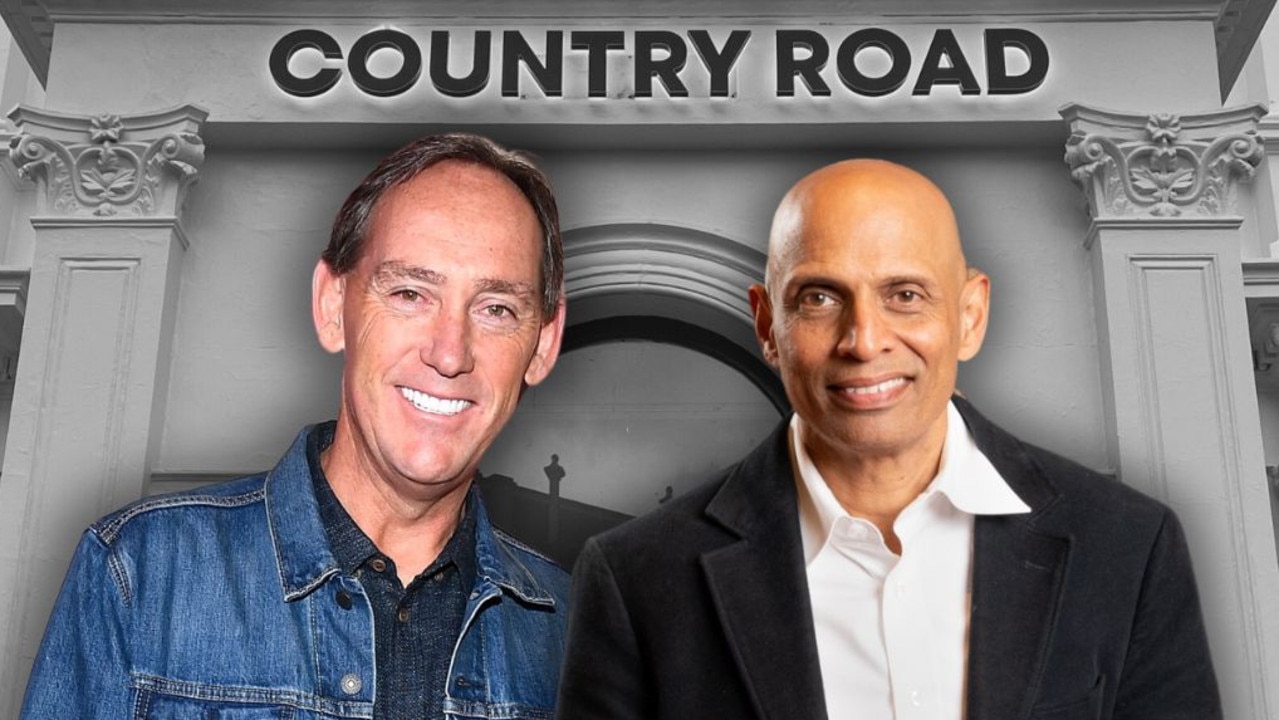

Nick Scali doubles full-year profit but warns of price rises to come

Nick Scali managing director Anthony Scali has warned he will be forced to push through price rises as record shipping charges ratchet up his costs.

Nick Scali managing director Anthony Scali has warned he will be forced to push through price rises of as much as 10 per cent as record shipping charges ratchet up his costs while he faces supply constraints due to lockdowns across Vietnam and Malaysia.

Mr Scali said the uncertainty around the protracted Covid-19 pandemic in Australia and threats of bottlenecks out of key manufacturing hubs in Asia had made him more conservative.

He said the furniture retailer would hold on to more cash and not lift its final dividend as high as the market had predicted.

However, he still managed to shower his shareholders with a final dividend that was up 11 per cent on last year.

Nick Scali doubled its full-year profit as it cashed in on a shopping bonanza as consumers updated their home furnishings during lockdowns and working from home.

Nick Scali, a national chain of furniture stores, witnessed rising costs in the second half of fiscal 2021 that were driven by ballooning shipping and freight charges.

Mr Scali told The Australian that these higher costs, if sustained, would eventually have to be passed to consumers.

“If it stays as it is I think prices will go up more on lounges than other goods because they absorb a lot of volume in a (shipping) container and so it could be another 5 or 10 per cent up,” he said.

Mr Scali said his shipping costs were several times higher now than before Covid-19 emerged.

“They are as much as five times more expensive and everybody has got an issue with this,” Mr Scali said.

“Every industry is being affected by this, unless our dollar rerates to offset it.”

Nick Scali charged out of the starting blocks on Thursday with a full-year profit that beat earnings guidance provided to the market just four months ago as the company set a high benchmark for other retailers to meet this reporting season.

Kicking off earnings season for the $320bn retail sector, Nick Scali posted a full-year net profit of $84.241m, up 100.2 per cent.

The profit was easily above recent guidance of $78m to $80m issued in May.

Sales revenue for the year grew by 42.1 per cent to $373.m, with same-store sales revenue growth of 34 per cent.

Online written sales orders for fiscal 2021 were $18.3m compared to $3m in 2020.

The EBIT contribution from the online channel for 2021 was $8.8m compared to $600,000 in 2020.

Nick Scali declared a fully franked final dividend of 25c per share, up from 22.5c for the same period last year, with a record date of October 4 and a payment date of October 25.

The final dividend was below market expectations of 39c.

Mr Scali said it was prudent to retain some cash given the uncertainties in the economy and supply problems in Asia.

“We are being conservative. We buy out of Vietnam and Malaysia, which has been completely shut down and in lockdown, so we can’t even ship out of there.

“The lockdown in Sydney looks to be getting worse, could be spreading to Newcastle … and we like to have some extra cash just in case, so we can do what we need to do.”

He said July trading was hurt by lockdowns in Greater Sydney, Victoria and South Australia.