisbane, said it appeared the locks were changed so quickly that the doors were left open to the clinic, which housed expensive dental equipment and pharmaceuticals, including pain-killing medications and anaesthetics.

“My receptionist lives just around the corner and she goes regularly to water the plants and she went around there to find the security gates open and the front door wide open, straight after the locks were changed,” Dr Walsh said.

“I don’t know what happened, how it happened or whether the locksmiths left it unsecured or the Smiles representative who was supposed to lock up after the locks were changed didn’t do that properly. But one of my staff found the property open.

“I told her to take photos, leave it, and inform the company, who met the police there. They thought they were broken into but there was no sign of a forced entry. I think it was just neglect, in my opinion.”

But in response to a series of questions from The Weekend Australian, including the allegation of misleading the market, chief executive Michelle Aquilina confirmed that six — not the majority stated in the ASX statement issued on April 17 — of those 16 dentists had withdrawn their termination.

“As these practitioners no longer work in our practices, they were requested to return any property belonging to the company, including keys to the clinics, which is standard operational process and within their terms of agreement. The company has not received any responses to these requests and no company property has been returned,” Ms Aquilina said.

“Totally Smiles contacted all patients who had appointments booked with the practitioners who left the business, offering either to re-book with another dentist operating within Totally Smiles or transfer their patient records in line with patient confidentiality laws to another practitioner of their choice.”

Another dentist, Philip Makepeace, who has more than 37 years’ experience and operates a clinic in Bundaberg, sold his practice to Smiles before it floated and was initially impressed.

“I thought it was a fantastic model but unfortunately it has not proved to be that,” Dr Makepeace said.

“The model appealed to me for a range of reasons. I turned 60 this week and … I could gain some assistance from bundled expertise to enable me to transition into retirement.

“It’s actually turned out to be completely diametrically opposite to that.”

Smiles lodged a cash flow update for the nine months to March 31 to the ASX on Friday morning, which showed the company was $5.3m in the negative. But Ms Aquilina highlighted that in the final three months to March 31, it was $500,000 cash flow positive, with available financing facilities of $23.4m.

She said the company was also in “advanced negotiations on a potential transaction which will materially improve the company’s financial position”.

“The company is using agreed mechanisms to defer some superannuation payments in response to the COVID-19 crisis and will fully meet its obligations,” Ms Aquilina said.

“Similarly, the business has had to defer a small number of dentist commissions and is working towards bringing these payments up to date as soon as possible, in consultation with our practitioners.”

But Dr Makepeace said financial troubles began before the coronavirus outbreak and the government’s ban on elective surgery, which started in the last week of March and was partially lifted on Monday.

Indeed, on February 24, in response to an ASX query, Smiles wrote that NAB had waived covenant breaches on the condition it appointed Deloitte as an investigating accountant to provide ongoing review and regular reporting.

“I’ve got an outgoings account that was due to be paid to me as landlord for finalisation on March 17, which was pre-pandemic. That’s not paid,” Dr Makepeace said.

“There are a number of suppliers, including my dental lab, with outstanding accounts that haven’t been paid. We have had a constant stream of suppliers over the last 12 or 18 months ring us and say we are not supplying you any more because you have got an outstanding bill of X-thousand of dollars.

“When there are hold-ups because suppliers are no longer prepared to ship until the previous bills are paid, that’s pretty serious.”

After the Smiles missed its deadline to lodge its half-year accounts with the ASX, Dr Makepeace joined a Zoom call with Smiles management and other dentists in early March. He said when he asked about the financial health of the company, he was told by a senior Smiles executive that it was “none of his business”.

“I mean really? How is it not my business? I’m a shareholder and joint venture partner … how is it not my business to answer a question that relates to your fiduciary duty to me?” he said.

John Camacho, who made a failed attempt to join Smiles’ board in early 2019 in the wake of the company hitting financial strife, has seen the profits at his four clinics tumble under Smiles’ ownership, with EBIT plunging 90 per cent within two years.

“I was never naive and thought from day one you were going to make the same amount of money. I appreciate that there were going to be some cost burdens that you had to absorb as part of that profit share in the first couple of years.

“But to go from 100 per cent pre-IPO to losing 90 per cent of that EBIT within two years … my joint venture partnership is worthless. The company has destroyed the value that was in the company. The millions that were invested are gone. There is no point crying about that, it’s done.”

But Ms Aquilina is confident she can turn the business around.

“Since becoming chief executive on April 14, I have drawn upon my 30 years’ experience in the dental industry and have been working with dentists and staff on a strategy for Totally Smiles based on redesigning the operating model to be more customer-centric and lead highly empowered customer-facing teams to be more effective, and supporting practitioners and staff to grow their practices. I am confident that the business has a positive future.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout