ARB books stronger sales, earnings despite tougher export markets

A slowdown in car sales and demand for 4X4 car accessories in the US sank export sales for ARB, but that was cushioned by solid demand for bullbars, towbars and roofracks at home.

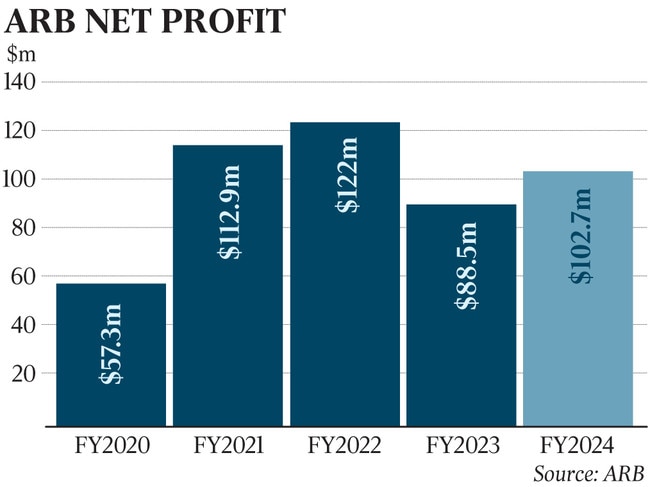

Car accessories manufacturer and retailer ARB has posted a double-digit lift in full-year profit despite its key US export market proving a drag on earnings as a softer economy resulted in a slowdown in new vehicle sales and headwinds for the auto aftermarket industry.

Weakness in Asia, particularly China, compounded the negative result for its international arm. But weakness in the Asia-Pacific, the US and New Zealand, where a so-called ute tax affected sales, was countered by sales gains in Australia through its aftermarket operations, store network and sales to ARB stockists.

ARB, typically a high-growth stock favoured by many fund managers, said the outlook for its operations was improving into the new financial year, with its aftermarket order book strong and its export orders “trending positively”, helped by new car accessories products coming to the market and less disruption to supply chains. In the key US market, the outlook was also positive, despite short-term market pressures.

The company also signalled it was considering strategic acquisitions to complement its organic growth opportunities, with these bolt-on deals to focus on product and distribution expansion.

On Tuesday, ARB posted a 3.3 per cent rise in full-year sales to $693.2m, as net profit jumped 16 per cent to $102.7m, broadly in line with market expectations. Profit before tax of $142.7m represented growth of 17 per cent over the previous financial year, excluding a one-off capital expense of $2.5m relating to the final deferred consideration payment for the acquisition of the Truckman business and a one-off capital gain of $1.2m relating to the sale of a factory in Thailand.

The company declared a final dividend of 35c a share, up from 30c, and payable on October 18.

ARB, which sells a portfolio of car accessories, especially for the 4X4 auto sector such as bullbars, towbars, roof racks and fridges, said sales into the Australian aftermarket achieved modest growth of 5.4 per cent in 2024. Export sales fell 6.5 per cent, reflecting a decline of 13.6 per cent in the first half and minor growth in the second half. International trading conditions remained challenging, ARB said, particularly in the US, where the broader industry experienced a downturn and ARB’s major wholesale customer continued to divest stores.

However, ARB was focused on implementing several new initiatives that the board was confident would deliver long-term brand and sales growth in the US.

Its UK-based Truckman business achieved strong sales and profit growth as new vehicle supply returned to the British market after two years of subdued conditions as a result of reduced new vehicle supply. ARB’s sales in New Zealand were significantly affected in the first half by the introduction of the so-called ute tax in that country, but since the removal of this tax in January, ARB’s business there had slowly recovered in line with the general economy and new vehicle sales.

Citi analyst Sam Teeger said the resilience of the Australian market for ARB was a key positive of the result, with strong sales in the third quarter accelerating into the fourth quarter, although the slowing economy in the US and weakening auto sales was a concern.

“The ARB ‘buy’ thesis remains intact but the market might be a bit disappointed by the ongoing US challenges,” Mr Teeger said.

Shares in ARB closed up 5 per cent at $42.32.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout