US owner of iconic underwear brand Bonds says Australian consumers facing tough economy

The US owner of iconic Australian brand Bonds has singled out the Australian economy as particularly difficult with a sharp pullback in consumer spending.

The US owner of iconic Australian underwear brand Bonds, Berlei and Razzamatazz has singled out the Australian economy as showing a sharp consumer spending pullback which is seeing falling underwear sales.

Addressing US analysts and investors for its latest quarterly financial results, HanesBrands Inc chief executive Steve Bratspies said the Australian economy was facing growing challenges and headwinds which was impacting spending on its underwear and activewear fashion.

The Australian apparel market was called out as being particularly “difficult” at the moment by HanesBrands, which also owns fashion brands Champion, Jockey and bedding label Sheridan.

“The continued macroeconomic-driven slowdown in consumer spending (is) impacting Australia, as well as decreases in Europe and parts of Asia,” the $US1.32bn ($A2bn) HanesBrands told US analysts.

The sliding performance of Australia, which is HanesBrands’s largest market outside of the US, was countering growth elsewhere for the group.

“(Underwear) growth in the Americas and Champion growth in Japan were more than offset by a decrease in Australia, which was driven by a very challenging macroeconomic environment,” the HanesBrands boss said.

HanesBrands, which bought Australian company Pacific Brands for $1.1bn in 2016, is the latest fashion and apparel retailer to warn of a deteriorating Australian economy and a slowdown in discretionary spending by consumers.

On Wednesday plus-sized women’s fashion chain City Chic and jewellery store Lovisa reported at their respective annual general meetings a sharp sales retreat since July as shoppers under mounting cost of living pressures are forced to rein in spending on discretionary goods, such as fashion, apparel and jewellery.

Accent Group, the nation’s largest footwear chain, has experienced a severe fall in sales over the first quarter with fashion chain owner Country Road Group, sneakers and streetwear retailer Culture Kings and department store owner Myer all recently reporting sliding quarterly sales.

HanesBrands told analysts it is forecasting a “muted consumer demand environment given the continued macroeconomic uncertainty, including increased pressure in Australia”.

Only two years ago HanesBrands had highlighted the Australian market as a high-growth region led by the classic Bonds underwear brand which it said had been transformed into a booming $500m business, thanks partly to a pivot to a more youthful customer base.

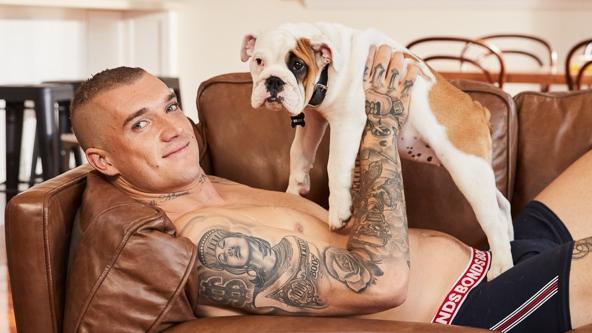

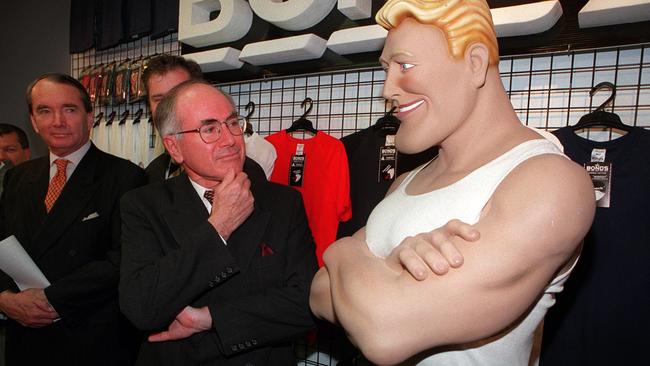

Once famous for its iconic, but staid, Chesty Bond white singlet, Bonds dressed itself up as a youth fashion champion, inking advertising deals with AFL player Dusty Martin which helped give the brand a huge boost.

In 2021 Mr Bratspies told investors the strong advertising investment around Bonds had paid dividends in Australia, where it had generated premium returns despite the relatively small population.

“We know this get-younger approach can work because we’ve already done it in Australia with one of our strongest brands, Bonds,” he said.

“It completely transformed their business and helped to make Bonds a $US390m business in a country whose population is 14 times smaller than that of the United States.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout