UBS predicts food inflation could rise this year

Shoppers will be relieved to hear food and grocery prices eased over the fourth quarter but they could soon resume their upward trajectory.

Food and grocery prices fell in the fourth quarter led by cheaper fresh and packaged groceries, according to a supermarket survey by UBS, however investors will be bracing for next week’s release of June quarter inflation numbers that could signal the next move for official interest rates.

Meanwhile, supermarkets are also still receiving price increases requests from suppliers who are facing their own cost pressures such as rising energy and wages bills, as well as a spike in commodities such as cocoa, and this could feed through to a rebound in food inflation this year if the heavyweight chains pass on some of those costs to customers.

In the lead-up to the Australian Bureau of Statistics issuing June quarter prices on Wednesday, UBS’s price tracker survey – which tracks 60,000 online prices across Woolworths and Coles – found that average fourth quarter food inflation hit 2.1 per cent, down from 3.4 per cent in the third quarter.

Within that survey, UBS said fresh information for the quarter was 0.7 per cent, down from 1.4 per cent, while dry grocery inflation of 2.3 per cent was against 3.3 per cent for the previous quarter.

The moderation in prices at the supermarket checkout will no doubt be of some relief to shoppers struggling under the weight of cost-of-living pressures, but the real test will be on Wednesday when official June quarter inflation is issued and which if remaining stubbornly high could force the Reserve Bank’s hand to lift interest rates at its August meeting.

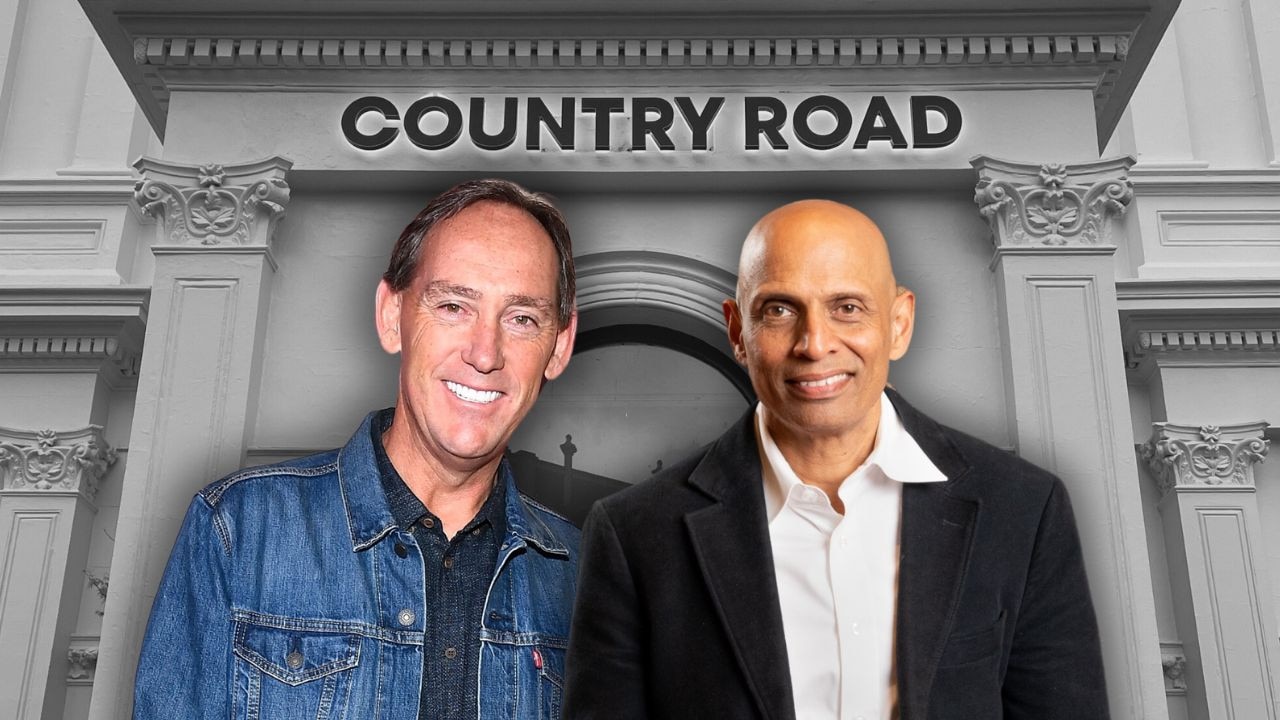

UBS analyst Shaun Cousins said the survey highlighted the fall in grocery prices but that supermarket prices appeared to be stabilising in May and June.

“Dry grocery has moderated yet remains above fresh with supplier requests continuing due to persistent inflation in conversion costs – freight, fuel, labour, domestic manufacturing – as well as specific commodities for example cocoa.

“The June 2024 UBS supermarket supplier survey forecasts inflation to lift slightly to 2.3 per cent in the next 12 months, up from 1.7 per cent in January 2024.

“A key question for fiscal 2025 is the extent to which Coles and Woolworths will accept supplier cost increases.”

Woolworths and Coles are to release their full-year results next month, and investors will gain a greater understanding and insight into the inflationary pressures within the supermarket sector, cost pressures facing suppliers and the buying behaviour of shoppers in the wake of stubbornly high food prices.

Coles will issue its full-year results on August 27 as well as hold an investor day on November 14, and analysts believe that with two of its major capital projects now largely complete there should be a shift of focus to the supermarket’s under-geared balance sheet.

Citi analyst Adrian Lemme believes following the success of new advanced automated distribution centres in Kemps Creek (NSW) and Redbank (QLD), Coles could have the capacity to construct another distribution centre in Victoria and still have room for $400m to $1.3bn in capital management over the next two years.

Investing in new distribution centres designed by global tech firm Witron as well as refurbishing stores should feed through to better margins and sales growth. “Following the success of the Redbank automated distribution centre (ADC) and positive indications on Kemps Creek, we believe Coles will develop another Witron ADC in Victoria at a cost of around $750m to further reduce costs.

“However, this is unlikely to materially impact capex before fiscal 2027 given the lag from announcement to construction. We also see a strong case to double the rate of supermarket store refurbishments to 100 per annum (12 per cent of stores) at an incremental cost of around $350m per annum.

“This would drive like-for-like sales growth in an environment where new store growth is becoming more difficult.”

Coles shares closed up 4c at $17.79 on Friday, while Woolworths lost 24c to $34.21.