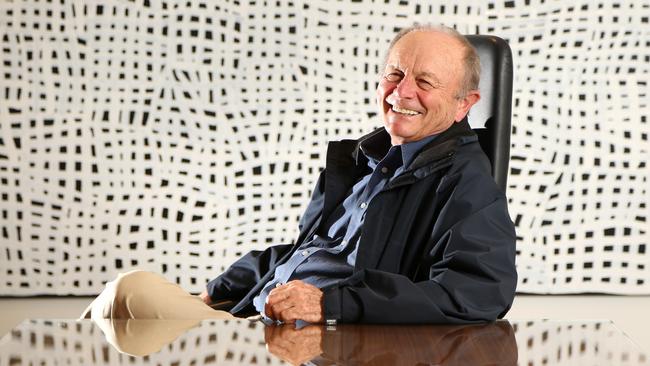

Harvey Norman chairman Gerry Harvey warns mounting debt will hurt Australian prosperity

Businessman Gerry Harvey warns Australia is headed for a ‘black hole’ of debt as vote-seeking politicians splash the cash, stoking inflation and keeping interest rates high.

Harvey Norman chairman Gerry Harvey has warned Australia is heading into a “great big black hole” of swollen government debt fuelled by politicians spending money to win votes, which will ultimately stoke inflation and keep interest rates higher for longer.

Mr Harvey believes Australia will be in a worse position in five years than it is today, as bills for health, NDIS, aged care and social services rise.

Anyone expecting interest rate relief soon would be disappointed as the billionaire retailer predicts rates won’t be significantly lower for at least another 12 months.

“Debt is a huge problem going forward, because the way that we are travelling at the moment, we are heading into a great big black hole,” Mr Harvey told The Australian after the retail group’s annual shareholder meeting in Sydney on Wednesday.

“That is not going to happen tomorrow. But if you’re trying to figure out five years from now, where will Australia be with the way ... we are behaving at the moment, we’ll be in a much, much worse position than we are today because of the cost of all of things the government wants – health, aged care, NDIS and social services – all this money they need, they haven’t got it.

“Where are they going to get it (money) from? Are they going to borrow it, what are they going to do?”

Mr Harvey, a billionaire businessman who has been in retail for more than 60 years, said the Australian economy was “OK” but struggling to find its confidence as inflation remained stubbornly high, stoked by high government spending. This would delay any cut in interest rates, he added.

“Governments can’t spend all this money and throw money out there in the economy, and then expect interest rates to drop and inflation to drop. It can’t happen,” he said. “And interest rates will not come down, or if they do it will be very minimal. We can be sitting here this time next year, and our interest rates might not be any different to what it is now, or it might be marginally lower, but it’s not going to be 2 per cent or 3 per cent where it was.” Earlier at the AGM, Harvey Norman delivered a trading update showing total sales between July and October were up 1.7 per cent, with same-store sales growth of 1.4 per cent.

At its flagship Australian operations, total sales were up 3.2 per cent and same-store sales up 3.1 per cent for the period.

The sales result was slightly below expectations.

Some analysts said Harvey Norman had underperformed one of its key whitegoods rivals, The Good Guys, owned by JB Hi-Fi.

Citi analyst Adrian Lemme said the trading update delivered at the AGM pointed to “steady growth” in its flagship Australian operations.

“Harvey Norman reported Australian franchisee like-for-like sales growth of 3.1 per cent in the July to October period, in line with their July trading update of 3.3 per cent. This is tracking below Citi (forecast) of 5 per cent but only slightly below analyst consensus of 3.7 per cent expectations for the first half of 2025,” Mr Lemme said.

“While we are cautious on the comparison given the different trading period, it does appear Harvey Norman Australia has underperformed The Good Guys (up 5 per cent like-for-like sales growth for September quarter).

“However, we note November is not included in the update period and continue to expect that more consumers are holding out for the all-important Black Friday sales.”

Harvey Norman chief executive Katie Page told shareholders that the retailer’s large-format home and lifestyle stores were thriving in communities with supportive economies, strategic regional planning and efficient transport and logistics systems.

Ms Page said online shopping wasn’t a threat to Harvey Norman and its core focus on physical stores. Harvey Norman has 198 franchised complexes and 120 company-operated stores in eight countries, reaching a population of 90 million shoppers.

“Rather than replacing physical shopping, online retailing complements our stores, providing customers the flexibility to browse, order, and pick up where and when they choose,” she said.

“Across our eight countries, Harvey Norman’s omni-channel model – integrating both physical stores and online services – remains a proven blueprint for sustainable retail growth, adapting to meet customer needs in a dynamic retail landscape.

“Each flagship store reflects our dedication to making a lasting impact. Powered by expert teams and driven by an understanding of the customer in each of the eight countries, Harvey Norman will continue to scale for real growth.”

Harvey Norman recently opened its maiden store in England and Mr Harvey believes the country could present a huge offshore growth opportunity for the retailer.

Harvey Norman is well entrenched in nearby Northern Ireland and Ireland.

Mr Harvey said the first English store was “obviously losing money” but it was in its early days of trading with customer reception very strong.

“Nobody knows really who Harvey Norman is.

“I was there and was talking to people and walking around and they said ‘who are you?’.

“But they walk around the store and they say ‘Wow, this is fantastic, there is nothing in England like you’.”

Later at the AGM there was a 98.9 per cent vote in favour of the retailer’s remuneration report but a 26 per cent vote against the re-election of Michael Harvey as a director, a 25.7 per cent vote against the re-election of Christopher Brown and a 21.2 per cent vote against the re-election of John Slack-Smith.

Harvey Norman shares rallied 2.3 per cent, or 11c, to close at $4.90 on Wednesday, valuing the company at $6.1bn.

The stock has surged almost 17 per cent since the start of January.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout