Review into the Reserve Bank is expected to recommend a significant overhaul

A new committee of RBA members and external economists appointed to review monetary policy and challenge decisions are thought to be among recommendations handed to the treasurer on Friday.

Changes to the Reserve Bank of Australia board, with the possible establishment of a new structure for deciding monetary policy, are expected to be recommended as part of a review which will be delivered to Federal Treasurer Jim Chalmers on Friday.

The review of the RBA’s objectives, policy implementation, governance and communications, was commissioned last July and marks the first major overhaul in 40 years.

Recommendations in the report are expected to include the appointment of a new committee which would include Reserve Bank members and external economists to review monetary policy, rather than the current structure of a board made up largely of business people.

The Reserve Bank’s nine-member board is currently made up of business figures, the governor and deputy governor of the RBA and the Secretary of the Treasury. The arrangement is considered unusual compared to institutions around the world.

Other central banks, such as the Bank of England, the Bank of Canada and the US Federal Reserve Board, have committees of monetary policy exports to determine monetary policy.

The US Federal Reserve Board has an open market committee appointed of Fed members and representatives of regional Feds which makes decisions on monetary policy.

The report is also expected to comment on the RBA’s use of inflation targeting as a guideline for its monetary policy decisions, which is currently set to deliver a range of inflation between 2 and 3 per cent.

The review is expected to support the continuation of inflation targeting, which is widely used by central banks around the world, but may have more specific recommendations on its implementation and the inflation ranged targeted.

Dr Chalmers on Thursday said he would consider the report before releasing it publicly in mid April.

He said the panel had been keeping him “up to speed” with its thinking and the government was prepared to make “a meaningful change (to the RBA) that lasts.”

He said the changes would be aimed at making the RBA “more robust” and improving its “structures, processing and objectives for the next few years,” he said in a radio interview.

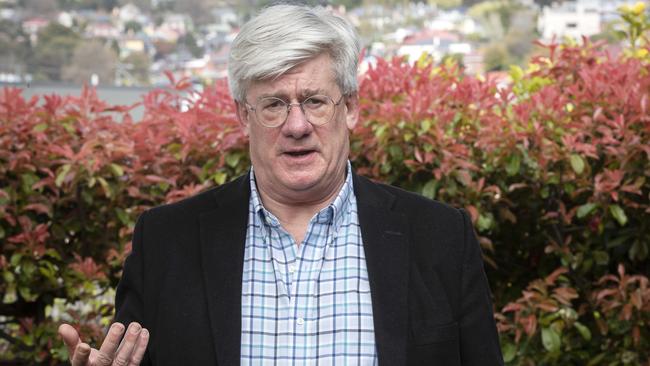

Economist Saul Eslake said that the current members of the RBA board did not have the “background or the expertise” to challenge recommendations on monetary policy movements put to them by RBA officials at their board meetings.

“It would be better if monetary policy decisions were taken by a body which had collectively greater experience in economics and monetary policy than the current board has,” Mr Eslake said.

He said this could be done with the appointment of a committee to make decisions on monetary policy, and the existing board acting in a more conventional way overseeing the administration and governance of the RBA.

Mr Eslake said that the current 2 to 3 per cent inflation target “remained appropriate”.

“It has served us fairly well and I would not be advocating any change to that,” he said.

He said the review could recommend changes such as bringing in more external people to the bank and more efforts to improve transparency in its decision making.

The review was being conducted by former senior deputy governor for the Bank of Canada, and current member of the financial policy committee of the Bank of England Carolyn Wilkins; Australian National University economics professor Renee Fry-McKibbin and the secretary for public sector reform, and former senior Treasury official Dr Gordon de Brouwer.

While the federal government currently has the right to appoint RBA board members and could change the current composition of the board without legislative change to include more economists, Dr Chalmers made it clear he expected to make more serious changes to the RBA’s structure which would require legislative change.

He said the government wanted to “build up” the RBA and “make it the best version of itself” which would require legislative change.

Dr Chalmers said the government had been engaging with the Opposition over the issue so that there could be a bipartisan approach to any major changes.

He said Opposition treasury spokesman Angus Taylor had been engaging with the panel “in good faith” and “ideally” and recommendations would be considered “in a bi partisan way.”

“This should be above politics,” he said.

Mr Taylor told the Australian on Thursday that it was “enormously important Australia has an independent, credible and capable Reserve Bank”.

He said he had “regular and constructive discussions with the RBA Review Panel as it formulated its recommendations.”

“It is essential that the review’s recommendations are agreeable for both major parties,” he said. “This will ensure certainty around the outcome of this review. With inflation at its highest level in decades, this is in the best interests of Australians.”

Mr Taylor said the Coalition’s focus was to make sure that the Reserve Bank’s monetary policy approach was “laser-focused on returning inflation to the 2-3 per cent target, while recognising any governance reforms need to be balanced, preserve the Reserve Bank’s independence, and bolster the Reserve Bank’s capabilities.”

He said the RBA had served Australia well for a long period of time.

“We want to make sure this crucial economic institution is maintained and that there are no distractions getting in the way of its core objectives,” he said.

Australian Banking Association chief executive Anna Bligh said it had been 40 years since the RBA had been reviewed.

“Australia and the world’s economy has immeasurably changed in those 40 years,” she said.

“The coming decades will see an even faster pace of change.

“Australia will need a future-fit central bank to meet the economic challenges ahead.”

The current seven-year term of RBA governor Philip Lowe expires on September 17.

Dr Chalmers said he would be making an announcement about the governor’s future “closer to the middle of the year”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout