Cettire bolsters board with appointment of Jon Gidney, as short interest climbs

The under-pressure luxury online retailer has tapped investment banker Jon Gidney to come aboard as it fights off short sellers and profit challenges.

Under-pressure luxury online retailer Cettire has tapped investment banker Jon Gidney as a non-executive director, amid a tough operating climate and jump in short-selling interest in the stock.

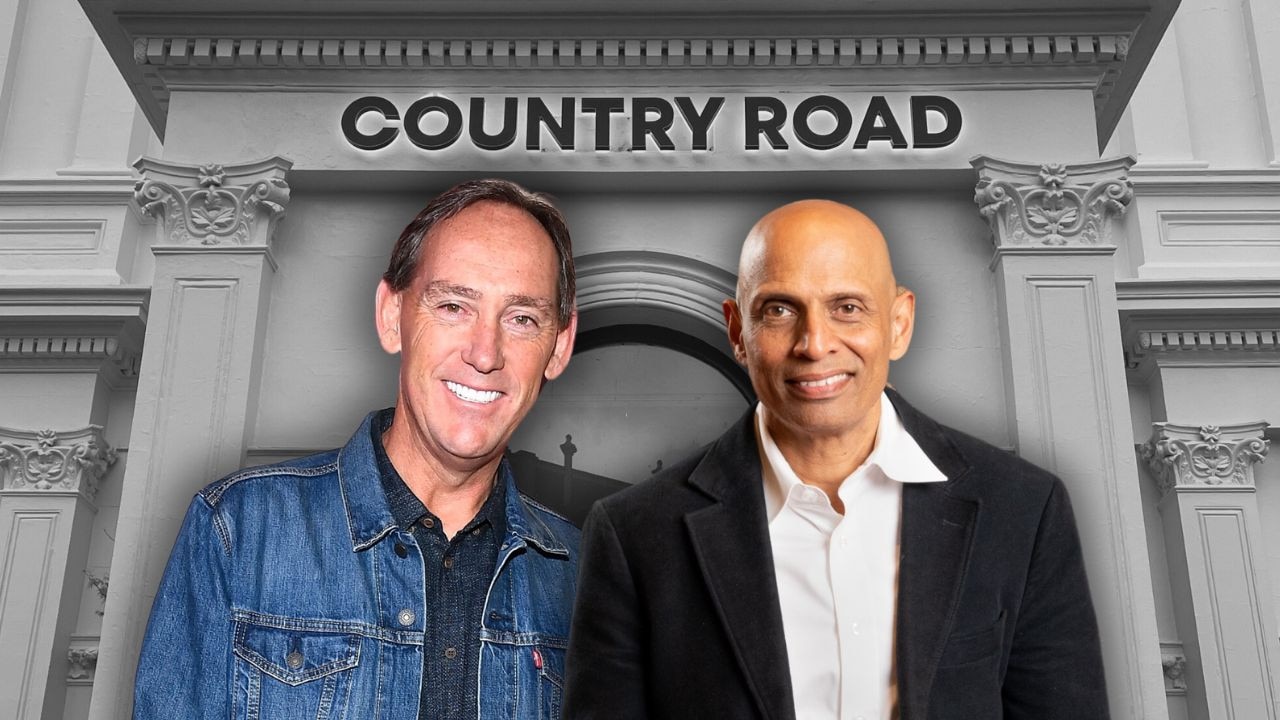

Cettire, led by reclusive entrepreneur and chief executive Dean Mintz, on Wednesday told the ASX the board appointment was effective immediately. Chairman Bob East said Mr Gidney’s focus on “strategy, governance and risk” aligned with the objectives of boosting the board’s experience and credentials.

Cettire has confronted a turbulent three months, culminating in a brutal earnings downgrade in June that resulted in investors pummelling the stock by 50 per cent on the day.

The company said its fourth quarter was being hit by tough trading conditions in the global luxury market and said adjusted earnings before interest, tax, depreciation and amortisation for the 2024 fiscal year would come in at $32m-$35m, not far off EBITDA for the first nine months of the same financial year.

Mr Gidney – who overlapped with Cettire’s finance chief, Tim Hume, at JPMorgan – has more than 30 years of experience in investment banking and remains a senior adviser at Wilsons. Before that, he held senior roles at Citigroup, Greenhill Australia and JPMorgan.

Cettire’s release pointed to Mr Gidney’s financial background and understanding of capital markets as supporting his addition to the board. He is also on the Asia-Pacific board of wealth technology firm FNZ Group.

The appointment comes as short interest in Cettire has markedly increased in recent months, with almost 8 per cent of its register loaned out, according to Shortman data. The stock is among the most shorted on the ASX.

Short selling involves an investor or trader borrowing a security whose price they are betting will fall.

Cettire has been in the sights of short sellers as questions have been raised about its model and customer service levels.

A series of articles in The Australian shed light on Cettire’s complex supply network and the probing of complaints by competition regulators in Australia and the US.

The US Federal Trade Commission has received 173 complaints about Cettire over four years, while the company has also been the subject of at least 50 reviews on Trustpilot by customers who reported receiving an empty Cettire box.

Cettire is also understood to be seeking a female non-executive director to add to its now five-member board.

The stock declined 2.8 per cent on Wednesday to $1.205, and has tumbled 58.4 per cent so far this year.

Online marketplace firms in the luxury goods industry have had a challenging period, which saw Cettire’s rival Farfetch acquired in a rescue deal by South Korean group Coupang. In March, Matchesfashion collapsed owing more than £210m.