Peter Hearl rallies support and lashes out at rebel investors

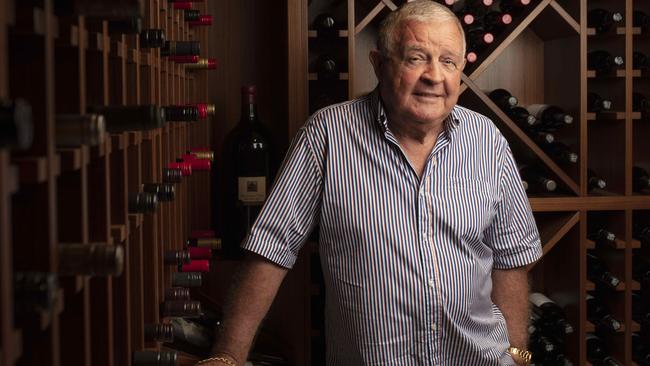

Chairman Peter Hearl has written to 420,000 Endeavour shareholders defending the company’s performance but rebel investors have called his letter ‘sheer rubbish’.

Endeavour Group, the under-siege owner of Dan Murphy’s and the nation’s largest pubs portfolio, has struck back against a relenting onslaught from its biggest shareholder, the Mathieson family, and rebel director candidate Bill Wavish, taking its case directly to its 420,000 shareholders to back the board at the upcoming AGM.

It has urged its shareholders to vote against Mr Wavish, the former Woolworths supermarkets and liquor boss at the AGM slated for October 31 as the fighting between the company and its largest shareholder intensifies.

In an extensive investor letter and presentation released to the ASX on Tuesday, Endeavour chairman Peter Hearl has led a multi-pronged defence of the company’s share price, financial performance and operations as well as refuting key arguments put by both Bruce Mathieson Senior and Mr Wavish.

Mr Hearl also lashed out at Mr Mathieson Sr, accusing the pubs billionaire of using “selective and incomplete” information that could “confuse shareholders”.

The chairman added the Endeavour board, which owns 1,700 Dan Murphy’s and BWS stores, wine operations and a portfolio of 354 pubs, was committed to renewal and reminded investors that if Mr Wavish was elected without the necessary regulatory and probity clearances there was a risk Endeavour would be non-compliant with some gaming and liquor laws.

“Your board recommends that you vote against the resolution to elect Mr Wavish,” the letter says.

“Endeavour has publicly committed to maintaining a majority of independent directors to represent the best interests of Endeavour and its shareholders as a whole; we ask all shareholders to reflect on this core tenet of our governance in assessing all resolutions at our AGM.”

Mr Hearl also states Endeavour was publicly committed to maintaining a majority of independent directors - which could be seen as a slight at Mr Wavish who some within Endeavour believe is now too closely associated and aligned with Mr Mathieson to be considered independent.

Mr Mathieson Sr owns 15 per cent of Endeavour and is publicly backing Mr Wavish’s candidacy for the board, which two weeks ago sparked the public and bruising corporate civil war in the company.

Central to Mr Mathieson Sr’s case and the candidacy of Mr Wavish are their claims of poor financial and operational performances by various parts of the Endeavour business, particularly its retail liquor chain Dan Murphy’s, as well as the pair’s concerns around a lack of financial discipline at the company and worsening debt.

Endeavour demerged from Woolworths in mid 2021, taking with it the liquor chains, wine operations such as wineries and wine brands, the Langton’s auction house, and the large network of pubs and their more than 12,500 gaming machines

In his letter to shareholders on Tuesday Mr Hearl railed against those claims, stating that the board was conscious of the recent volatility in Endeavour’s share price, and blamed regulatory uncertainty in the gaming sector, and increasing cost of capital with rising interest rates.

“The Bruce Mathieson Group campaign has used selective and incomplete information which has the potential to confuse shareholders as to the company‘s performance,” Mr Hearl wrote.

“The board and management team are committed to driving returns for shareholders, notwithstanding these factors, through a collaborative approach with regulators and industry, and a disciplined approach to capital management.

“Endeavour continues to lead the market in liquor retail and hotel operations, and has delivered strong growth in fiscal 2023, our first year of operating without disruption from the Covid-19 pandemic, with profit after tax up 6.9 per cent when compared to fiscal 2022, our first full year operating as a demerged entity.”

In the investor presentation, Endeavour argued since the demerger, Endeavour has delivered 19 per cent growth in earnings per share, 14 per cent growth in EBIT and declared $752m in fully franked dividends to its shareholders.

“The board and management of Endeavour acknowledge the company’s disappointing share price performance and are committed to a strategy that we believe will increase shareholder value. It is important to contextualise the Endeavour’s share price performance, however, across both retail and gaming peers rather than a select group of food retailers.”

Endeavour also said its flagship Dan Murphy’s as well as BWS were performing strongly, denying the Mathieson and Wavish camp’s claims that costs were out of control and that its balance sheet remained strong.

In response, a spokesman for the Bruce Mathieson Group said Endeavour Group continued to use data that was “self-serving and misleading”.

“Exactly what you would expect from a board trying to entrench their own positions. The value has been destroyed in the last 12 months, and they’ve lost ground to Coles Liquor for nine quarters straight.

Later, Mr Mathieson Sr added that Endeavour was focusing on performances of the company from years ago.

“This is just sheer rubbish out from Endeavour today. They keep talking about performance four years ago. Does anyone talk about the premiership four years ago? Or even last year? They should be focused on the next year.

“We have the best of the best hotels in country. We are 40 per cent bigger than Coles, yet they are outperforming us. We should be belting the competition but we are not.

“I’ve owned over 1000 hotels over 40 years. I know how to build and run businesses in this industry. Peter Hearl once ran 6 KFCs and Colonel Sanders tells you how to run them. (Endeavour CEO) Steve Donohue has never built anything.”

Mr Mathieson Sr also denied that he had plans to break up the company.

“I don’t. I want it run properly and for the share price to go from $5 to $10-plus. I’m never selling my Endeavour shares. These are for my family for generations to come. I’ve put that in my will.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout