Australian Vintage will trigger a dilutive capital raising, as sales flatline and debt balloons

Australian Vintage has resorted to a dilutive capital raising as sales flatline and debts grow amid boardroom chaos that will now see its long-serving chairman exit.

Embattled winemaker Australian Vintage has resorted to a highly dilutive $19.9m capital raising struck at almost one third below its recent share price and 75 per cent under its asset backing.

The decision comes as its sales flatline due to tougher trading conditions, ballooning debt and its future prosperity becomes increasingly tenuous.

In a horror year for Australian Vintage, which experienced a collapsing share price and profit warnings, it now says it will need to take a $38m impairment charge against goodwill for fiscal 2024.

That will likely plunge the company deep into the red, as it is buffeted by the volatile conditions now hitting the wine sector led by consumers reining in their spending just as a critical level of wine oversupply is crunching prices.

However, amid a growing revolt by top investors in Australian Vintage – whose brands include McGuigan and Tempus Two – some have argued against the need for the dilutive capital raising, especially as its banker, NAB, has agreed to a refinancing deal.

Oscar Oberg, lead portfolio manager of WAM Capital which has just under 5 per cent of Australian Vintage, questioned the logic for the $19.9m capital raising unveiled on Tuesday.

“We have seen many examples of agricultural companies listed on the ASX over the years that go through bad periods, and a lot of these bad periods are caused by cyclical factors out of their control,” Mr Oberg said.

“In our view Australian Vintage is currently within a poor cyclical period and will get through this period without the need to raise money.”

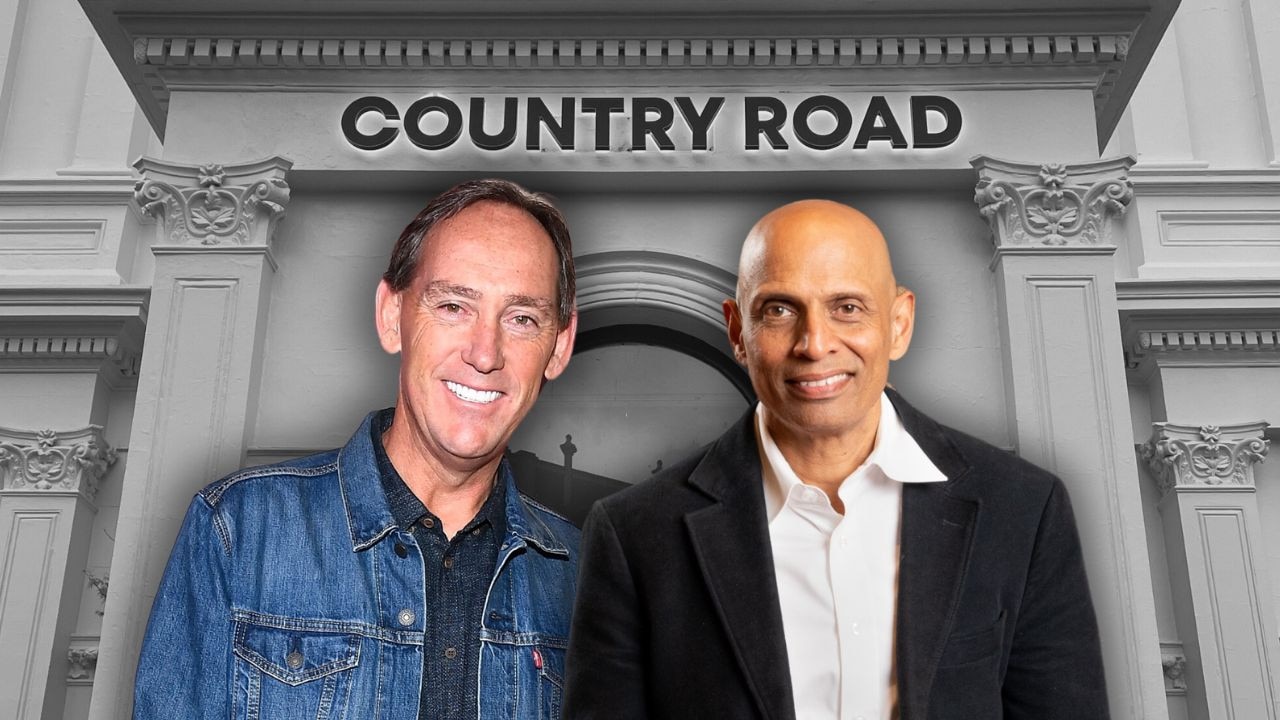

Australian Vintage chairman Richard Davis will leave after the equity raising is completed as the winemaker scrambles to arrest its financial decline and gather it executives and new directors to lead it through its current calamities.

On Tuesday, Mr Davis told The Australian that despite NAB agreeing to refinance its debt, the $19.9m equity raising was vital to give it “head room” as it entered the first half of 2025.

“In the first half we will have negative cashflows, as that is when we pay out our grape growers – 75 per cent of them – so that puts us into negative, and the period of the last six months has been uncertain and we haven’t hit our targets which affects our cashflow,” Mr Davis said.

“So we want to head into the first half with sufficient head room.”

The makers of wines McGuigan and Tempus Two, which has had its shares suspended from trading since late last month, is facing an increasingly tough and challenging trading environment for the wine sector, made all the worse by the recent and sudden exit of its chief executive and the collapse of merger talks with the nation’s second largest winemaker, Accolade Wines.

Facing flatlining sales, which have been worse than expected, and higher-than-expected debt levels, Australian Vintage has triggered the $19.9m capital raising as it seeks emergency support from institutional and smaller shareholders – although the raising will not be underwritten to leave it exposed to the chance investors will turn their back on the offer.

On Tuesday Australian Vintage, whose shares are down more than 90 per cent from its peak two decades ago, unveiled a trading update worse than tipped by the market, the capital raising and a boardroom restructure.

In its trading update it said it now expected full-year sales to be in the range of $257m to $261m, in line with 2023 but lower than internal expectations. Net debt as at June 30, absent the capital raising, was expected to be $70m to $75m, higher than the $43m to $50m previously expected.

It said it had in-principle terms agreed with existing financier, NAB, for up to $30m of incremental debt capacity out to November 2026. It would also seek an equity raising of up to $19.9m launched to further improve liquidity, reduce leverage and increase balance sheet strength.

The equity raising will consist of $5.5m institutional placement, around $9.5m for a 2 for 7 accelerated, non-renounceable entitlement offer for institutional investors and $4.9m from a 2 for 7 non-renounceable entitlement offer to retail shareholders.

However, the equity raising will be at a fixed price of 20c per share, against a closing price of 34.5c before it went into a trading halt and a 73.5 per cent discount to its net tangible asset per share value of 75.5c. The shares are expected to resume trading on Thursday.

Australian Vintage said it now expected 2024 underlying earnings to be in the range of $29m to $31m, up 11 per cent on the prior corresponding period. Margin pressure is expected, driven by a combination of persistent cost inflation, competitor pricing and sales mix.

The company said it expected near-term conditions to remain challenging and that the rebalancing of supply and demand would take time.

“There is so much red wine, so you can’t get pricing,” Mr Davis said.

“I won’t say it’s irrational behaviour, because if people have got excess wine, obviously they’re going to try and move it to realise it into cash.

“But that puts pressure on the whole industry. You’ve got China starting to open up, so that will take up some of the excess. There is signs of people exiting the industry, which will see a rebalancing, but it’s not going to happen over the next six months or 12 months. It will take a couple of years and if you look over the history of the wine industry, this has happened before and no doubt will happen again.”

It comes as last month its CEO Craig Garvin was ejected from the company with the board citing in an announcement that he had engaged in workplace behaviour that showed a “lack of judgment”. That workplace issue is yet to be fully explained.

The sudden departure of Mr Garvin also then was followed by the collapse of merger talks with Accolade Wines, whose wines include Hardys, St Hallett, Grant Burge and Petaluma, with some insiders arguing the two incidents were related. Accolade’s decision to walk away, left Australian Vintage without a key lifeline and now the company is scurrying to fix its balance sheet.

After the raising, chairman Davis will retire. John Davies will be appointed interim chairman. Current director Naseema Sparks will not seek re-election at this year’s AGM.