Inside the rise and fall of beloved Australian footwear brand Wittner

Over a century ago, a single store in Melbourne’s west marked the beginning of the Wittner legacy that grew into an iconic Aussie brand. So how did it all unravel for this beloved company?

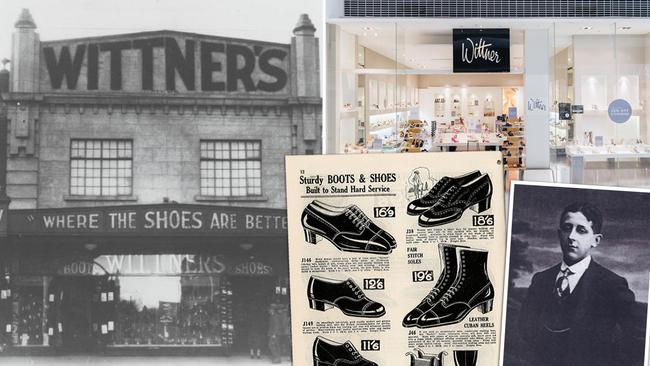

Over a century ago Hymie ‘HJ’ Wittner opened his first store in Footscray in Melbourne’s west, selling school shoes and work boots.

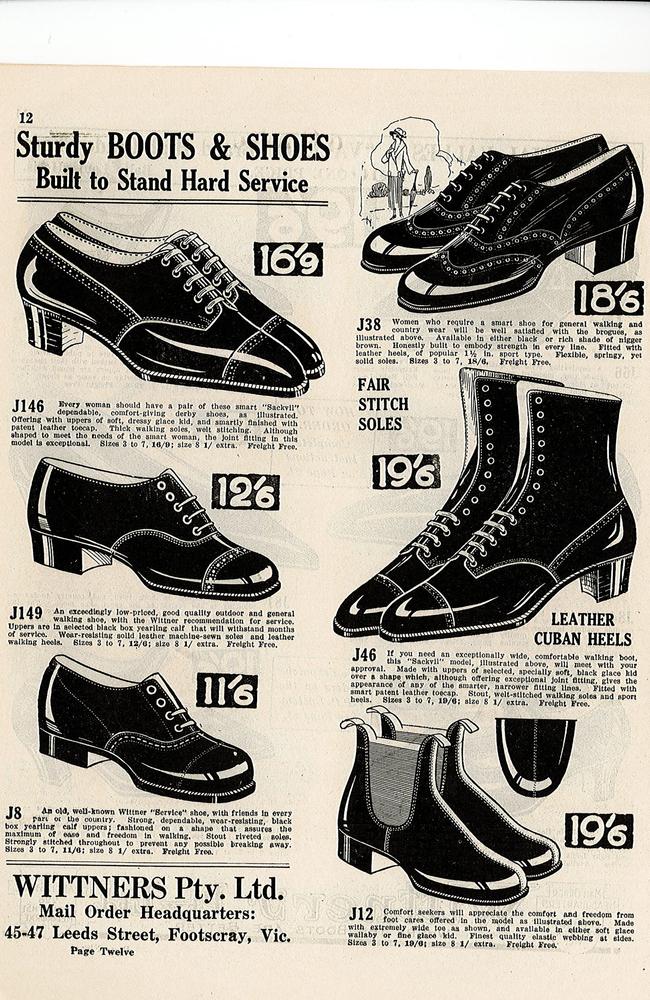

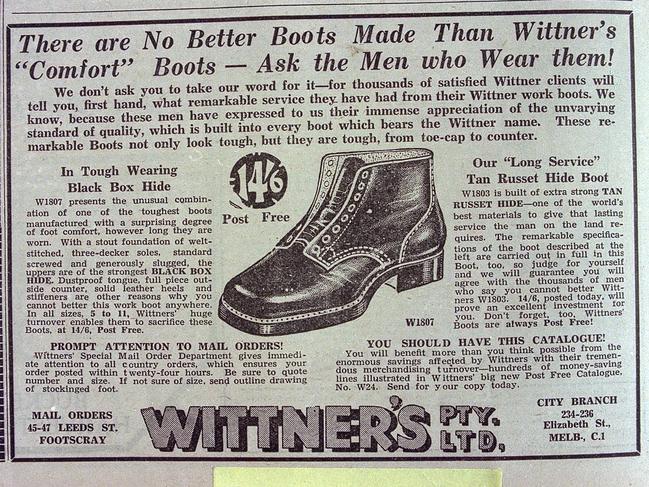

The modest shopfront was home to the country’s first mail-order footwear business.

From these humble beginnings, Wittner transformed into an Australian success story.

Wittner became a beloved footwear brand known for its quality, craftsmanship and timeless designs.

At its peak the iconic brand operated more than 70 stores across Australia and New Zealand, as well as 30 concession outlets in department stores including Myer and David Jones.

The expansive retail footprint contributed to annual revenues of $70m.

But over the past few decades Wittner began to crumble.

Rising operation costs and slimmer margins coupled with a rapidly changing online market and cost-conscious consumer made it impossible for the brand to stay afloat.

On Wednesday it announced it had collapsed into administration.

It’s not the only one.

A host of well-known Aussie brands have ended up in the retail graveyard in recent months, including Jeanswest and Mosaic Brands, whose stable covered Katies, Noni B, Rivers, Rockmans and Millers.

So where did it all go wrong?

Humble beginnings

HJ’s father Arnold purchased a general store in 1912 in Footscray, which went on to become Wittner’s first store.

The business pioneered Australia’s first mail-order footwear business.

HJ used to distribute handwritten catalogues to rural customers, making quality shoes accessible beyond city centres.

Business started booming, and the local Footscray Post Office had to expand just to keep up with the flood of orders.

Becoming a household name

In the late 1970s, Wittner bought more than a dozen factories in Melbourne and Sydney.

It later decided to move offshore, manufacturing in China, India and Brazil.

The Wittner family continued to design the products.

In the early 2010s Wittner had 73 stores and 500 staff. It opened its first Tasmanian store in Hobart in 2012.

The brand was well regarded as one of Australia’s last wholly family-owned retail companies.

Second-generation former chief executive, David Wittner, who took over from his father HJ, hand-drew the Wittner logo which remains today.

David’s wife, Rosette, became the handbag buyer for the business.

Their children Debra, Peter and Michael all served pivotal roles in the business.

Ex-employee Catherine Williamson was then appointed chief executive in 2021, signalling a new start in incorporating external leadership.

The family is mostly sold out of the business now. It’s understood Ms Williamson stepped down from her role 18 months ago.

It is now owned by British special situations investor Hilco Capital.

The sharp decline

Despite efforts to boost revenue through online channels and expand concession stores in Myer and David Jones, rising labour and utility costs started to erode the brand’s profit margins.

It’s understood Wittner previously put itself up for sale in mid July 2023, amid a flurry of businesses hitting the market.

On Wednesday afternoon, the company announced it had collapsed into administration.

Deloitte insolvency experts Sal Algeri and David Orr have been appointed joint administrators to three businesses that trade under the Wittner brand – Wittner Group Holdings, Wittner Retail Australia and Wittner Retail New Zealand.

Mr Algeri said the iconic women’s boot company will trade as normal as they undertake an urgent sale and/or recapitalisation of the business.

Professor of marketing and consumer behaviour at Queensland University of Technology Gary Mortimer said the collapse signalled how tough it was for businesses to make profit in the current economy.

“The same cost pressures that are facing families, retailers are facing the same,” he said.

“Every time there’s a decision to increase the cost of wages – electricity, security, insurance – all of those costs just continue to erode margin.

“Even if you’ve got a business with very strong top line sales, once you pay for those costs of goods, shipping them in, transportation, wages, rents, other marketing costs, it can diminish margins very quickly.”

Facing pressure from low cost rivals

The Australian footwear retail market, made up of 1200 players, is worth $4.9bn.

Retail Doctor Group founder Brian Walker said the industry was predicting a decline of about 3.5 per cent.

“The issue that happens with these businesses is that they’re either increasingly large-scale big players or very niche bespoke curated offers,” he said.

“And the businesses falling over are the ones that are caught in the middle. They’re too big to be small and too small to be big.”

With an increasingly price sensitive consumer, Wittner became outpriced by low cost competitors, Professor Mortimer said.

“We’ve got cheap and cheerful at one end. It’s dominated by discount department stores and to a growing extent, the likes of Temu and Shein,” he said.

“At the top end of the market, you’ve got luxury prestige brands like Burberry, Chanel and Christian Louboutin. They’re pretty insulated from the cost of living crisis.”

Professor Mortimer said the mid-tier footwear brand market was very crowded and highly exposed to discretionary spending.

“When consumers are doing it tough, struggling with rent payments, mortgage payments, increasing electricity insurance rates, they’re less inclined to go out and buy a new coat or in this case, a new pair of boots or shoes,” he said.

“They’ll say, ‘I really want a pair of boots for this winter. Do I spend $300 at Wittner or do I consider $149 at Mathers or maybe I’ll pop into Zara?’”

Failed to adapt

Mr Walker said Wittner was ultimately unable to adapt to a fast-changing market.

“They had an ageing population as their core customer, becoming more and more cost focused, rising overheads and heavy competition,” he said.

“The core part of Wittner’s model was the department store model. Well, that’s also going backwards.

“In their day, they were seen as a very contemporary brand. But that’s a transient thing.

“It’s very hard to keep refreshing and re-energising it, particularly when sales are dropping, return on funds are dropping and available capital is dropping.”

Brands need to continuously adapt to match evolving market and consumer trends, Mr Walker said.

“Every retailer should be having a pilot store, they should be testing and evolving,” he said.

“No one can sit still. And the models that are falling over, like Jeanswest, are models that have sat still.”

Professor Mortimer predicted Wittner would adopt an alternative structure, by trading online only or through concession stores instead of stand-alone stores.

“One of the benefits of concession is there’s less operational costs involved,” he said.

“There may be ways around reducing costs. Clearly, their top line sales were strong. It’s just margins have been eroded through the cost of doing business.

“So, potentially the brand will live on.”