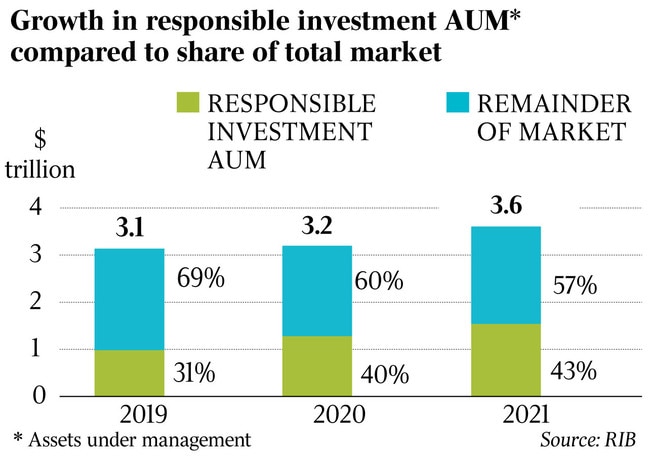

Responsible investing on the rise with 43pc of market

The value of assets managed with a responsible investing framework has risen to $1.54 trillion, accounting for 43 per cent of the total market, according to the industry’s association.

The value of assets managed with a responsible investing framework has risen to $1.54 trillion, accounting for 43 per cent of the total market, according to the industry’s association.

In a new survey to be released on Monday, the Responsible Investment Association Australasia said there was some $2.06 trillion in assets under management that had been “self-declared as practising responsible investment”.

However, research conducted by EY for the association ruled out some $521bn, which failed a scoreboard of measures.

The RIAA also provides a certification scheme for responsible investors.

“Many key actors in the sector formulated new or improved stewardship policies and disclosed stewardship practices in a more comprehensive manner than ever before,” the report reads.

“Intensified activity in corporate engagement was partly in response to the release of the revised UK Stewardship Code in 2020, which requires signatories to report how ESG and climate change issues are considered and integrated in investment activities.

“Given that a significant proportion of international investment managers active in Australia are signatories to the code, it is not surprising to see a rise in stewardship reporting in this region.”

The survey also found that performance concerns were the strongest deterrent to the responsible investing market for survey respondents, followed by a lack of viable products or options. A lack of trust and concerns about greenwashing were also significant deterrents, the survey found.

Emma Herd, a climate change and sustainability services partner at EY, said investors were “facing more demand and increasing scrutiny on their approach to responsible investment and the market is responding, with more funds being managed responsibly than ever before”.

“As a wave of mandatory reporting and product disclosure regimes come into force, understanding the current state of the market and the range of approaches being adopted by responsible investors is critical,” Ms Herd said.

The Australian Securities & Investments Commission – in releasing an information sheet on the matter in June – said it was attempting to lift the quality of ESG reporting by fund managers and superannuation funds.

Assets tied to ESG investing strategies are expected to rise to around $US50 trillion ($70 trillion) by 2025, Bloomberg says.

DWS, Deutsche Bank’s asset management subsidiary, replaced CEO Asoka Woehrmann, earlier this year, hours after a German police raid as it probed alleged greenwashing. Still, RIAA executive manager for programs, Estelle Parker, said responsible investing had reached “a tipping point”. “Investors are expecting real, measurable action,” she said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout