Endeavour chairman Peter Hearl strikes back at Mathieson claims

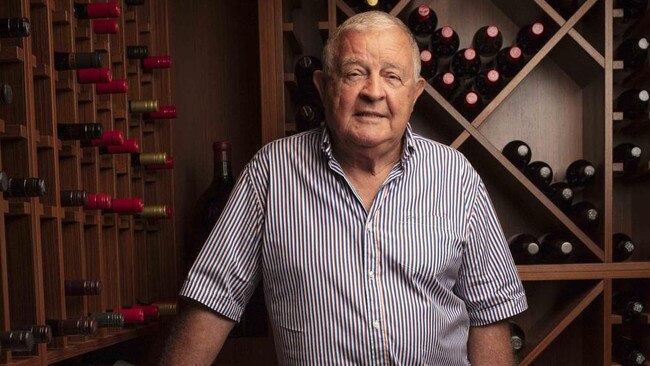

Peter Hearl has accused the group’s major shareholder and pubs billionaire Bruce Mathieson Snr of not presenting a ‘balanced or accurate view’.

The chairman of Endeavour Group — which owns Dan Murphy’s, BWS and the nation’s largest pubs portfolio — has written to his largest shareholder, Bruce Mathieson Senior, accusing him of disseminating inaccurate information about the company which is misinforming shareholders about the group’s true performance.

He also laid out the reasons why former Woolworths supermarkets boss and retail veteran Bill Wavish is not eligible at this time for election to the Endeavour board, detailing too how despite requests for Mr Wavish to participate in a director recruitment process he had refused to engage.

Mr Mathieson Snr and his son Bruce Mathieson Junior, who is a director of Endeavour, have publicly supported Mr Wavish’s candidacy and have publicly stated they will use their 15 per cent stake to support him if it comes to a vote at the AGM next month.

In his letter sent on Friday, Endeavour chairman Peter Hearl said it was “disappointing” Mr Mathieson Snr was not providing a “balanced or accurate view of the business” in his correspondence with the company or in his your public commentary.

“(It) only serves to misinform shareholders and have a negative impact on the business to the detriment of all shareholders,” Mr Hearl wrote to Mr Mathieson Snr.

In a forthright letter laying out the strong performance of its businesses and Endeavour’s commitment to good corporate governance, Mr Hearl also took a swing at Mr Mathieson Snr’s comments about the regulatory impacts on the Endeavour gaming arm and how that had hurt the share price.

He questioned why the pubs billionaire was now overlooking that regulatory impact on the share price and questioned his motives as the current boardroom stoush — which broke out this week — turns into a very public battle being played out before shareholders and the market.

“I can only assume you are not addressing this issue as it doesn’t suit your subjective narrative around the performance of the board and management team,” Mr Hearl wrote.

Mr Hearl strongly defended the decision by the board not to allow a shareholder vote on the election of Bill Wavish as director at next month’s AGM if he hasn’t gained the necessary regulatory and probity clearances – as demanded by Endeavour’s constitution.

“I remain firmly of the view that the manner in which Mr Wavish‘s nomination as a director is addressed in the Endeavour Group Limited Notice of Meeting is appropriate and correct.

“The relevant terms of the Endeavour Group Limited constitution are unambiguous. The requirement that the resolution be withdrawn should all necessary regulatory approvals not be received in time is not a tactic, as you suggest, but rather an action that complies with the requirements of the constitution.”

The debate over the eligibility of Mr Wavish to voted on as a director at Endeavour’s upcoming AGM on October 31 has emerged as a major flashpoint between the two warring camps.

Soon it could be fought out in the courts. Mr Mathieson Snr has warned of possible legal action and retained the services of law firm Arnold Bloch Leibler, which has asked for a copy of the Endeavour share register.

Mr Hearl stated in his letter that Mr Wavish could have chosen to engage earlier with the Endeavour board to gain the necessary regulatory approvals.

He said the elections of Anne Brennan, Bruce Mathieson Junior and Rod van Onselen as directors did not come with special favours in terms of being appointed before regulatory approvals were gained.

No director election was put to shareholders at the AGMs – when those directors ran – prior to all regulatory approvals being obtained.

This week, Mr Mathieson Snr launched an extraordinary attack on the chairman, accusing him and the board of a “cynical” attempt to block the election of Mr Wavish to the board to entrench an “insiders’ club” in the boardroom.

In his letter to Mr Hearl, he lashed out at statements that Mr Wavish might be ineligible to run as a director because he didn’t have the necessary regulatory and probity clearances. He said they were “preposterous”, arguing the board was applying one standard “for those in the club” and a different standard for someone who wasn’t an “insider”, but nonetheless, highly credentialed to be a director.

Mr Mathieson Snr has also publicly bagged Endeavour’s board and management for what he views as the company’s poor performance and sinking share price, which is down 25 per cent in the last 12 months.

Mr Hearl robustly defended Endeavour’s performance, saying its brands were the clear market leaders in its categories.

“On any reading of our business performance over the past four years, we have been the clear market leader in our categories and to suggest otherwise would demonstrate a fundamental misunderstanding of Endeavour Group’s results,” Mr Hearl wrote.

“Endeavour Group‘s retail business [Dan Murphy’s and BWS] has grown sales by $1.5bn since fiscal 2019, nearly three times the growth of the nearest competitor. Over the same period EBIT growth outpaced sales growth, due to the success of our customer-led strategy.”

Mr Hearl said Dan Murphy’s loyalty card scheme, MyDan’s, has 5.2 million active members, with an industry-leading scan rate for a membership program of 79 per cent.

“The strength of the program is further demonstrated by the fact that MyDan’s members’ basket sizes are more than double the size of non-member shoppers.”

Mr Hearl ended his letter by saying he reiterated his availability to discuss with Mr Mathieson Snr the group’s performance or the other matters in the letter.

In response to the Hearl letter, a spokesman for the Bruce Mathieson Group said the Endeavour board were more interested in “putting up roadblocks and fighting with technicalities”, than responding to the “obvious and fundamental challenges across the business”.

“Board insiders are clearly putting much more energy into entrenching themselves than turning around the business despite the glaring issues. Five billion dollars of shareholder value has been destroyed. That’s a fact and needs an urgent response.

“Let’s talk about a plan to fix this mess, instead of using the constitution to deny shareholders an opportunity to have their say.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout