Endeavour ‘weaponising’ constitution to block Bill Wavish board bid

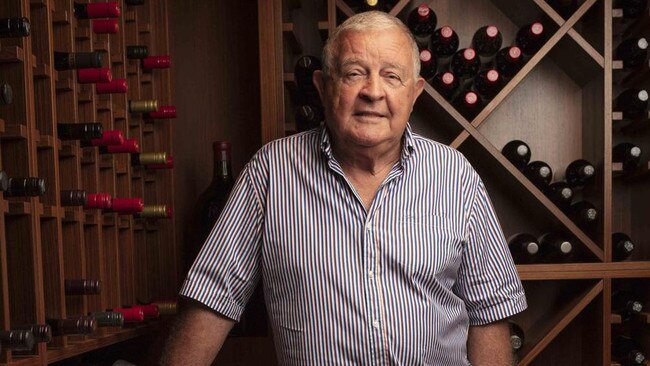

Former Myer chairman Bill Wavish is seeking legal advice on his next steps to attempting to secure a seat on the board of Dan Murphy’s drinks chain owner, Endeavour Group.

Bill Wavish has accused the board of liquor and pubs giant Endeavour Group of “weaponising” its constitution to block shareholders voting on his election as a director at the upcoming general meeting, and is seeking legal advice as to his next steps as the owner of Dan Murphy’s is engulfed in a bitter civil war.

Although he is not considering legal action at this stage to break the deadlock between him and the Endeavour board over his right to be considered for election by shareholders, lawyers could become involved and some kind of conciliation and backroom deal sought amid a growing and embarrassing corporate brawl.

Even though Mr Wavish, a former Woolworths supermarkets boss and executive chairman of Myer, doesn’t have the necessary regulatory and probity clearances to be considered eligible for election as a director – as clearly stated by Endeavour’s constitution – his camp believes there are alternatives that can be considered. These could include shareholders voting him in as a “director elect’’ or having observer status while he awaits regulatory clearance.

The Wavish camp believe Endeavour is “weaponising” the constitution to stymie him and ultimately derail his board bid.

Endeavour argues its constitution will not allow shareholders to vote on the election of Mr Wavish as a director at the AGM on October 31 unless he has first received the full suite of regulatory and probity clearances. These approvals can take up to six months.

If Mr Wavish can’t gain clearance before the AGM, which is likely, the resolution will need to be pulled and shareholders won’t vote on Mr Wavish’s candidacy.

Endeavour has also argued that Mr Wavish was repeatedly invited to participate in the formal director search process underway and to be considered with other prospective candidates for two open boardroom positions but that he declined to participate in this process.

The very public battle for the Endeavour boardroom and support of its shareholders ratcheted up a notch on Wednesday as the two warring camps – former retail veteran Mr Wavish and segments of the Endeavour board led by chairman Peter Hearl – levelled accusations at each other over the process of electing directors, the direction of the company and the performance of its retail jewel, the 266 Dan Murphy’s stores.

Further light was shed on the civil war within the boardroom when the notice of meeting for its AGM, published on Wednesday, set out the potential ineligibility of Mr Wavish being a candidate for election, but director and major shareholder Bruce Mathieson Jnr went against his fellow directors.

The notice of meeting stated that Mr Mathieson Jnr, whose family led by pubs billionaire Bruce Mathieson Snr owns 15 per cent of the company, was publicly supporting the candidacy of Mr Wavish and would support him being elected a director.

Outgoing Endeavour director Colin Storrie has decided to abstain from making a decision on Mr Wavish’s boardroom grab. His reasons for this were not given in the notice of meeting.

It means the Mathieson family are now in conflict with the rest of the Endeavour boardroom.

Adding further heat to the war over Endeavour was the intervention of former Woolworths CEO and highly respected retailer Roger Corbett. On Wednesday he attacked the board and management for ruining the Dan Murphy’s model, which he says has “lost its mojo” by abandoning a winning “everyday low pricing” strategy to instead offer a “bewildering” pricing policy.

The former Woolworths boss savaged Endeavour, which owns 1700 Dan Murphy’s and BWS stores as well as more than 350 pubs, and said he couldn’t understand what Dan Murphy’s prices were, labelling Endeavour’s claims about the success of its loyalty program as “baloney”.

In a withering attack on the Endeavour board and management, Mr Corbett questioned why – in his belief – Dan Murphy’s was losing market share and facing slowing sales growth.

“They are losing market share because they’ve lost their mojo,” Mr Corbett said.

“It is terribly confused. You walk into a Dan Murphy’s store and in the days of (former boss) Tony Leon there was a precise, clear offer. You walk into a Dan Murphy’s store today, and they have just completely lost their mojo. It is bewildering, I wouldn’t know what their pricing policy was,” Mr Corbett said.

The former Woolworths boss, who bought Dan Murphy’s in 1998 and helped build it into a massive profit driver for Woolworths, said a chain such as Dan Murphy’s was a “category killer” and must have a clear pricing policy to back that.

“Dan Murphy’s has now clearly lost its way. The everyday low pricing formula is in my view the most powerful retail formula in the world if you can get yourself into it. It took Walmart in the US to being the biggest retailer in the world, it took Woolworths from a share price of $2.43 to $30, and it hasn’t moved since.”

Mr Corbett, who is a shareholder in Endeavour and says like many he has lost money as the share price has sunk, has weighed into the civil war and is backing the candidacy of his former Woolworths colleague Mr Wavish to the board. Mr Wavish was finance director when Woolworths, under Mr Corbett, bought Dan Murphy’s and together they oversaw its huge growth from only six stores in Victoria to a national liquor retail champion.

Mr Corbett said arguments from Endeavour about the power of its Dan Murphy’s loyalty program was “baloney”.

“Loyalty programs are no alternative to running a really good business. People don’t come to you because of loyalty programs, they come to you because you have the best possible merchandise at the best possible prices.”

He asked if the loyalty program was so successful, why were Dan Murphy’s same-store sales so poor and why were they losing market share?

Endeavour argues its loyalty program is a leading offer in the sector that drives sales. There are 5.2 million MyDan’s active monthly users, 600,000 more than 12 months ago with a scan can rate at the checkout of nearly 80 per cent of transactions. Furthermore, MyDan’s members’ basket size is more than double the size of non-member shoppers while data from the loyalty scheme assists Dan Murphy’s in modernising its offers.

Mr Corbett also argued that Mr Wavish had a fabulous mix of finance and retail skills. He said Mr Wavish could be voted on and if elected could sit as a “director elect” until he received approval.

However, in a lengthy explanation of the strict constitutional rules of the company – and in particular the standards and eligibility requirements candidates for election to the Endeavour board must meet – the company warned if Mr Wavish did not receive all necessary regulatory and probity clearances by the commencement of the AGM the resolution on his election would need to be withdrawn, and no vote would take place.

–

‘They are losing market share because they have lost their mojo’

Roger Corbett

–

“Having regard to the timing of Mr Wavish’s nomination, the outstanding probity assessments, pending necessary regulatory approvals and ongoing formal director search process, the board is not in a position to determine whether it is in the best interests of Endeavour for Mr Wavish to be elected as a director of Endeavour at the meeting and therefore recommends that shareholders vote against the resolution.”

On Tuesday the up-until-now battle waged behind closed doors within the boardroom of the nation’s largest liquor retailer, hotels and pokies owner Endeavour Group, broke into full public view after Mr Wavish won support from Mr Mathieson Snr to nominate as a director.

Mr Wavish fired the opening shots in what could be a protracted public war, describing parts of the Endeavour business such as its 1700 Dan Murphy’s and BWS stores as “appalling” and blaming the board for “blowing away” money as its debt levels skyrocketed.

Mr Wavish, who had numerous executive roles at Woolworths between 1999 and 2006, said he spent up to $1m buying shares in Endeavour and the first step to fix its problems would be to get on the board.

Mr Mathieson Snr, the billionaire pubs baron whose hotels and gaming empire was merged with Woolworths 20 years ago and the spun out in 2021 into the independently listed $9.5bn Endeavour business, described Mr Wavish on Tuesday as a “brilliant businessman”.

The forthright billionaire then turned on Endeavour’s chairman and CEO for its recent ills and cratering share price, laying the blame at their feet.

“Endeavour is very, very poorly run under the guidance of (chairman) Peter Hearl and (CEO) Steve Donohue, and the figures prove it, don’t they? We are not going ahead, we are going backwards and in the industry hotels aren’t dropping off in value, and it has performed very poorly under this management,” Mr Mathieson Snr told The Australian.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout