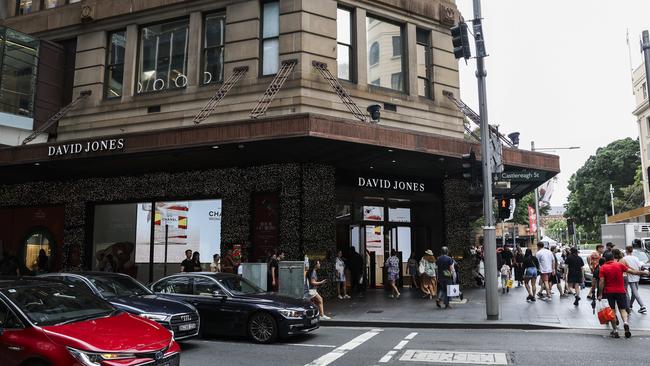

Even well-heeled shoppers have their price limits, says David Jones boss Scott Fyfe

The world’s leading luxury fashion brands have slowed their aggressive price rises of the past few years as they discover there is a limit to how much consumers will pay.

The world’s leading luxury fashion brands have slowed their aggressive price rises of the past few years as they discover there is a limit to how much consumers will pay for a top designer dress, blouse or handbag, David Jones chief executive Scott Fyfe says.

“If you went back 18 months ago we saw a lot of premium and luxury brands putting prices up, we have seen less of that in the last six months and I think the premium and luxury brands have realised that the price elasticity in the market isn’t there as customers are seeing cost-of-living pressures,” the boss of the nation’s upmarket department store told The Australian on Wednesday.

“In the US, in the UK and northern Europe we have seen that. And the premium and luxury brands have realised that the price elasticity of increasing prices isn’t going to resonate with customers in the current climate,” Mr Fyfe added, as he also unveiled an ambitious $250m investment program for the private equity-owned David Jones that will result in store refurbishments, improved online offering, a new mobile app and new David Jones loyalty scheme.

Luxury brands led by fashion houses such as Hermes, LVMH, Chanel and Gucci have lifted their prices by about 25 per cent in the past few years as they combat cost inflationary pressures within their own businesses but also take advantage of surging popularity for their brands to seize fatter profit margins. Hermes, known for its $12,000-plus Birkin bags, belts, handbags, jewellery and homewares, lifted prices by 7-10 per cent in 2022 and the LVMH-owned Louis Vuitton likewise raised prices to deal with higher manufacturing costs.

But even the nation’s well-heeled shoppers have their limits.

“[The brands] have slowed their price increases, and that is a global trend,” Mr Fyfe said.

And it is amid this tougher trading environment at the luxury end of fashion and apparel retail, as well as in the broader retail sector, that David Jones’s owner, private equity firm Anchorage Capital Partners, has pushed the button on a new investment program to position the department store in a stronger and more competitive position for when an upturn comes.

Under the leadership of Mr Fyfe, who formerly ran Country Road Group, David Jones will seek to double its online business and connect better with loyal shoppers through a refreshed omni-channel platform with all the usual bells and whistles of apps and loyalty schemes.

“The market is challenging for consumers, we all know the headwinds, but clearly our strategy remains really robust and we are going to make some real milestone changes in the next 18 months,” Mr Fyfe said.

“Significant investment of $250m in the next three years, that’s the most investment David Jones has put in (since Covid) and it shows you our confidence in the strategy and the confidence of our owners.”

The investment comes despite the challenging trading conditions, which has seen a pullback in sales and shoppers hunting for promotions and bargains.

“Now is the time for us to invest for the upside that we predict will come in the future,” Mr Fyfe said. “It will put David Jones in a very strong position when the economy does turn and we know from experiences that when the tailwinds get back into the market that David Jones will really exploit those tailwinds and we will reposition the business where it needs to be, both physically and digitally.”

Of that fresh round of spending, $100m will be invested in its stores to ensure that by 2027 more than 42 per cent of its store footprint (stretching across 40 outlets) will be refurbished. Meanwhile, $75m will be directed towards updating and expanding the chain’s digital offerings across online and smartphone apps.

Anchorage bought David Jones in late 2022 for $100m from South Africa’s Woolworths Holdings and is now addressing much-needed investments in digital to ensure the upmarket department store keeps the pace with rivals.

“We are putting significant investment into online,” Mr Fyfe said. “This is a business that we want to double in the next three years. We know that this is a growth channel for David Jones, we know that now 20 per cent of our customers are omni-channel customers – shopping in stores and online with us.

“The investment into our online business is going to be three key initiatives. Firstly, we’re going to launch a customer app pre-Christmas this year, which will allow us to connect closer to customers, give customers a personalised experience, and will allow customers to have notifications on the brands that they love and adore at David Jones.

“And then the next part of the digital evolution is going to be our actual website, where we’re going to take control of the front end and make it a market-leading experience for customers. So improve our navigation, improve the imagery and improve the customer journey.”

He said it would be a “real lever for growth” in what was becoming a more competitive online retail market.

David Jones is also streamlining its back-end infrastructure and will shift from two warehouses to one. From 2026 it will have a new state-of-the-art distribution centre aimed at making it more nimble and efficient.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout