Woolworths plans liquor arm split and ASX listing for June

Woolworths says it is pressing ahead with split of its drinks and hotels business as the retailer announced a $1.1bn first half profit.

Woolworths is pressing ahead with the $10 billion split of its drinks and hotels business Endeavour Group after the COVID-19 pandemic disrupted plans to unshackle it last year, while its Australian supermarkets have burst into 2021 to outstrip rival Coles and snatch market share.

Endeavour Group, which houses the Dan Murphy’s liquor chain and a nationwide stable of pubs, will spin off and list on the ASX with strong tailwinds from the first half of fiscal 2021 where the liquor arm of the business posted earnings growth of 24.1 per cent and a sales uplift of 19 per cent despite shuttered pubs and other challenges posed by the health crisis.

It led a vanguard of Woolworths key divisions across supermarkets and general merchandise chain Big W to report double digit earnings growth for the six months to Christmas at a time when COVID-19 was a huge disruption for all retailers but a boon for retailers in food, liquor and homewares.

An upbeat Woolworths chief executive Brad Banducci delivered a bullish assessment of the outlook for the next six months and although he cautioned supermarket sales growth would moderate compared with the spike last year when the pandemic induced panic shopping, he was not as pessimistic as Coles CEO Steven Cain last week who warned of a sector-wide drop in sales this year.

“Looking ahead to the rest of the financial year, we expect sales to decline over the March to June period compared to the prior year in all our businesses, with the exception of hotels where venues were closed for much of the final four months last year, as we cycle last year’s COVID surge,” Mr Banducci said.

He stressed it was a softer, moderation of sales rather than a sharp pullback with the extra store costs around keeping them COVID-safe also expected to shrink in the June half, further cushioning Woolworths earnings.

Evidence of a slower pullback was in Woolworths trading update which showed its supermarket sales over January and February lifted 8 per cent, down from 8.3 per cent in the second quarter, and also easily outstripping Coles which kicked off 2021 with sales growth of just 3.3 per cent.

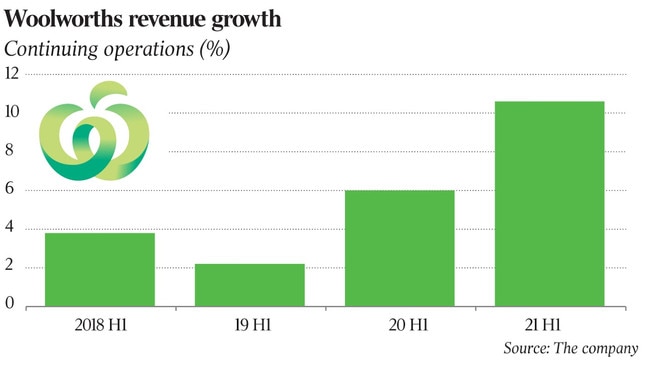

Woolworths on Thursday posted a 10.6 per cent increase in half-year revenue to $35.845 billion as profit rose 28 per cent to $1.135bn, just ahead of market forecasts of a profit of around $1.1bn.

The retailer declared an interim dividend of 53 cents per share, up from 46 cents per share last year, and payable on April 14. Woolworths shares closed up 1.1 per cent at $39.50.

An update on the planned spin off of Endeavour Group said the timetable was back on track after last year’s COVID derailment with a separation and likely demerger to happen in June, although a private equity bid for the business valued at around $10bn could scupper that.

Mr Banducci on Wednesday did not comment on whether Woolworths had been approached by private equity with a bid.

Meanwhile, Woolworths mirrored the strong performance of other key retailers which saw their sales, and especially online sales, boom during months of lockdowns and other restrictions due to the COVID-19 pandemic.

Even Woolworths’ laggard Big W was able to return to strong profit growth in the December half after years of underperformance and a string of multimillion-dollar losses as it booked a 20.1 per cent rise in half-year sales to $2.581bn and a 165.7 per cent increase in earnings to $133m.

At Woolworths flagship Australian supermarkets arm it reported first-half sales growth was 10.6 per cent to $23.449bn, moderating gradually over the half with second quarter sales growth of 8.3 per cent. Earnings for Australian supermarkets grew by 13 per cent to $1.329bn despite incremental COVID-19 costs of $168m in the half.

For its Australian food arm there was an increase in comparable items per basket of 14.4 per cent, partially offset by a decline in comparable transactions, down 9.1 per cent, with customers continuing to shop less frequently but with larger baskets. Higher e-commerce penetration also contributed to the growth in items per basket. Australian Food sales per square metre increased 7.6 per cent to $18,538.

Shoppers continued to embrace online shopping, which was accelerated by the pandemic, with e-commerce sales increasing by 92 per cent to $1.8 billion in the half.

“The first half of fiscal 2021 continued to be impacted by COVID, with elevated sales and higher costs as we worked to maintain a COVIDSafe environment for our customers and team,” said Mr Banducci. “While we have all been living in this uncertain environment now for 12 months, ongoing localised outbreaks remind us that we need to remain both vigilant and agile.”

He said despite incremental COVID costs of $277m for the group and the hotels earnings being well below the prior year, first half group earnings grew by 10.5 per cent to $2.092bn.

For Endeavour Drinks, its liquor chain business, total sales for the December half rose 19 per cent to $5.7bn with same store sales up 17.5 per cent. COVID saw a continued drive in elevated in-home consumption and trading up, although at more moderate levels than the previous two quarters as restrictions for on-premise venues were eased, Woolworths said. For the hotels division of Endeavour, sales fell by 27.5 per cent to $667m as earnings fell almost by half to $122m, reflecting closed venues due to COVID-19.