Covid-19: Metcash lines up share buyback, bigger hardware play

Profitable wholesaler Metcash is splashing cash and tooling up in a show of confidence that keeps investors happy and extends its hardware play.

Consumer bellwether business Metcash is looking past current lockdowns and pandemic fears to splash cash in a show of confidence that keeps investors on side as it continues its hardware play.

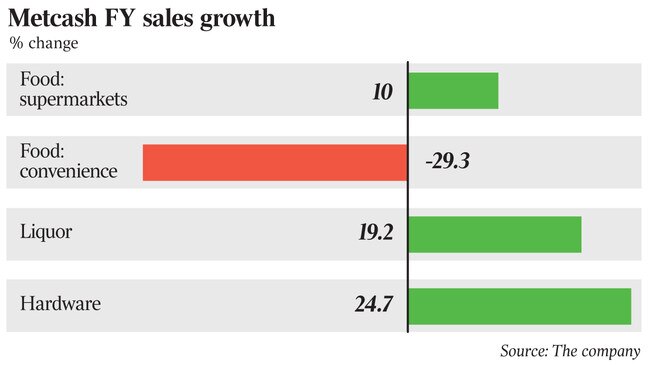

The grocery, hardware and liquor wholesaler on Monday said it is continuing to benefit from “shifting consumer behaviour” with revenues for the full year to April 30 growing by nearly 10 per cent to $14.3bn.

Profit after tax came in at $239m, reversing last year’s loss of $56.8m.

Metcash, a backbone goods supplier to independent IGA, Mitre 10, Total Tools, Cellarbrations and other stores, will pay a higher dividend of 9.5c and is conducting an off-market buyback of about $175m to distribute excess capital to investors.

Metcash said it was a “standout year” with record sales underpinning significant earnings growth and record operating cash flow of $475.5m, up from $117.5m in the 2020 financial year.

Underlying profit surged 27 per cent to $252.7m.

Chief executive Jeff Adams said Metcash had successfully navigated significant challenges and uncertainty associated with Covid-19 thanks to the foundation work undertaken in the past two and half years on store upgrades, sharpening price competition and improving the range of offerings.

“When we did get the burst of customers, new or returning, coming in during Covid-19, they found the stores changed,” he said.

There was a “continuation of an increased preference for local neighbourhood shopping and the migration from cities to regional areas” which had driven strong sales growth.

The first six weeks of the new financial year showed continuing benefit from the ‘shift in consumer behaviour’ despite new lockdowns and restrictions around the country.

“Consumer confidence goes up and down based on changes to local catchments as per health regulations, but overall it’s very positive.

“One of the reasons why the board made the decision to increase the dividend and to enact the up-market share buyback was more confidence in not only the current performance of the business, but also looking at future performance.

“We have made significant progress with key initiatives such as our store upgrade programs, rolling out new store formats, expansion of private and exclusive label ranges and accelerating our e-commerce plans.

“It has been an exceptional year for Metcash.

“People have continued to shop with us.”

The group’s liquor and hardware businesses were standout performers, delivering underlying earnings before interest and taxes (EBIT) growth of about 22 per cent to $88.7m and about 62 per cent at $136m, respectively.

Metcash responded promptly to its growth in hardware earnings by increasing its ownership of Total Tools Holdings to 85 per cent, from 70 per cent, for an acquisition cost of $59.4m.

“The reason we have invested more in hardware is because there is quite a big growth opportunity there.

“It’s a very fragmented market.”

TTH is the franchisor to the largest professional tools network in Australia with 90 bannered stores, and complements Metcash’s Independent Hardware Group.

Since September last year, TTH contributed EBIT of $24m for the eight months.

A solid pipeline of residential construction activity is boosting sales but strong global demand for housing materials is placing continued pressure on stock availability, particularly that of timber.

The food business also performed well, delivering underlying earnings of 5 per cent to $193m.

Total EBIT came in at $401,4m, up 20 per cent on the previous financial year.

The group has continued to benefit from a shift in consumer behaviour in the first eight weeks of the new financial year with its supermarkets, liquor and hardware segments up 14.2 per cent, 26 per cent and 29.1 per cent, respectively, compared with the same period in FY20, excluding the positive impact of Covid-related trading restrictions.

“Metcash’s strong group performance and financial position, together with confidence over future operating cash flows, will result in around $354m being returned to shareholders,” Mr Adams said.

Investors will receive a final dividend of 9.5c per share, fully franked, taking the full-year payout to 17.5c per share, an increase of 40 per cent.

The last day for shares to be bought to be eligible for the $175m buyback is June 30, with the tender opening on July 19 and closing on August 13 at an indicative price of $3.10 per share.

The buyback will have an 85c capital component, with the balance being a fully franked dividend.

The buyback will be based on a tender, with investors selling at a discount of between 10 to 14 per cent below market price.

In a note, retirees-focused equities fund manager Plato Investment Management said shareholders who didn’t participate would still benefit from the off-market buyback.

“This compares with on-market buybacks, where companies buyback stock at market

price,” Plato’s senior portfolio manager Peter Gardner said.

“At current prices, we would expect the buyback to be of marginal value for 15 per cent tax rate Australian investors,” he said, but it would be dependent on investor circumstances and other factors.

Plato expects to tender all Metcash shares owned by the Plato Australian Shares Income Fund into the buyback.

On the outlook, the group said it had “managed well” through the significant challenges associated with Covid-19 in the 2020 and 2021 financial years, however uncertainty remains over the potential impact of any future trading restrictions or changes in consumer behaviour.

Metcash supplies goods to 5226 stores across the supermarket, convenience, liquor and hardware segments, an increase on the 4968 it supported last financial year.

Metcash shares closed up 0.8 per cent on Monday, at $3.69.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout