Leaked documents show falling sales and missed budgets at Solomon Lew’s fashion empire

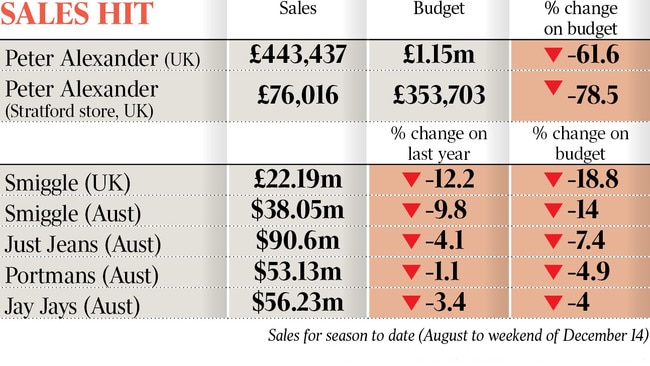

Premier Investments’ Peter Alexander sleepwear brand is trading 61.6 per cent below budget in the UK, and Solomon Lew’s other fashion brands in Australia are facing sliding sales growth and a wages blowout.

Premier Investments’ popular sleepwear brand Peter Alexander, long seen as a high-growth apparel brand, has made a disastrous start to life in Britain, with sales from its three maiden stores trading 61.6 per cent below budget.

Indeed, one Peter Alexander shop in the major Stratford shopping centre in east London was as much as 78.5 per cent below its sales budget targets, internal documents obtained by The Australian can reveal.

Smiggle is also struggling in Britain, with the hole in its sales budget widening and its sales between August and last weekend down 12.2 per cent on the same period last year, to be as much as 18.8 per cent, equating to millions of pounds, below budget forecasts.

Premier’s pain isn’t isolated to Peter Alexander or Smiggle in Britain, with the internal documents revealing all of the group’s other fashion and retail brands in Australia such as Just Jeans, Portmans, Dotti, Jacqui E and Jay Jays are also failing to hit budget targets and are facing negative sales growth compared to the same period last year.

Making things worse, the sales decline and missed budgets have been accompanied by a blowout in wages at the fashion and apparel brands that sit within Premier Investments. According to management accounts, the proportion of salaries to sales for the collective retail brands has risen to 23.2 per cent between August and the second week of December, up 190 basis points from the previous level of 21.3 per cent.

Alarmingly, at Peter Alexander in Britain, its salaries as a proportion of sales sits just over 73 per cent, with the brand in the UK only enjoying a profit margin of around 70 per cent. The wages blowout could further threaten profitability.

The fashion brands are reporting similar large falls in sales in New Zealand with bigger holes in their management forecast budgets. They form part of a group of brands that Premier Investments plans to sell to department store Myer, in a deal expected to be sealed in the new year, but Myer will be buying these fashion stores just as sales and gross profits are under immense pressure.

Amid tougher economic conditions, especially for discretionary retail, these Premier fashion and apparel brands are recording local sales declines of between 1 and 9.8 per cent since August, according to management accounts obtained by The Australian.

The sales drop has had a flow-on effect to Premier Investments’ gross profit, with some businesses such as Smiggle’s Australian arm now just over $5.3m below gross profit budgets; Portmans’ local gross profit is $2.3m below budget; and Just Jeans as much as $4.77m below budget for its Australian stores’ gross profit targets. Collectively the brands that sit under Premier Investments are as much as $17m under gross profit targets for the Australian arm, the internal documents reveal.

This evening a statement from a Premier Investments spokesman said the sales figures obtained and referenced by The Australian “are incomplete, selective and misleading”.

“They refer to a budget set well ahead of this financial year. Premier does not manage its business to these numbers, but rather to a broad range of metrics and what it sees in the market as the season evolves.

“Premier will continue to do this with the key trading events of Christmas, Boxing Day and the January and Back-to-School sales to come, all of which are critical to the first half 2025 results.”

This comes after Mr Lew did not provide a sales and trading update for the company’s retail arm, Premier Retail, at its AGM on Friday, citing the crucial importance of the upcoming Christmas and new year sales, but analysts have estimated that in the absence of that AGM trading update the group sales continue to be negative at around 3.5 per cent down on last year.

These internal documents show many of Premier Investments’ brands suffering sales declines greater than 3.5 per cent between August and midnight Saturday last weekend.

Controlled by billionaire Mr Lew, Premier Investments has a collection of fashion and apparel brands which are set to be sold to Myer, as well as its twin high-growth chains Peter Alexander and Smiggle, which both have ambitious offshore expansion plans and could possibly be demerged from Premier.

At the AGM, Mr Lew, the chairman and major shareholder, said there was an opportunity for 10 more Peter Alexander stores in the short term. But early sales from the brand’s launch in the UK last month with its first three stores have been underwhelming, raising some early concerns within the business about the sleepwear’s positioning in Britain.

Documents obtained by The Australian show the sleepwear brand had a budget of £1.155m ($2.28m) of sales in Britain since its launch in November – but has instead rung up sales of only £443,437 between November and last weekend to be 61.1 per cent under budget.

The three Peter Alexander stores in the UK are all struggling. Its store at White City, London, is 69 per cent below budget; the Bluewater shopping centre store is 65.2 per cent under budget; and the Peter Alexander store at Stratford is currently sitting at £76,016 in sales as of midnight last Saturday, to be 78.5 per cent below its sales budget of £353,703.

Smiggle is at the moment showing some of the largest sales dips and missed budgets in Britain. According to internal management reports it had sales between August and last weekend of £22.191m, which is down 12.2 per cent on the previous corresponding period and 18.8 per cent below budget.

Meanwhile, Mr Lew is currently steering through a sale of his five apparel brands – Portmans, Just Jeans, Dotti, Jay Jays and Jacqui E – to Myer and has plans to also possibly demerge Peter Alexander as that sleepwear label looks to offshore expansion.

But Mr Lew, one of the smartest retailers in Australian history, is facing cost-of-living pressures that are hitting widely across the retail sector.

The internal documents reveal Australian sales at Just Jeans (the largest of the Premier Retail fashion apparel brands in terms of sales and stores) between August and midnight last Saturday (or season to date) are down 4.1 per cent, or $3.88m below last year and 7.4 per cent under management budget.

The Australian sales for Jacqui E are down 3.3 per cent since August, and 5.6 per cent behind budget, and its Australian stores of kids stationery chain Smiggle has witnessed a 9.8 per cent sales slide over approximately the last four months to be 14 per cent or $6.2m behind internal management budgets.

Portmans’ local sales of $53.128m for the period are down 1.1 per cent for the season to date, or 4.9 per cent below budget; Jay Jays’ local sales are negative 3.4 per cent for the period or 4 per cent under management budget; Dotti sales of $35.823m season to date are down 2.2 per cent or 3.6 per cent behind budget.

The fashion and apparel brands are mostly facing even tougher conditions in New Zealand, with steeper sales falls and larger holes in their budgets.

The slowing pace of sales at Smiggle, once the rock star of the brands within Mr Lew’s portfolio, is also stark with it falling millions behind budget.

In September Mr Lew sacked longtime Smiggle boss John Cheston citing “serious misconduct” although this allegation has never been fully explained. Mr Cheston has strongly denied any wrongdoing and has accepted a role as the new CEO of jewellery store Lovisa.

Meanwhile, shareholders in Myer and Premier Investments will be asked to vote early next year on the proposed sale of the five apparel brands to Myer by Mr Lew’s fashion empire for more than $860m in Myer shares.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout