Wesfarmers profit surges, unveils a $2.3bn capital return

Bunnings’ owner will shower shareholders with a $2.3bn capital return after a profit surge, but warned of mental health toll from lockdowns.

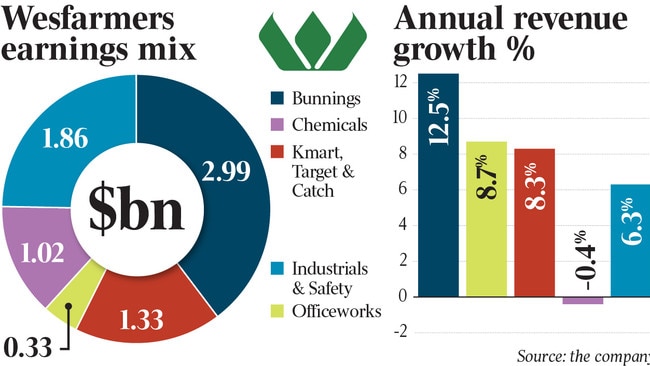

Wesfarmers has trumpeted the strength of its conglomerate model through the Covid-19 pandemic, with four of its five divisions posting earnings growth in 2021, enabling it to deliver a $2.3bn capital return to shareholders.

It emerged from the first year of the Covid-19 pandemic with a gold-plated balance sheet carrying no net debt – unusual for a company of Wesfarmers’s size – a rising return on equity that is at its highest level in years and even growing profitability from its once troubled discount department stores Kmart and Target.

However, the Perth-based conglomerate is showing some bruises from Covid-19 and the fresh round of lockdowns inflicted on eastern states since July.

Wesfarmers chief executive Rob Scott warned the impact of lockdowns on household and business confidence had become more acute as recent lockdowns were extended, with further widespread restrictions to negatively impact overall business activity and trading performance.

“The big issue at a national level, which is unique, is that we have both of our largest cities, Melbourne and Sydney, in lockdown. This is the first time we have had that for an extended period of time,” Mr Scott told The Weekend Australian.

“And interestingly we are seeing probably a greater lack of confidence emerging in Melbourne … the longer the lockdowns last the more the hit to both consumer and business confidence and we are really starting to see that, particularly on the small business side in Victoria.

“At the moment the sales impact is challenging and the next couple of months are going to be really challenging, but what is on my mind is less on the short term impact of profit and more about how do we support our team and the community.”

At the moment Wesfarmers had as many as 2500 staff members in isolation.

Bunnings during the pandemic has racked up a total of 9000 workers lost to forced isolation, throwing into chaos distribution centres and logistics into chaos.

It will continue to pay staff in isolation or that have no work, costing Wesfarmers an extra $2m to $4m a week.

Reporting the company’s annual results on Friday, which showed net profit up 40.2 per cent to $2.38bn as sales rose 10 per cent to $33.94bn, Mr Scott revealed a dent to its strong profit and sales momentum coming out of 2021, driven by lockdowns and shuttered stores.

The poor performance was most acute for its Kmart and Target chains which recorded a 14.3 per cent slide in sales since July, with that sales plunge worsened by the permanent closure of some stores. For Bunnings, which proved itself a huge sales driver through the first year of the pandemic, sales were down 4.7 per cent for the first seven weeks of 2022.

But for now Wesfarmers investors can celebrate the strong profit result for 2021, and the $2 per share capital return, driven by workhorse Bunnings and solid contributions from Officeworks and discount department stores Kmart and Target.

At Bunnings the home renovation boom helped lift sales by 12.5 per cent to $16.871bn and earnings by 19.7 per cent to $2.185bn, while Officeworks proved its worth in helping Australians ‘‘work and learn’’ through the pandemic as its sales rose 8.7 per cent to $3.03bn and earnings increased 7.6 per cent to $212m. For the Kmart Group (Kmart, Target and Catch) sales were up 8.3 per cent to $9.98bn and earnings better by 69 per cent to $693m.

Wesfarmers’s profit from continuing operations and before significant items, such as $59m for Target store closures and conversions and the treatment of a sale of a stake in Quadrant Energy, rose 16.2 per cent to $2.421bn.

The group result was in line with market expectations, and while Bunnings earnings missed consensus by 2 per cent, it was partly offset by a 7 per cent better than expected result from Wesfarmers’s chemicals division.

Mr Scott said the strong financial result for the 2021 financial year was a testament to the dedication of team members and leaders, who continued to find new and valuable ways to meet customers’ needs and support the community during a period of significant disruption.

“While Covid-19 had a significant impact on operations during the year, the group’s businesses maintained their focus on building deeper customer relationships and trust,” Mr Scott said.

“In line with Wesfarmers’ objective of delivering superior and sustainable long-term returns, the businesses continued to invest in providing greater value, quality and convenience for customers, including through strengthened data and digital capabilities.”

Wesfarmers announced a $2.3 billion capital return at $2 per share. The distribution is subject to approval by Wesfarmers shareholders at the annual general meeting on October 21.

“We had an opportunity to do a capital return and that is quite tax-effective for shareholders. For most shareholders that will be a tax-free capital return, and we have had approval from the tax office to do that.”

Mr Scott said Wesfarmers didn’t have a large enough reservoir of franking credits to opt for a share buyback or special dividend.

The final dividend was lowered by 5 cents to 90c per share, payable on October 7. The full year dividends of $1.78 per share are up 17.1 per cent on 2020.

Shares in Wesfarmers closed down $1.76, or 2.8 per cent, at $62.20.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout