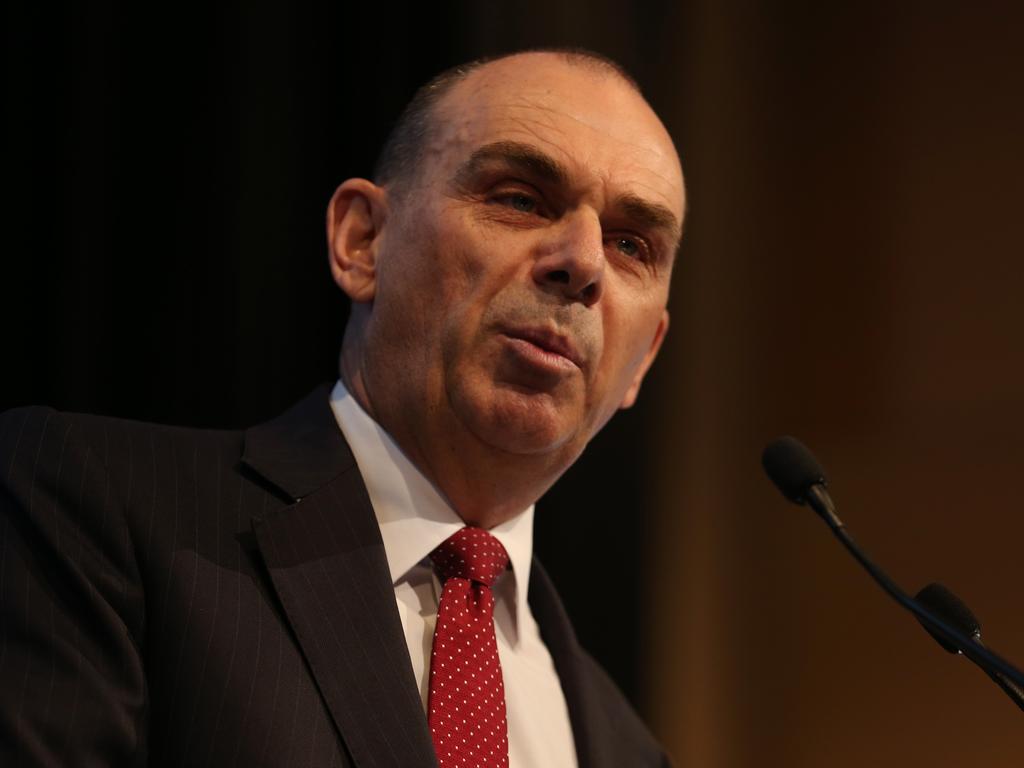

Reserve Bank governor urges banks to lend again

Reserve Bank governor Philip Lowe has called on the banks to increase their lending to support the economy.

Reserve Bank governor Philip Lowe has called on the banks to increase their lending to support the economy during the coronavirus pandemic, while again stating that negative interest rates remain “extraordinarily unlikely” in Australia.

Appearing alongside fellow Council of Financial Regulators members APRA chair Wayne Byres and ASIC chair James Shipton on a Financial Services Institute webcast on Thursday, Dr Lowe said the nation’s financial system was “resilient and is well placed to deal with COVID-19”.

“The system is in this strong position partly because over the past decade APRA has worked with financial institutions to boost their capital and to reduce their liquidity risks,” he said, adding that banks were “also profitable and they have had low levels of problem loans”.

But financial regulators “wanted to emphasise that it is important that lenders continue to support the flow of credit to the economy”, Dr Lowe said.

“The second point is that the capital and liquidity buffers that exist are available to be drawn upon if required to support the economy. I would like to reinforce this point.

“If there was ever a time to allow these buffers to be used, now is that time.

“We should not expect to see capital buffers be maintained during a once-in-a-century shock.

“These buffers have been built up to be utilised in events such as this, and some reduction in capital ratios is entirely appropriate as lenders support their customers through this difficult period.”

With the virus causing “the biggest and most sudden contraction since the 1930s”, Dr Lowe said the unprecedented fiscal and monetary policy response was designed to “build a bridge to the point when the virus is contained and the capacity of our health system has been scaled up so that it can cope”.

“The banks too have been part of building this bridge through their repayment deferrals and their provision of credit lines to businesses” and it was “both understandable and desirable that lenders draw on the buffers that were built up in better times”.

“It is in the banks’ own interest and in the interest of the broader Australian community that banks support their customers now and also support them in the recovery phase when credit will be needed so that businesses can once again expand,” he said.

Despite all the efforts to date, “the future remains unusually uncertain”, Dr Lowe warned.

While an “obvious source of uncertainty is the pace at which the various restrictions are eased”, restoring people’s confidence on their health and the economy was a “critical issue”.

“It is interesting that the initial evidence is that countries that have had fewer restrictions are also experiencing very large contractions in economic activity,” Dr Lowe said.

“This suggests that voluntary decisions that people have made in response to the uncertainty about their health and their finances is also playing a major role.

“In the face of this uncertainty, people have been reluctant to go out and spend and businesses have been reluctant to invest.”

His comments came as former Treasury secretary John Fraser said the Australian economy was in “pretty good” health going into the COVID-19 crisis, which was going to whack economic output.

“It’s like getting a baseball bat into your face ... and three more hits,” Mr Fraser said on a podcast on Thursday, noting that the federal government had done a good job of managing the turmoil.

“Inflation will be a big part of the cure to get rid of the debt.”

Mr Fraser expects inflation will see an uptick over the next three to five years, and if he had his way official interest rates would have been lowered but at a slower clip than what the central bank had implemented.

For its part, Dr Lowe said the RBA was “doing what it can to keep funding costs low and credit available” and the government had granted a six-month exemption from responsible lending obligations when lenders provide credit to existing customers who run a small business.

“Consistent with this, ASIC has been encouraging lenders to work closely with their customers to provide short-term assistance and support their longer-term viability (and) APRA has announced temporary changes to its expectations regarding bank capital ratios.”

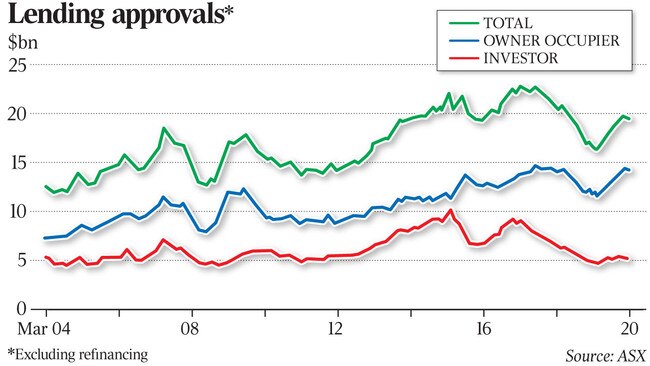

Dr Lowe said the “early evidence” was that RBA policies designed to keep funding costs low and credit available were “working as expected”, in that banks had reduced their lending rates to record lows, with interest rates for small business declining the most.

But he cautioned that there was “a limit to what can be achieved with monetary policy”.

In a Q&A session following his panel appearance, Dr Lowe again reiterated his distaste for negative interest rates as a monetary policy tool in Australia.

“I said previously that it was extraordinarily unlikely that we would have negative interest rates and there has been no change,” Dr Lowe said.

“The board is not contemplating negative interest rates in Australia. I think the costs of that exceed the benefits.” Dr Lowe’s comments mirrored those of US Federal Reserve chair Jerome Powell, who said last week that “the committee’s view on negative rates really has not changed. This is not something we’re looking at.”

Dr Lowe added that “fiscal support through this difficult period has also been crucial and will continue to be over the months ahead”.

“So too will be a reinvigorated economic reform agenda that gives the community the confidence that once the virus has passed, we can move quickly out of the economic shadow it is casting,” he said.

Also speaking on the FINSIA panel, Mr Byres said the impact on the financial system of shifts in asset prices caused by COVID-19 was likely to play out over an extended period and would therefore be “manageable”.

The APRA chair said it was reasonable to assume that the price of some assets would change as a result of factors like decentralisation.

“The key thing in whether that causes stress or strain in the financial system is less about the nature of the shift and more about the time horizon over which it occurs, because if it’s a gradual shift that occurs over years, the system will adjust, financial institutions will adjust and values will adjust. And it will be in an orderly fashion.

“The shocks and stresses to the system occur when there’s a snap adjustment.”

It was difficult to predict the effect on property prices. “It will play out over time,” he said.

additional reporting: Joyce Moullakis