Online shopping trends reverting to pre-Covid-19 patterns as Amazon makes gains in Australia

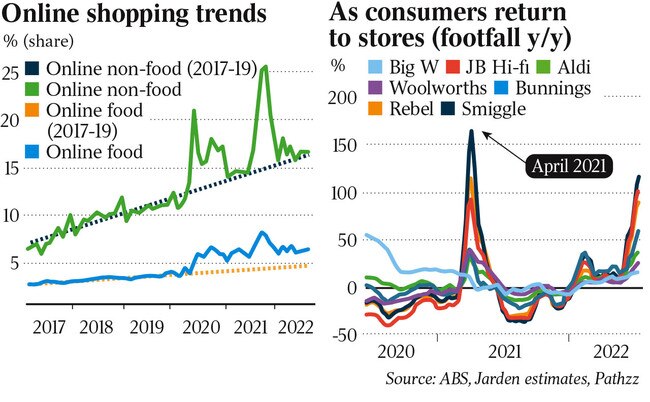

A waning Covid-19 pandemic and the easing of health restrictions have pushed online retail down in the past three months, while traffic is up in shopping centres.

A waning Covid-19 pandemic and the easing of health restrictions have pushed online retail down in the past three months, while traffic is up in shopping centres and at omni-channel stores.

But a broader shift online – traffic rose 23 per cent in the 12 months to August at a basket of 54 retailers tracked by analysts at investment bank Jarden – has been a major boon to Amazon. The online store has lifted its share to account for more than 40 per cent of all online traffic in Australia.

In a note on the retail sector, Jarden analysts forecast it will overtake eBay as the most visited transactional site in the country in the next 12 months.

The other major online winner is Flight Centre, according to the research note distributed late last week, with traffic increasing by 167 per cent in the last year.

Travel and soft goods were the only two categories that saw a rise in online traffic in the three months to August – the former boomed, increasing 377 per cent in the period.

The analysts, led by Ben Gilbert, said the negative online traffic trend reflected the cycling of lockdowns in the previous corresponding period and was consistent with credit card data produced by Commonwealth Bank, as behaviours taken up during the pandemic began to unwind.

“Online penetration (excluding food) is back to the pre-Covid trend as stores reopen, with this set to benefit malls and omni-channel retailers,” wrote Mr Gilbert. “By brand, traffic was strongest for Flight Centre while soft goods improved. Kathmandu (up 30 per cent), City Chic (up 16 per cent) and Just Jeans (up 12 per cent), with Mitre 10 (up 25 per cent) and Nick Scali (up 9 per cent) stronger also.”

Mr Gilbert said the research showed the largest declines were at IGA, Hype, Platypus, Dinnerly, Youfoodz, Dusk, Adairs, Harvey Norman and Kogan.

“For those with omni-channel offers, we note the net impact is still strong positive sales, given the lift in store traffic,” the note reads.

“Looking forward, we are becoming increasingly cautious on the consumer outlook, with savings rates falling, costs up and the full impact of rate hikes yet to hit household cash flow.”

Retail sales data has shown a large jump compared to the same month in 2021, with spending significantly impacted at this time last year during a surge in coronavirus infections and tight restrictions across much of Victoria and NSW at that time. The latest Australian Bureau of Statistics data, released earlier this month for July, showed a 52.6 per cent rise in spending in the clothing and footwear category alone, as well as a 35.6 per cent increase in department store sales.

Mr Gilbert said there was mostly good news from the recently wrapped-up reporting season, but warned “storm clouds” were forming before Christmas.

“The consumer sector delivered strong updates but the lack of guidance and the fact consumers are yet to feel the impact of interest rate hikes leave us more cautious,” he wrote.

“ Looking at current trends remains challenging given the year-on-year benefit from store closures, stimulus and low rates in the previous corresponding period,” the report reads.

Mr Gilbert added that Amazon was outperforming the market, “aided by increased capacity and a move to next-day delivery in Sydney⁄Melbourne”.

“We expect market commentary on the competitive threat of Amazon to build, particularly if it was to increase the brand offering in areas such as electronics and build an automated Melbourne distribution centre,” he wrote.

The Jarden note also includes details of how the country’s two largest supermarkets, Coles and Woolworths, are tracking against each other, with the larger Woolworths leading online. Coles, however, was “coming back”.

“Woolworth‘s fourth quarter online grocery penetration of 9.7 per cent remains well ahead of Coles at 8 per cent. However, it would appear the gap has begun to narrow in recent months,” Mr Gilbert wrote. “Ahead of (a new automated distribution centre), it remains a key debate if Coles can take share online. We remain cautious here given online grocery shoppers are generally sticky.”