Tycoons bankroll Singapore solar plan: billionaires back $30bn link

Two of Australia’s richest men, Mike Cannon-Brookes and Andrew Forrest, are backers of a solar farm to supply up to 15 per cent of Singapore’s electricity needs.

Two of Australia’s richest men, Mike Cannon-Brookes and Andrew Forrest, have emerged as key financial backers of one of the country’s biggest renewable energy projects – a solar farm providing up to 15 per cent of Singapore’s electricity needs.

Sun Cable on Sunday said it had raised $210m of new funding to push ahead with its signature clean energy scheme – the $30bn Australia-Asia PowerLink development – with fresh funds ploughed in by the Atlassian co-founder and the Fortescue Metals chairman.

The capital raising provides enough funding for the project to hit financial close and paves the way for a set of renewable developments, with Sun Cable saying it is working on “multi-gigawatt”-scale facilities, underlining the company’s plans to become one of Australia’s biggest clean energy producers.

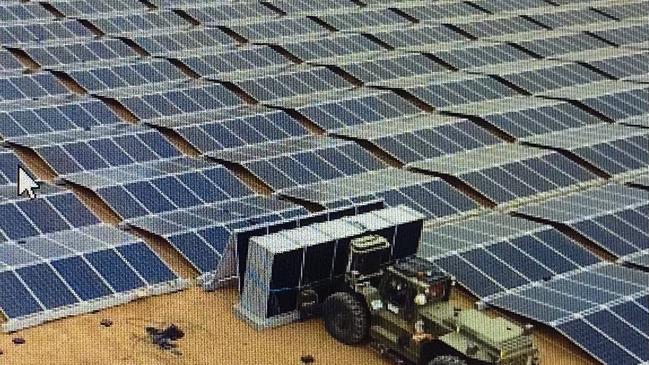

The solar project in the Northern Territory, which is estimated to deliver carbon emissions abatement of 8.6 million tonnes per year, will help power Darwin and Singapore. It includes the world’s largest battery and a 4200km high-voltage undersea cable from Darwin to Singapore, the longest in the world.

Mr Cannon-Brookes is backing Sun Cable just a week after putting on ice an $8.1bn takeover bid for AGL Energy, pitched as one of the biggest decarbonisation projects in the world today.

Supporting Sun Cable would help deliver Australia’s huge potential as a major renewable energy exporter, he said.

“This brings Australia one step closer to realising our renewables exporting potential. We can power the world with clean energy and Sun Cable is harnessing that at scale,” said Mr Cannon-Brookes, who is making his investment through his family’s Grok Ventures fund.

“It’s a blueprint for how we export energy across the world. We fully back this vision.”

After the failure of Mr Cannon-Brookes’ bid for AGL, made alongside asset management giant Brookfield, shareholders are set to vote in June on a plan to split the company into two: a green retailer named AGL Australia seeking to be carbon neutral by 2040, and a coal-dominated generator, Accel Energy, with a goal of net-zero emissions by 2047. The Australian reported last week that Accel Energy had applied for a retail licence to serve big commercial and industrial customers as it edges closer to a shareholder vote on the proposed demerger.

Mr Forrest, the founder of Fortescue Metals, has tapped his private Squadron Energy firm to fund his investment in Sun Cable.

Both men were existing shareholders in Sun Cable, and the company said both took up their maximum entitlements while declining to disclose their respective stakes.

“Sun Cable’s vision will transform Australia’s capability to become a world-leading generator and exporter of renewable electricity and enable decarbonisation. I’m proud to be a cornerstone investor in Sun Cable, its team and its vision,” Mr Forrest said.

Sun Cable chief executive David Griffin said the Series B funding – the second round – was an important milestone ahead of a final investment decision on the Australia-Asia PowerLink at the end of 2023.

“Our mission is to capture abundant renewable energy resources and transmit that energy over large distances to large and growing load centres – and to do that at scale,” said Mr Griffin, who is the largest shareholder in Sun Cable.

“So obviously Australia is a powerhouse. But we have learned an enormous amount over the period since we started developing this project. And we’re applying that IP to the development of subsequent projects as well.”

Equity and debt for the hefty $30bn budget for the Australia-Asia PowerLink will be handled separately once the scheme moves closer to sign-off.

Mr Griffin said he did not know whether Mr Cannon-Brookes would reprise his rejected bid for AGL but agreed with the thrust of the billionaire’s green ambition.

“The technology is absolutely there for the move from fossil fuel generators to a net-zero economy,” Mr Griffin said.

Developing transmission links would be central to delivering on renewable ambitions.

“We need to be able to generate electricity where the renewable energy resources are abundant and transmit that in an efficient manner to where the loads are. That’s our company mission,” Mr Griffin told The Australian.

“If you’re going to go back in time, the coal generators are all built in logical locations, because that’s where then they have their resource, their fuel, and transmission was built out towards them.

“Now, with the scale of that transition that we’re talking about, we have to do exactly the same thing. But we have to build that transmission to where the renewable energy resources are.”

Replicating Australia’s world-scale coal and LNG export industries with solar power should be a major focus for the nation, Mr Griffin said.

The Australia-Asia PowerLink project will create more than 1500 jobs during construction, 350 operational jobs and 12,000 indirect jobs. It will start supplying energy to Darwin in 2026.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout