Tupperware on the brink as Australians fall out of love with the one-time kitchen staple

The iconic kitchen essentials brand was a staple in many households across Australia, but changing times could see Tupperware and its famed parties relegated to the history books.

Iconic kitchen essentials brand Tupperware, once a must have for Australian households last century, is on the verge of going out of business as it faces financial collapse.

Sales of its plastic containers have dried up after the Covid-19 pandemic sparked a brief resurgence in Tupperware as lockdowns saw many return to the kitchen.

But a lack of brand presence, an outdated “party plan” system and changing customer behaviour have sparked trouble for Tupperware Brands.

The US-based group, which has had a presence in Australia since the 1950s, said it has engaged financial advisers due to “substantial doubt about its ability to continue as a going concern”.

Tupperware chief executive Miguel Fernandez said that the kitchen essentials business had commenced a journey to turn around its operations.

“The company is doing everything in its power to mitigate the impacts of recent events, and we are taking immediate action to seek additional financing and address our financial position.”

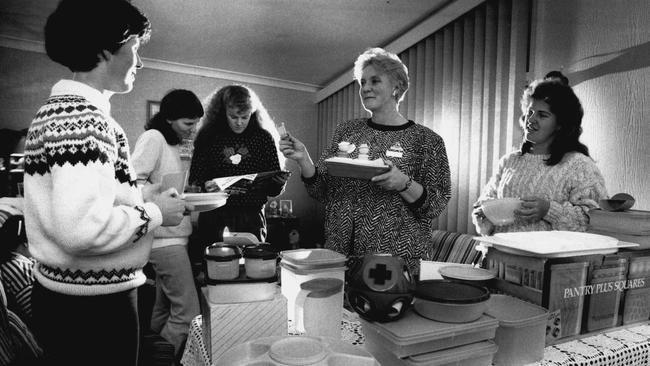

Tupperware was known for its “party plan” system of marketing, which was developed by its American employee Brownie Wise in the late 1940s. Party plan was a way to market Tupperware’s sealed containers directly to consumers at social events, consisting mostly of stay at home mothers.

QUT marketing professor and retail expert Gary Mortimer said Tupperware had failed to keep pace with a changing world with its direct to consumer business model no longer relevant.

“This is a product that worked really well 50 years ago when mums could enjoy catching up without their kids. Generationally things have changed and mums are not hanging around the home all day and this method has all but evaporated.

“There is also a shrinking market as the stay at home mothers that used to be clientele in its prime are getting older and the brand Tupperware holds little importance to younger people.”

Dr Mortimer said that Tupperware has also struggled on a distribution front - with accessing its products hard to come by and other brands freely available in supermarkets and discount retailers such as Kmart.

Tupperware also experienced difficulties in appealing to customers from a price point with its containers often considerably more expensive their rivals.

“There is always a segment that looks for quality and buy on quality, but a larger portion just wants something reasonably priced, especially in today’s climate,” he said.

“It might also sound strange, but their durability is an issue — its not the type product you have to buy and replace frequently, so there is no repeat purchasing.”

Tupperware commenced a three-year turnaround plan in 2020 to transform the fortunes of the struggling outfit by cutting costs and also equipping its direct sellers with digital sales tool.

Tupperware was approached for a comment but did not respond before publication.

With full-year earnings from 2022 delayed as it looks to secures its future, results from 2021 showed that Tupperware had benefited somewhat from lower promotional expenses as a result of “right-sizing initiatives” related to its turnaround plan in a number of countries including Australia.

A “larger and more active sales force and the use of digital tools” in Australia over 2021 underpinned Tupperware’s performance in the Asia Pacific, offsetting a reduction in sales across the region.

It had also looked to offload assets in Australia with it making $US13.2m ($19.5m) from the sale of a manufacturing and distribution facility in Victoria in 2020.

“They did well in the early stage of the pandemic as they launched a retro range — which by all reports sold really well. At that stage we saw sales lift as the range connected with their audience — those in their 40s and 50s who had parents that owned the exact style of Tupperware products,” Dr Mortimer said.

This resurgence helped Tupperware to report a profit of $20.3m in 2020 from its Australian operations compared to $203,000 in 2019, according to documents lodged with ASIC.

With the future uncertain for Tupperware, Dr Mortimer said that the once loved staple of kitchens across the world could face a similar destiny as Nokia and Kodak.

“Kodak and Nokia also experienced similar problems with their relevance as they came up against newer products that disrupted their business model,” he said. If you don’t continue to adapt and evolve then it is hard to continue.”

Shares in the Wall Street-listed group plunged 50 per cent on the development, taking total losses for the past year past 90 per cent.

In March, Tupperware reported a US24c per share loss for the fourth quarter of 2022, which sparked alarm bells from investors who had expected a US22c per share profit.

Preliminary adjusted diluted loss earnings per share for 2022 was US46c per share compared to a profit of $US2.93 per share in 2021

“Due to the challenging internal and external business economics, coupled with the increased levels and cost of borrowings under its Credit Facility, the company currently forecasts that, if it is unable to obtain adequate capital resources or amendments to its Credit Agreement, it may not have adequate liquidity in the near term,” Tupperware said this week.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout