Woolies CEO’s ‘3am moment’ is rewriting the retail game

The annual results mark the point where the massive disruption and chaos of the Covid pandemic is now fully behind the supermarket operator. This means that after nearly three years it is no longer playing havoc with the bottom line or Woolies’ operating rhythm. And importantly this means his customers are reverting back to the more normal shopping habits they had in place before Covid.

This involves shoppers reducing the numbers of items in the basket when going to the supermarket, but they are also going into the store more frequently. Of course inflation is now influencing behaviour in a different way with customers clearly reaching for value shopping, while Woolworths is responding by starting to work its massive loyalty scheme harder.

The other point for Woolworths is that it is a more productive business today on nearly every measure than it was before the pandemic.

Canberra is about to review the nation’s competition settings and on Wednesday both Treasurer Jim Chalmers and his assistant Andrew Leigh took aim at big business for dropping the ball on productivity rates in Australia, particularly for a sub-par performance over the past decade. Chalmers set the tone for a review of competition policy with his Competition Taskforce suggesting that big business has been getting too big and the entry of more start-ups would help boost productivity.

Crime buster

Banducci was only speaking on behalf of his own business but he described it to The Australian as his “3am thoughts” after poring through Woolworths’ numbers during a two-day board meeting.

“At the end of June, every operational statistic in our business was better than it was at the end of June the previous year. But it was also ahead of the relative measure before Covid,” Banducci says.

The Covid pandemic is widely regarded in economic circles as the moment when Australian productivity went backwards, given companies were mostly in survival mode and ultra-short term planning, rather than going for longer-term growth.

The Woolworths boss says by the June quarter, his business was ahead in productivity since where it had been before Covid.

“That doesn’t sound like much but that’s actually a really important point. I don’t know many other businesses that find themselves in quite the same position.”

Woolworths has a big cost coming down the line fast with a 5.7 per cent annualised staffing wage increase, but Banducci is confident he can hold onto the productivity gains through this.

Woolworths has been spending around $2bn a year over recent years overhauling how it gets its goods to the stores at a more cost-effective rate. Banducci says his supply chain overhaul is past the halfway mark with 2024 representing a big year.

Two giant automated warehouses – one for goods, the other for chilled food – are on track to progressively open in western Sydney in the next year. That comes after the opening of a monster fresh food warehouse in Victoria at the end of 2020.

It’s these big-ticket investments plus a ramp-up in spending on online channels and data analytics that has allowed Woolworths to pull away from rival Coles.

New Coles boss Leah Weckert copped heat from investors this week when shares in her supermarket were sold off seven per cent on the back of surging margins and signs sales momentum had slowed.

Coles too attracted significant attention for calling out crime attacks, which had led to cost blowouts. Banducci acknowledged crime had picked up during Covid and is a problem for all retailers around the world but remains “immaterial” for Woolworths’ costs. He said the crime trend was lower than pre-Covid, which puts a large gap between Coles and Woolworths.

Woolworths has been investing in mitigation, higher security in the entrances of stores and digital upgrades at automated checkouts. But he says the conversation should be around keeping staff safe and keeping intrusion to a minimum for the 99 per cent of customers that do the right thing.

Balancing act

Banducci meanwhile doesn’t take a step backwards when talking about the supermarket giant’s latest annual profit of $1.72bn, an increase of 13.7 per cent in a year when supermarket earnings margins got wider. Strong sales momentum in the June quarter has flowed through to the opening weeks of the September quarter. This largely backed the 3.5 per cent share price jump on Wednesday.

But the supermarket operator is at the pinch point of inflation, caught between rising prices at the checkout, which are seriously hurting households, while on the other side there are demands from suppliers hurting with their own costs to push through even more increases and at a more frequent pace.

Banducci says the result is about getting the balance right between customers and staffers and shareholders.

“We don’t always get it right,” he adds, pointing out a downgrade in December 2021 when a number of Covid costs were rising through to the surface and this sparked a painful double-digit share price slump over a matter of days.

Banducci points to the absence of baked-in Covid costs that are helping to improve margins, while productivity benefits are also finding their way to the bottom line.

