A survey of supermarket prices shows dry grocery inflation at 9.1 per cent and worsening

Australians already struggling with the cost of food and grocery prices are in for more pain in the new year, says UBS.

Australian consumers are facing rampant inflation across the supermarket aisle for dried and packaged groceries, and a new survey of supermarket prices shows inflation is running at more than 9 per cent.

To make matters worse, that is expected to continue to rise into the new year.

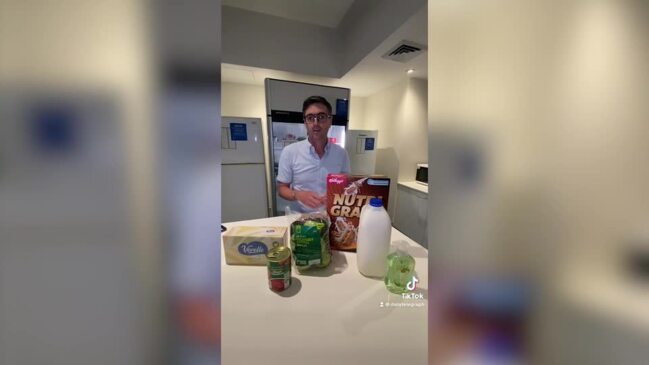

Although many shoppers believe the price of groceries, ranging from cereals and tomato sauce to taco shells and kitchen cleaners, might already be expensive, analysts believe current elevated shelf prices still don’t adequately reflect the cost increases faced by suppliers caused by dislocated and disrupted supply chains.

This pressure on grocery suppliers caused by the higher costs of energy, packaging, transport and labour is tipped to push them to approach the supermarket chains for more price increases – further feeding inflation into 2023.

The latest price tracking report from investment bank UBS, which tracks more than 60,000 prices of supermarket items, shows that food inflation on average grew by 9.1 per cent in November.

This was in line with the growth rates of 9.1 per cent in October but a step up on the 8.4 per cent rate of price inflation in September.

Although the prices of fresh food have begun to moderate, dropping to 9.1 per cent inflation in November against 10.2 per cent in October, the rise was most felt in dried groceries.

The UBS survey found that dry grocery inflation was 9.1 per cent in November, up from 8.5 per cent in October and 7.8 per cent in September.

“Across fresh and dry grocery, there have been steady increases in the rate of inflation, whereas fresh is more volatile given supply variances,” said UBS analyst Shaun Cousins.

“Food inflation is now above the 8.7 per cent expected in the 12 months to June 2023 from the June 2022 UBS supermarket supplier survey.

“Trade feedback indicates that cost pressures remain – for example supply chain-specific product inputs – and are arguably still rising for dry grocery suppliers, with the expected further cost increases to support dry grocery inflation in early calendar 2023.”

Mr Cousins said dry grocery prices were showing a steady rate of increase.

“And we are not convinced that the rate of dry grocery food inflation has peaked, in that, in our discussions with the trade these pressures remain, particularly in the supply chain that are going to require further price rises in the new year.

“It is the big-name brands, like cereals, tomato sauce, biscuits and also, within that we are talking about detergents and household goods, and they are dealing with supply chains that are still challenged and then individual inputs that are enduring rates of inflation which is at times a function of tight supply.”

Mr Cousins said suppliers were likely to go back to the supermarket chains such as Woolworths and Coles seeking price increases as they deal with higher input prices for key areas such as labour, packaging and transport.

This would help push up food and grocery prices in early 2023.

“The cost pressures that suppliers are facing are not fully reflected in current supermarket shelf prices,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout