Reinvented retailer Target back in fashion

After three years of dramatic store closures and changing fortunes the retailer is now fighting back.

With painful store closures now behind it, Target is ready to play again. And this time the retailer believes it has an edge in a rapidly changing market.

The Wesfarmers-owned department store believes a focus on affordable fashion and homewares can help it thrive as households start to find cash harder to come by while rising interest rates and inflation bite. And with younger shoppers increasingly pushing back over the harmful impact of fast-fashion, Target is playing another card: reputation.

The retail chain has just come out of a near three-year makeover, designed to put it on a more financially stable footing. This involved the loss of more than half of its store network and more recently a significant investment in digital to drive online sales.

Richard Pearson, who has led Target for the past 2½ years, says the restructuring is done and the retailer now has a strong platform to grow from. “We think our brand is very strong in terms of the value credentials in the minds of the customer. Our job is to make sure we’re delivering against that.

‘‘For customers that means giving really good-quality products for really good prices. That’s how we see ourselves set to win in the future,” Pearson says.

Like most retailers, he is closely watching the coming year and expected slowdown.

Analysts with brokerage Morgan Stanley have said consumers are set to become more pressured moving into 2023, hit by a combination of rising interest rates, lower household savings, above-trend inflation and the negative effect from falling house prices.

“Obviously, people are going to just spend less money altogether, so we need to make sure we’re absolutely on top of our game to remain relevant and capitalise on any opportunities that do come along,” Pearson says. “However, we do play at the value end of the market, so there could be some opportunities there.”

Target was once the dominant player over retail sibling Kmart, but a rush of international fast-fashion brands moving into the Australian scene over the past decade including H&M, Uniqlo and Zara quickly eroded its market share and exposed some of its underlying weaknesses.

Target was ultimately folded into the Kmart group, where it shares back office functions.

However, a competitive market also means some of the same international brands have since scaled back their Australian ambitions. Target has refined its offer, including value and fashion sustainability, reflecting the shifting dynamics.

Pearson maintains the retail landscape remains as competitive as ever, but the battle has now shifted online.

Players such as Amazon now compete aggressively in homewares, while apparel has moved online.

“As well as facing those international competitors, we also realise we have to invest and really improve our e-commerce and digital capabilities. And that really is at the heart of our future strategy,” Pearson says.

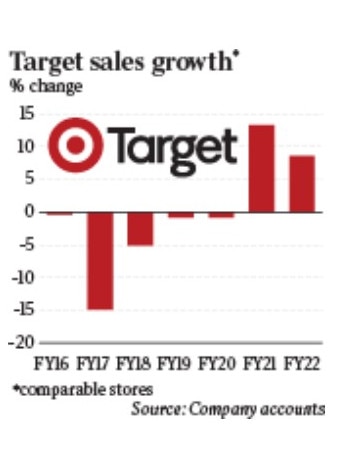

Going into the restructure, Target’s comparable store sales growth (the best measure of retail performance) was steadily going backwards, falling as much as 15 per cent in 2017.

In the past year Target’s comparable store sales posted 8.6 per cent growth, the fastest in the entire Wesfarmers retail portfolio which extends to Bunnings, Kmart and Officeworks.

Internally the changes are described as a “reset”. But even that is underplaying the work that has been done. It has come through nearly three years of substantial store closures, overhauling the product offering.

Store shift

To highlight how dramatically Target’s footprint has changed, at the end of June it had 128 stores, which is less than half of the 300 it had just four years ago. Many of the stores, including the small Target format, were converted to Kmarts, while others were simply closed down. Country areas were particularly hard hit by the closures, mostly because the stores were too small to support the big retail cost base.

Digital sales for Target are now the second highest in Wesfarmers group behind Officeworks, with 22 per cent of sales coming through online channels.

Pearson says even with a focus on digital, a physical store network will continue to play an important role. “Most customers still want to have some kind of physical experience in retail. So I think the two channels are blurring more and more as we go forward.”

Person, who has more than two decades of experience in retail and consumer goods, including Kmart, Mecca and Caltex, said the changes were difficult but necessary. The retailer had hit a moment “where something fairly fundamental had to happen”. “Target had reached a point after several years of declining performance where it simply wasn’t viable to keep going as it was. The cost base was too high. The customer proposition was unclear. So we lost a lot of customers,” he said.

Many of the stores had been unprofitable. Whether some of the sites could perform better in the Wesfarmers group under the Kmart banner was considered.

“It was a really tough decision to make and a really hard course of action, but it’s one that I think has been justified in that it’s put Target on a really solid foundation for future growth.”

Today Target is focused on “affordable quality for everyday life”, he adds.

Apparel, particularly women’s and children’s clothing, remains its strength, and this is supported by a “soft” homewares and toys offering.

One area where Target is finding an edge is a shift toward sustainable fashion. This means auditing through the entire supply chain, to ensure it meets Wesfarmers’ broader targets around sustainability, including workforces in low-cost manufacturers, mostly in Asia.

Pearson says the retailer has people on the ground working with suppliers and on quality control and setting expectations around high standards. So this means it’s not just a matter of talking up sustainability from Target’s Melbourne head office.

“All those reputational matters are massively important to us,” he says. “We pride ourselves on working in collaborative partnerships with our suppliers. We will only become more and more important to our customers, who expect a big brand like Target to always do the right thing.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout