Poultry producer Inghams warns chicken sales will slow this year

In tough times shoppers usually turn from red meat to chicken to save money, but the nation’s largest chook producer Inghams has warned sales growth is slowing.

Shoppers are easing back on buying chicken on their supermarket runs, despite the cheap protein traditionally proving popular in tougher economic times, the nation’s largest poultry producer has warned.

Inghams Group has noted that while its chicken sales through the supermarket channel grew strongly in fiscal 2024 as households switched from eating out to cooking at home, that growth was beginning to slow into the new financial year as consumers picked up cheaper cuts of chicken, or even smaller quantities, to stretch their budgets.

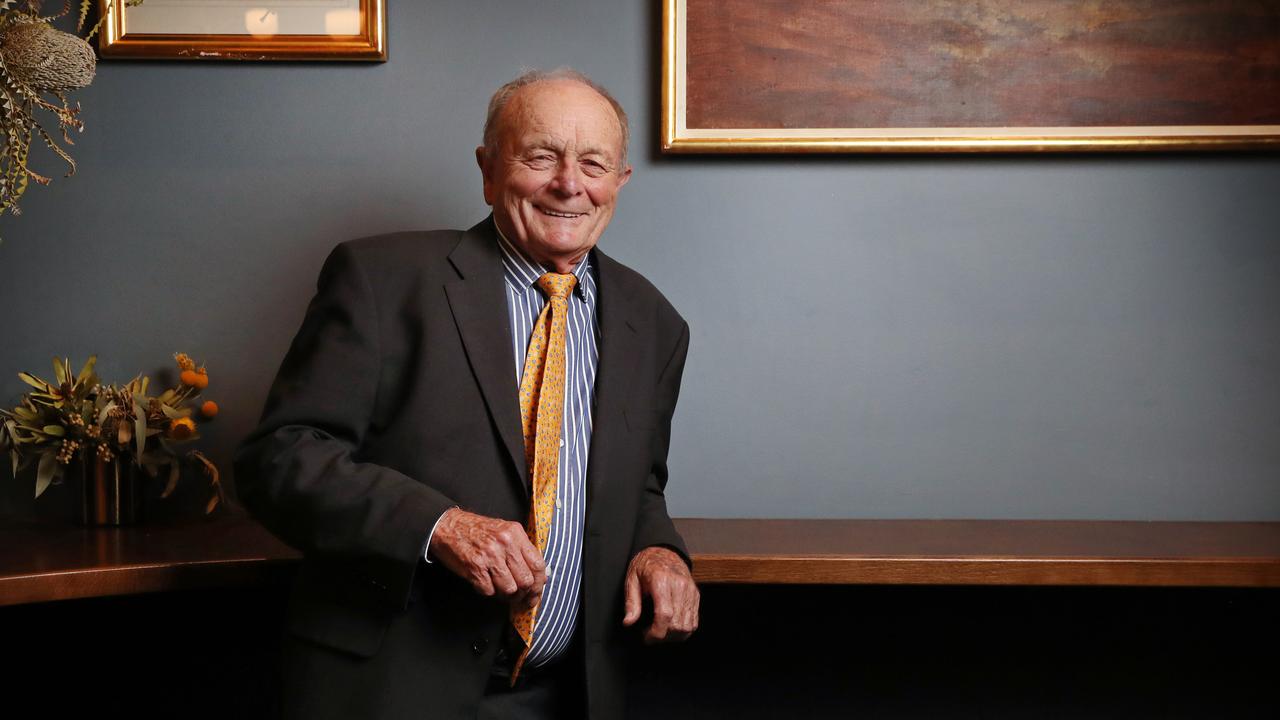

“Chicken enjoys a relative price advantage to other proteins, so it continues to grow, but the rate of growth is slowing,” said Inghams chief executive Andrew Reeves, who oversees Australia and New Zealand’s biggest poultry producer.

“There is some change in the sorts of products that they (consumers) are buying, naturally there’s probably a little bit of a bias towards cheaper cuts at the moment, which I think is understandable given the environment we are operating in.”

Mr Reeves said Inghams had witnessed declining sales into fast-food chains, restaurants and cafes through 2024 as consumers switched to home cooking, and this had lifted its chicken sales into supermarkets.

However, that growth in the supermarket aisle is now slowing.

“Chicken growth over the last year has maintained its pace with population growth, demand is soft, there is no question about that and we are still experiencing growth of chicken sales in the supermarket channels. The chicken market is not in decline but it is probably just not growing as fast as it has historically,” Mr Reeves said.

“Supermarket (sales) are probably growing at a slower rate.”

Inghams on Thursday posted a 68 per cent lift in full-year net profit to $101.5m as revenue rose 7.2 per cent to $3.3bn. The result was slightly below consensus forecasts and given the more bearish outlook on volumes combined with a new Woolworths deal that will see less volumes into the supermarket major, it triggered a 20 per cent slide in Inghams’ share price to close at $3.09. The company declared a final dividend of 8c per share, payable on October 9.

Lower volumes were experienced in the fast-food, restaurant and cafe channels as diners switched to eating at home to save money, something recently highlighted by Collins Foods, the operators of 279 KFC chains in Australia, which warned its sales were sliding as cost of living pressures bite.

Mr Reeves forecast a slight fall in chicken volumes for 2025, with core poultry volumes to fall by 1 per cent to 3 per cent, driven by cost of living pressures, a tough economy, a cautious shopper and the new Woolworths contract, although Inghams has softened the blow of that lower volume deal with Woolworths by securing new business from other customers.

Mr Reeves said he expected consumer conditions to remain challenging in the near term, which would see its volumes decline and Inghams likely to report underlying earnings for 2025 of $236m to $250m, which would represent flat to 6 per cent growth.

Not helping the affordability of chicken were inflationary pressures that forced Inghams to lift average prices by around 5 per cent in 2024.

Mr Reeves said chicken still remained a popular choice for Australians.

“Our research tells us that over 70 per cent of Australian households consume chicken three times a week and that says that it still remains Australia’s favourite protein and we are not seeing that change anytime soon. But there is a softness and it isn’t growing at the same rate it was historically.”