Woolworths lobs $872m takeover bid for Priceline owner API, trumping Wesfarmers’ $763m offer

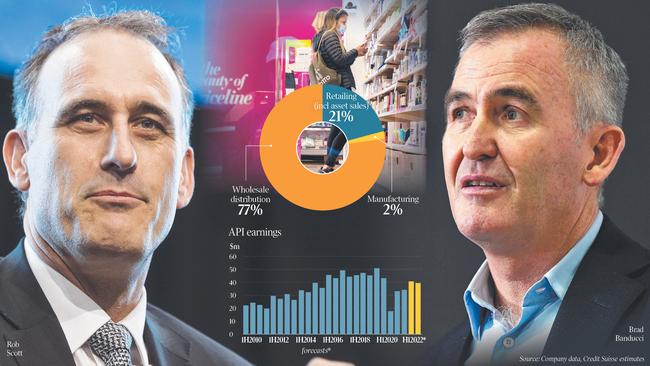

Wesfarmers and Woolworths are locked in a battle to buy out the owner of Priceline as they attempt to gain a foothold in the lucrative pharmacy sector.

Wesfarmers and Woolworths – two of the country’s largest retailers – are locked in a battle to buy out the owner of Priceline as they attempt to gain a foothold in the lucrative pharmacy sector.

Despite the advanced nature of takeover talks between Wesfarmers and Australian Pharmaceutical Industries, Woolworths on Thursday lobbed a surprise bid valuing the company at $872m.

In doing so, Woolworths has raised the ire of the powerful Pharmacy Guild. “Why is a company with interests in the alcohol, tobacco, gambling and nightclub industries wanting to move into healthcare?” a guild spokesman said. “How does it hope to convince Australians that it is serious about their health and welfare?”

Woolworths’ $1.75 per share bid – compared to a $1.55 offer from Wesfarmers agreed to by the API board last month – is part of a wider strategy unveiled by chief executive Brad Banducci to transform his supermarket group into a health and wellness retailer that touches customers on purchases from cholesterol pills and flu shots to bread and milk.

Mr Banducci said in an interview that he had been working for some time on the new direction into the health and wellness category, which is reflected in the recent divestment of its liquor and hotels division Endeavour Group.

“I do think there will be more of a focus on health and wellness, and that is something we have been working on for a few years, of course that included the demerger of Endeavour Group and we will continue to progress our aspirations in this space and we have a really good opportunity to accelerate that,” he said.

“There is always a little bit of opportunity with this kind of thing, but I do think it is more of a health and wellness company … and is something we have been working on for quite a few years.”

At stake in the burgeoning bidding war is not just bragging rights of who ultimately wins control of API, a pharmaceutical wholesaler as well as owner of pharmacy retail banners Priceline and Soul Pattinson Chemist, but a gateway into the fast growing health and wellness category worth $16bn annually.

And both parties have deep pockets to fund a war of attrition.

Wesfarmers, valued at more than $65bn and whose retail companies include Bunnings, Kmart and Target, is cashed up after divesting select coal, energy and industrial businesses with an eye on expanding into new areas. The company’s chief executive, Rob Scott, launched a $1.38 cash per share offer for API in July to value the company at $687m and later upped that to $1.55 to win over the takeover target’s board.

Now Mr Scott will face off with Mr Banducci and a group that has recently demerged its liquor and hotels arm and begun to acquire other businesses, spending almost $1bn to buy a stake in PFD Food Services and take control of Australia’s biggest data services company Quantium.

A spokesman for Wesfarmers said it would not be making a statement at this time.

The last time Wesfarmers and Woolworths faced each other in direct battle, outside of the supermarket aisle, was 10 years ago via Woolworths’ ill-fated launch into the hardware sector, with its Masters hardware chain that aimed to pinch customers and profits from Bunnings. That ended in disaster with Woolworths forced to close down Masters and write off billions of dollars in investments.

Now the pressure is on Wesfarmers to once more revise its takeover price for API or risk losing out to Woolworths.

Shares in API rallied almost 20 per cent when Woolworths unveiled its bid and by the close of trade had ended up 16 per cent at $1.735. The Woolworths offer price represents a premium of 20 cents per share, or 12.9 per cent, over the price agreed between API and Wesfarmers under their scheme implementation deed announced on November 8.

API is one of Australia’s largest health and beauty retailers and pharmaceutical distributors, and is the parent company of the Priceline, Soul Pattinson Chemist, and Pharmacist Advice banner brands that provide a range of retail services to its community pharmacy partners and company-owned Priceline retail stores. API also operates Clear Skincare, a non-surgical skincare clinic business, and Consumer Brands, a health and personal care business.

Mr Banducci, whose flagship businesses are in Australia’s largest network of supermarkets, as well as supermarkets in New Zealand and general merchandise retailer Big W, said the retailer was committed to a “better tomorrow for all Australians” in terms of their health and wellness.

“And part of that better tomorrow is helping our customers in affordability but also with wellness, it is something we have been working on for a few years.

“If we get the opportunity to partner with API we want to partner with community pharmacists and very consistent with leveraging expertise to provide the right advice for our customers on the things that matter to them.”

Woolworths has sold off its liquor and hotels arms but still has a sizeable business in selling tobacco at its supermarkets, as well as aisles crammed with junk food and high sugar products.

Mr Banducci defended its governance in selling these types of products and it would not stop offering it to customers at the same time it owned a pharmacy group and transformed into a health and wellness company.

“There are a whole number of categories we are looking at and try to improve what we are doing there … and with tobacco I would like to say we are one of the most responsible sellers of it and we will continue to consider how we operate in that segment, but also sugar … and other products, there are a whole range of things we need to continue to lift our game on which tobacco is one of them.

“And I don’t see it as a bad thing that we saw our tobacco sales go back by 20 per cent in the last quarter and it says a lot about how we are going to be very responsible in this category.”

Woolworths said it was willing to explore potential alternative control transaction structure options, such as a takeover bid with a minimum acceptance condition of 50.1 per cent. “Health and wellness is a large, fast-growing category and API would be a fantastic addition to our food and everyday needs ecosystem,” Mr Banducci said. “If successful, we will continue to support API’s community pharmacy partners to deliver better experiences for both customers and pharmacists.

“We will also work to strengthen API’s wholesale and distribution business to ensure that all Australians continue to have timely, cost-effective access to a full range of PBS and other medicines, via their community pharmacy, regardless of where they live,” he said on Thursday.

“We are strongly committed to supporting the community pharmacy model, including pharmacy ownership and location rules, to ensure pharmacies are well represented in all communities, especially in regional and remote parts of Australia.

“We also know that customer expectations across retail are evolving in areas like convenience, innovation and value.”

A Wesfarmers spokesman declined to comment on Thursday.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout