Myer boss Olivia Wirth says its ‘day zero’ in her task to integrate Lew’s apparel brands

Myer boss Olivia Wirth has won overwhelming shareholder approval for the acquisition of Solomon Lew’s apparel brands and now has the huge task of integrating them from ‘day zero’.

Myer executive chairman Olivia Wirth has declared it’s “day zero” in her monumental task to integrate the portfolio of apparel brands she has bought from billionaire Solomon Lew.

Shareholders in the department store and Mr Lew’s Premier Investments on Thursday overwhelmingly supported the deal.

Ms Wirth has now revealed her immediate plans, or as she termed it “first movers”, for Myer’s new fashion stores – Portmans, Just Jeans, Dotti, Jacqui E and Jay Jays. From next week she will bring the new labels into Myer’s loyalty program, Myer One, in order to begin mining crucial retail insights from its millions of shoppers as well as ramping up the group’s e-commerce presence.

The former Qantas loyalty scheme chief, who was appointed the boss of Myer 10 months ago, will now face the challenge of integrating 780 specialty stores and 17,300 staff who come with the acquisition of Premier Investments’ apparel business – and which marks the biggest shake-up to Myer’s operations in almost 125 years.

After the extraordinary general meeting on Thursday during which 96.16 per cent of votes were cast in favour of the deal, Ms Wirth told The Australian that she had a shopping list of immediate plans ahead for her and the management team.

“It is day zero for us, and we are very much looking forward to focusing on the running of the business and working out how we can integrate; and that will start in earnest next week – and we have been pretty clear on how we are going to think about what the first phase is and very much focused on having these businesses run parallel, independently almost, to make sure we can continue to ‘trade the day’ and hit the targets that are set,” she said.

“But at the same time we believe there will be some ‘first movers’ that we will be focused on and that is focused on loyalty and on data, and on making sure that we can introduce Myer One across all the apparel brands because that gives us data, it gives us insights and accesses a 10 million membership base at Myer that we can actually start promoting and educating them about the apparel brands.”

She will also have access to the retail nous and experience of Mr Lew, who is approaching seven decades in the Australian retail industry, and who joins the Myer board as a director next month – having swapped Premier Investments’ stake in Myer for a now personal stake in the department store owner.

Across town in Melbourne on Thursday and two hours after the Myer vote, shareholders in Premier Investments – presided over by Mr Lew – also voted overwhelmingly to sell the apparel brands to Myer for 890.5 million Myer shares. The deal drew a 99.96 per cent ‘yes’ vote and the whole meeting was completed in 15 minutes.

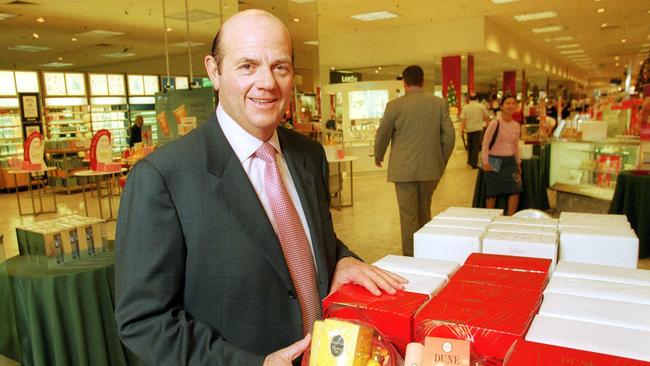

Mr Lew’s return to the Myer boardroom marks almost 23 years since he was ejected from the old Coles Myer board during a shareholder revolt.

After the Premier Investments vote on Thursday, he told The Australian he wasn’t caught up in the history or emotional connection to Myer but rather a decision based on financial facts.

“This is a business and we are investors in the company, that is what it is all about – in the best interests of shareholders,” Mr Lew said.

“You don’t invest hundreds and hundreds of millions of dollars just because you have a view or whatever the case may be; obviously this is a company (Myer) that has not been run well for a couple of decades and we now have an executive chair and CEO in Olivia, she’s made some incredible hires … and so there has been quite a bit of change and there is further change now.

“And obviously the Premier apparel brands have a lot of appeal. Just look at the margin difference – this is now a margin business.

“If you look at the overall Premier (apparel brands) business on one quarter of the sales of Myer, 25 per cent of sales of Myer, we make as much money as Myer – so the opportunity going forward for them (Myer) learning how to do the business, there will be a lot of synergies playing through and that’s what we saw and what they came to us for.”

As part of the transaction the Myer shares issued to Premier Investments will be distributed in specie to its investors. Mr Lew’s personal investment vehicle, Century Plaza, will emerge as Myer’s largest shareholder with a stake of about 26.8 per cent.

He will join the Myer board alongside former Premier Investments director Gary Weiss, who is Myer’s deputy chair, and current Premier Investments director Terry McCartney. Although Premier Investments will cease being a shareholder in Myer after the deal, Mr Lew said Mr McCartney would continue as a Myer director given his long and successful career in the retail industry, including as the former boss of Myer Grace Bros.

Mr Lew disagreed with comments made at the earlier Myer shareholder meeting by activist and former Rothschild banker David Kingston who savaged the deal, its high price especially in the wake of a punishing profit warning by Premier Investments this month, and the future profitability of the apparel brands business Myer was buying – which he described as “baggage” and past their prime.

“The brands are loved brands, the brands make a lot of money … we have a huge market share … we are the biggest seller of denim in the country,” Mr Lew said.

Mr Lew wasn’t at the Myer meeting to hear the criticism, but Mr Kingston, who now runs K Capital and who more than 20 years ago advised Mr Lew on Premier Investments’ stake in Coles Myer, launched a withering attack on the transaction – particularly the high valuations placed on the apparel brands. He also rubbished the independent expert report produced by Kroll which supported the deal.

Mr Kingston called Ms Wirth’s defence of the deal a “list of motherhood rationales” and said “no one would describe the apparel brands being purchased as A-grade brands”.

Ms Wirth launched a spirited defence of the deal before shareholders and in response to Mr Kingston’s criticisms.

“This is important because it delivers a unique proposition for our customers, which drives loyalty and importantly for our shareholders it drives margin,” she said.

“We believe the combination of apparel brands is absolutely the right way for us to set ourselves up for the future.

“It will ensure we deliver scale, it will deliver diversification of earnings … and importantly the capability that exists within apparel brands we believe to supercharge the way that we approach the apparel business within Myer.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout