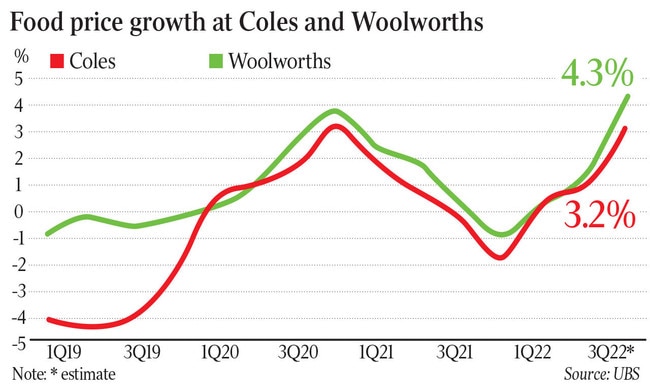

Inflation in fresh and packaged groceries accelerated in third quarter at Woolworths and Coles

Food inflation jumped more than 3 per cent at both Woolworths and Coles in the March quarter, placing further strain on household budgets.

In February, Woolworths chief executive Brad Banducci said inflation was “alive and real” across the supermarket aisles. That prediction is turning into reality with grocery prices accelerating quickly through the third quarter, led by fresh food and meat.

The pick-up in food inflation was most stark at Woolworths where March quarter prices rose 4.3 per cent, a large leap from 1.4 per cent in the previous quarter, while inflation at Coles was more muted, up 3.2 per cent against 1 per cent in the second quarter, according to research from UBS.

The investment bank’s retail equities analyst Shaun Cousins, in his latest Australian supermarkets survey, said inflation had accelerated – placing further pressure not only on consumers but on the major supermarket chains as they sought to protect profit margins and sales from higher supplier prices.

Mr Cousins said that in the latest quarter fresh food exceeded dry grocery inflation, with meat expected to face ongoing pressure. “Dry grocery inflation rose during the third quarter and was ahead of the 2-3 per cent increase Woolworths indicated for its shelf prices, excluding promotions, for the first 7 weeks,” he said.

“The pace of dry grocery inflation acceleration will be steady rather than dramatic … although trade feedback is for it to continue to rise, with third-quarter below the 6.1 per cent dry grocery inflation expected for the next 12 months from the Jan 2022 UBS Supermarket Supplier Survey.”

In February Mr Banducci, boss of the nation’s biggest supermarket chain, warned that inflation was “alive and real” with supermarket prices gaining 2 to 3 per cent in January and rising into April, as a range of pressures, from the war in Ukraine to shipping delays, lifting the cost of getting fresh food and groceries from the farm and factory gates to the supermarket loading dock.

Earlier this year, Coles chief executive Steven Cain warned inflation was a looming threat, and pledged to maintain Coles’ competitiveness, saying protecting consumers from bill shock is his “No.1 priority”.

The UBS supermarkets report said the pace of dry grocery inflation would be steady rather than dramatic and differed between the major chains, reflecting the different strategies both supermarkets were using in the face of sustained food inflation this year.

“Woolworths dry grocery inflation is well above Coles, arguably reflective of confidence from Woolworths that its more affluent customers can withstand price increases, as well as its greater cost investment (and fewer cost savings) than Coles, following significant EBIT margin compression for Woolworths in the first half,” he said.

Mr Cousins said some inflation in the system could be a positive for food retailers.

However, the breadth and depth of the current inflationary cycle was significant, with some consumers potentially trading down by purchasing private label and smaller pack sizes, while the reopening of the economy – including restaurants and cafes – could see premiumisation tailwinds wane and weigh on supermarket revenue growth.

Mr Cousins said it was possible for supermarkets to expand their profit margins in this environment, but there were risks, especially as consumers switched channels to restaurants and cafes rather than walking into a supermarket.

“Covid and other related costs are elevated and will unwind in time, yet revenue tailwinds will also moderate as will some of the boost to gross margins from lower markdowns,” he said.

“The bigger headwind is channel shift, which is structural.”

And while more consumers might be shopping online for their groceries, that did not mean fatter profits for the supermarkets via their own online platforms.

“Volatility has been a factor, yet channel shift-driven EBIT margin dilution is a function of lower online margins versus stores,” the research notes.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout