Auditor risks soar

Some of Australia’s biggest companies have failed to change auditors for decades.

Some of Australia’s biggest companies have failed to change auditors for decades — in one case for 65 years — raising concerns about a heightened risk of corporate disasters under a practice that has been outlawed in Britain and Europe.

Former competition tsar Allan Fels warned that the trend could unleash “disastrous consequences” for consumers and investors, while former stock exchange chief executive Elmer Funke Kupper said auditor firms should be rotated at least every 10 to 12 years.

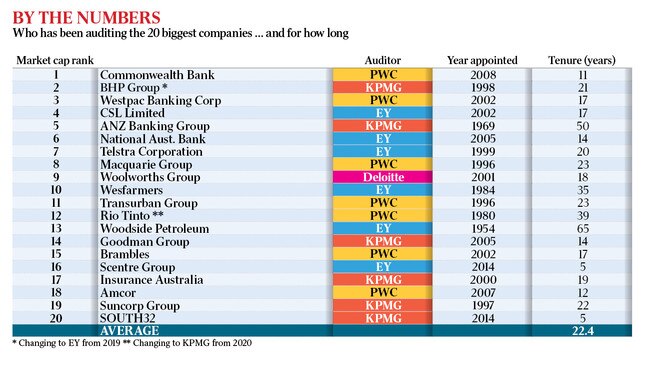

An analysis of the 20 largest publicly listed Australian corporations shows that the average tenure of auditing firms employed across the group has risen to 22.4 years — longer than the maximum 20 years allowed under European laws.

The list of top 20 firms, which oversee more than $1 trillion in total market capitalisation, is littered with companies that have retained the services of one of the four global auditors — KPMG, Ernst & Young, PwC or Deloitte — since floating on the sharemarket or since their inception as a company.

Oil and gas giant Woodside Petroleum has retained its auditor Ernst & Young for 65 years — since the Perth-based company listed in 1954. ANZ Banking Group has kept its auditor KPMG for at least 50 years, according to the earliest available public accounts in 1969.

A parliamentary inquiry will this month hold a series of public hearings into the accounting firms over conflicts of interest, poor audit quality, which can help trigger corporate collapses, and the tight-knit relationship between government and the big four accounting giants.

Mr Fels said yesterday: “It’s clear that the tenure of audit firms in Australia is far too long. It’s about time it stopped. Auditors have an awesome responsibility. They are the stewards of the spending of billions of dollars and it’s crucial that this job is done properly. When it’s not done properly there are disastrous consequences for consumers, investors and businesses dealing with them. We need a higher level of improved stewardship.”

Auditing firms are legally required to provide assurance that corporate financial statements give an accurate and fair view of a company’s financial position, liabilities, and profits and losses. However, the quality of audit work has fallen under criticism from global regulators, amid concerns about conflicts of interest at the big four accountancies as they shift focus from their stock trade in auditing to consulting work.

Mr Funke Kupper said auditor firms should be rotated at least every 10 to 12 years. He drew a comparison to rules that state company directors are no longer considered “independent” if they have been with a group for more than 10 years.

“There should be a time limit on auditors,” Mr Funke Kupper said. “Twenty years sounds like a long time. Good governance says that if you’ve been a company chairman or director for more than 10 years, you are no longer independent and you should be doing something else.

“It’s good to have a single auditor over a single business cycle, but most business cycles are over seven or eight years.”

The scrutiny of big accounting firms has intensified since May last year, when a British parliamentary inquiry called for the big four to be broken up following the collapse of contractor Carillion with debts of £1.5bn. All four firms did work for the doomed company.

The sector has faced a ratcheting up of regulation over the past two decades following the demise of now-defunct accountancy Andersen, which was embroiled in both the Enron collapse in the US and the implosion of local group HIH Insurance.

The Australian Securities & Investments Commission has turned the spotlight on the local arms of the big accountancies. Its most recent audit review found inadequate work had been done in 20 per cent of examined areas of financial accounts.

While auditing firms do not face rotation rules in Australia, individual accountants within a firm are barred from playing a “significant role” in the audit of a listed company for more than five out of seven successive financial years, leading to the switching of senior partners engaged on a company about every five years.

EY, PwC and Deloitte declined to comment. Eileen Hoggett, head of audit at KPMG Australia, said the rotation of lead audit partners was “a very effective system” which has been “a positive initiative for audit quality”. It added “fresh thinking to an existing team which already has an accumulated understanding of the business”.

“We believe (company) directors are best placed to determine the need for a change of auditors,” Ms Hoggett said.

“Our focus is on improving audit quality across our entire portfolio of clients, and a deep understanding of the business is critical to a robust quality audit.”

As revealed by The Australian, documents released under Freedom of Information laws show that ASIC warned senior Treasury officials in mid-2017 that it believed the reasons behind poor audit quality results were cultural and caused “primarily (by) the lack of auditor independence”.

The regulator was concerned that “rotations don’t work because in large, diverse enterprises, incoming auditors have (a) huge company learning curve so it can take years before they have the sophistication to know and willingness to challenge company account presentations effectively”.

An ANZ spokesman said that while KPMG has been the bank’s external auditor “for some time” the bank had “strong processes in place to ensure appropriate independence” and formally reviewed the relationship at least once a year.

BHP Billiton, which is dual listed on the ASX and on the London stock market, will switch its auditor to EY from KPMG after a 21-year stretch due to the new laws in Britain, which were introduced between 2014 and 2016.

Rio Tinto, which also has a dual-listing, has been forced to switch its current auditor PwC after a 39-year tenure, and will now employ KPMG.

National Australia Bank has retained EY since 2005, when it punted KPMG after an 85-year tenure following the inquiry into the $360m foreign exchange scandal.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout