Quinbrook Infrastructure Partners acquires US-based PurposeEnergy

Quinbrook Infrastructure Partners is seeking to make a splash in the fuels and biogas sectors with the purchase of US-based PurposeEnergy.

Specialist value-add investment manager Quinbrook Infrastructure Partners has moved into the renewable fuels sector after acquiring US-based PurposeEnergy.

Quinbrook would not disclose the purchase price of the renewable fuels and biogas specialist but it is expected that it will provide a capital commitment of more than $300m over the next three years for the development of PurposeEnergy projects.

Gold-Coast-based Quinbrook managing partner and co-founder David Scaysbrook said biofuels were an often overlooked area of decarbonisation.

“Quinbrook is excited to be moving into such a high growth and important sector that desperately needs more sustainable solutions that convert organic food waste into renewable power and biogas,” he said.

“The demand for renewable fuels is exploding and in PurposeEnergy we have found a highly capable technical and operational team that have been in business over a decade, delivering impactful solutions for customers and the environment.

“Now is the right time for us to scale this business to realise its full potential. PurposeEnergy is a great example of the Quinbrook model for value-add investing.”

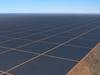

With a $5bn portfolio Quinbrook – which is focused exclusively on the infrastructure needed to drive the energy transition – is the largest solar developer in the United States and the United Kingdom.

It has recently been linked to a bailout of the troubled $35bn Sun Cable project which was forced into administration in January. Sun Cable is developing the AAPowerLink – the world’s largest solar farm and battery storage facility – in the Northern Territory,

Over the past 15 years, PurposeEnergy has developed, owned and operated multiple projects that convert organic waste streams to biogas for use in industrial processes, conversion to renewable electricity, or refinement to renewable natural gas (RNG).

PurposeEnergy founder and chief executive Eric Fitch said the company has demonstrated technical and operational excellence in treating process wastewater and organic residuals for industrial food and beverage producers.

“The investment by Quinbrook will greatly expand our ability to identify, finance, build and operate new projects, helping our customers achieve their ESG goals while conserving capital to invest in their core businesses,” he said.

Headquartered in New Hampshire, PurposeEnergy uses proven technologies, including proprietary methods developed and patented by the company to convert organic waste streams to high-value biogas and RNG that is sold to customers under long-term contracts.

While it has largely served the food and beverage industries, the company also works with dairies and depacking operations to convert organic waste streams to energy.

It has developed, designed and built seven projects which support the ESG (environmental, social and governance), business and decarbonisation objectives of some of the largest food and beverage companies in the world.