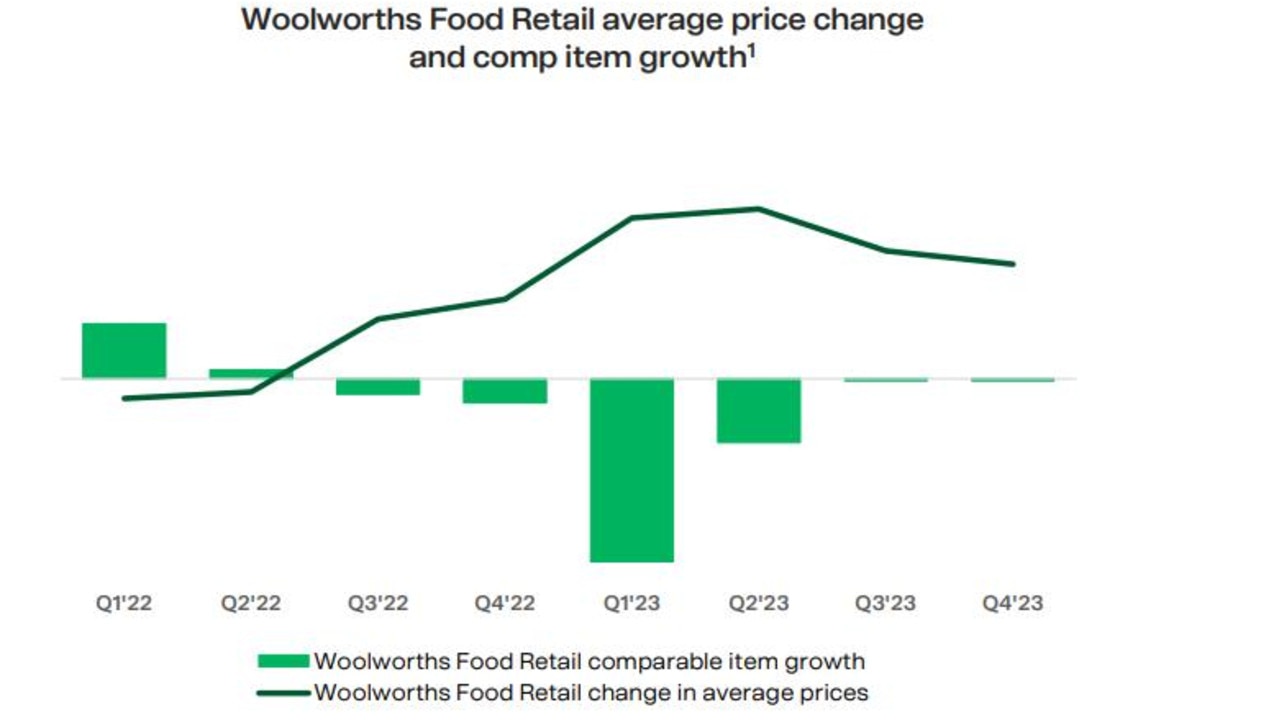

Woolworths has seen signs that average price inflation has started to moderate, particularly in the June quarter while average price growth was flat, although prices for some products remain elevated.

He says the pricing index for Woolworths products has been the best it has ever been against major competitors including Coles, Aldi and even online giant Amazon. This means customers are shopping more at his supermarket. Supermarket sales in the first eight weeks of the financial year are up 6.5 per cent.

“I feel we’ve done the right thing for our customers. But they do expect more from us. So we shouldn’t rest on our laurels.”

Meanwhile, annual sales at Woolworths’ digital business under WooliesX, which extends to supermarket home delivery and its massive rewards scheme, are now running at more than $6.4bn, consolidating its position as the third biggest business unit. At current growth rates WooliesX is on track to overtake New Zealand in terms of total sales in coming years.

Banducci says there is more value from the business that can’t be quantified from the accounts, including the ability to drive more sales from targeted discounts in the Rewards scheme that has 14 million members. The discounts are currently aimed at increasing the tag rate of getting shoppers to use their card, which in turn generates more data, but they may eventually replace the “yellow tag” weekly discounts.

Even so it is not all going Woolworths’ way, with the discount department store Big W seeing sales reverse a bigger-than-expected 6 per cent since the end of June. Banducci puts it down to cost of living challenges on tightness of cash around discretionary spending.

However, the test on this will come later this week when Kmart owner Wesfarmers releases its numbers. More recently Kmart has been a big beneficiary of shoppers trading down to value.

The latest set of accounts mark a significant moment for Woolworths’ boss Brad Banducci, with two important messages hitting him in the middle of the night that are likely to get lost in the headline numbers.